In recent years, the US stock market has been a hot topic among investors and financial experts. With record-high valuations and volatility, many are left questioning whether the market is overpriced. This article delves into the factors contributing to the current market conditions and provides insights into the potential risks and opportunities.

Historical Context and Valuation Metrics

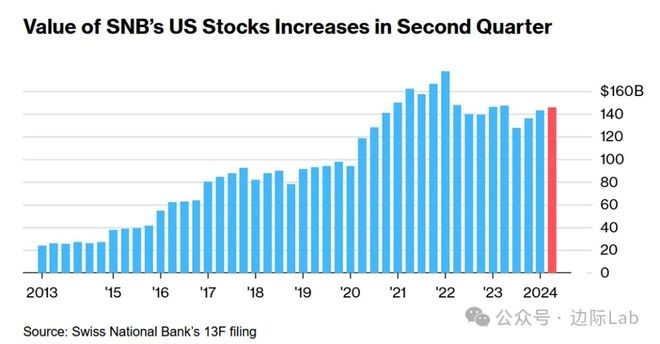

To assess whether the US stock market is overpriced, it is crucial to consider historical data and valuation metrics. Over the past decade, the S&P 500 index has experienced significant growth, nearly doubling in value. However, this growth has been accompanied by increased volatility and concerns about valuation.

One common metric used to evaluate market valuation is the price-to-earnings (P/E) ratio. The P/E ratio compares the current market price of a stock to its trailing 12-month earnings per share. Historically, a P/E ratio of 15 to 20 has been considered normal. As of the time of writing, the S&P 500 has a P/E ratio of around 25, indicating that it is slightly overvalued compared to historical averages.

Factors Contributing to Overvaluation

Several factors have contributed to the current overvaluation of the US stock market:

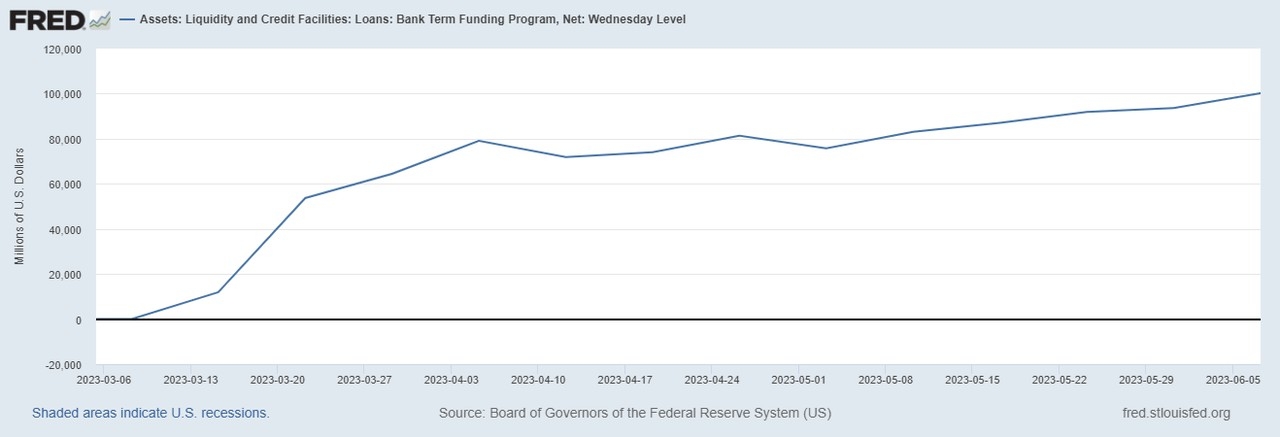

Low Interest Rates: Central banks, particularly the Federal Reserve, have kept interest rates low for an extended period, making bonds and other fixed-income investments less attractive. This has pushed investors into stocks, driving up prices.

Economic Growth: The US economy has experienced steady growth over the past few years, leading to increased corporate earnings and higher stock prices.

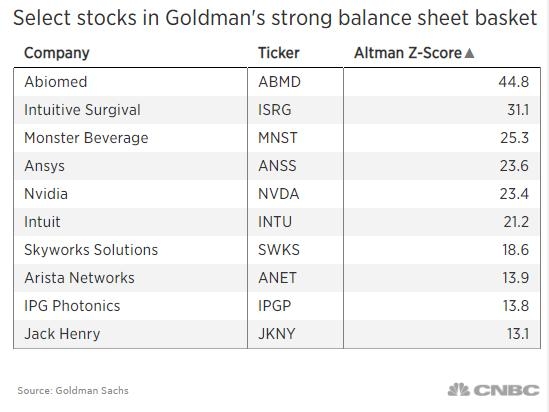

Tech Sector Dominance: The tech sector has been a major driver of the stock market's growth, with companies like Apple, Amazon, and Microsoft leading the way. However, this has also created concerns about market concentration and the potential for a bubble.

Market Sentiment: Optimism among investors has driven stock prices higher, despite some concerns about valuation and potential risks.

Potential Risks

Despite the strong performance of the US stock market, there are several potential risks to consider:

Inflation: As the economy continues to recover, inflation may rise, leading to higher interest rates and potentially dampening stock market growth.

Economic Slowdown: A global economic slowdown could negatively impact corporate earnings and lead to a decline in stock prices.

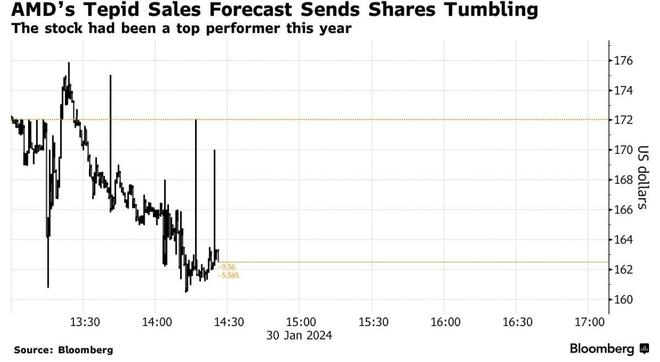

Tech Sector Volatility: The tech sector's dominance in the stock market has raised concerns about market concentration and potential volatility.

Case Studies

To illustrate the potential risks and opportunities in the US stock market, let's consider a few case studies:

Facebook (now Meta Platforms Inc.): Facebook's stock price has experienced significant volatility, with periods of rapid growth followed by sharp declines. This highlights the potential risks associated with investing in high-growth tech companies.

Tesla: Tesla's stock has experienced explosive growth, but it has also faced concerns about valuation and the company's ability to sustain its growth.

Amazon: Amazon has been a major driver of the stock market's growth, but it has also faced criticism for its labor practices and potential for antitrust issues.

Conclusion

In conclusion, the US stock market is currently overvalued compared to historical averages. However, this does not necessarily mean that it is headed for a crash. Investors should carefully consider the potential risks and opportunities before making investment decisions. By staying informed and diversified, investors can navigate the complexities of the stock market and potentially achieve long-term success.