Understanding the Current State of the US Stock Market

The stock market is a vital indicator of the health of an economy. As investors, it's crucial to stay informed about the latest trends and movements. The question on many investors' minds lately is: "Is the US stock market falling?" In this article, we'll delve into the current state of the US stock market, analyze the factors contributing to its fluctuations, and provide insights into what the future might hold.

Recent Market Trends

Over the past few months, the US stock market has experienced significant volatility. The S&P 500, a widely followed benchmark index, has seen both sharp gains and losses. While some investors have been able to capitalize on these fluctuations, others have been left scratching their heads.

Several factors have contributed to the current market conditions. The most notable are:

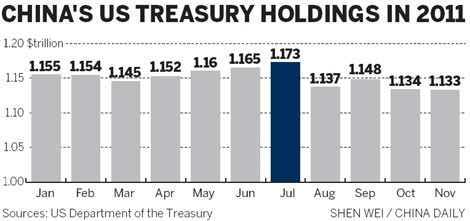

- Economic Uncertainty: The ongoing trade tensions between the US and China have created uncertainty in the global economy. This uncertainty has led to increased volatility in the stock market.

- Interest Rate Hikes: The Federal Reserve has raised interest rates multiple times in the past year, which has made borrowing more expensive for companies and consumers. This has put pressure on stock prices.

- Corporate Profits: Many companies have reported lower profits than expected, which has caused investors to question the sustainability of the current bull market.

Analyzing the Data

To determine whether the US stock market is falling, we need to look at the data. The S&P 500 is a good starting point, as it represents a broad range of companies across various sectors. Here are some key data points to consider:

- Historical Performance: The S&P 500 has experienced several corrections over the past few years, but it has always recovered. This suggests that the current market downturn may be temporary.

- Valuation Levels: The stock market is currently trading at a higher valuation than it was during the dot-com bubble of the late 1990s. This could indicate that the market is overvalued and due for a correction.

- Economic Indicators: Key economic indicators, such as unemployment and inflation, are still relatively strong. This suggests that the economy is not in a recession, which could help support stock prices.

Case Studies

To further understand the current market conditions, let's look at a few case studies:

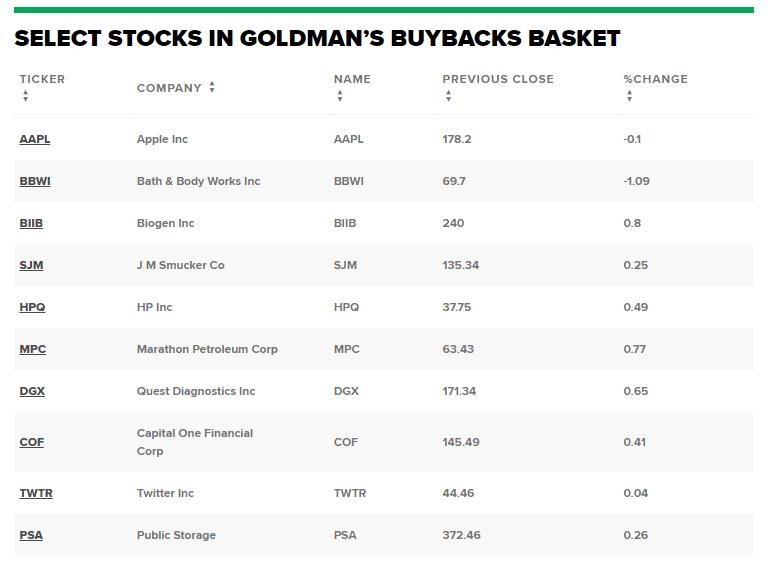

- Apple Inc.: The tech giant has seen its stock price fluctuate significantly over the past few months. While the company's fundamentals remain strong, investors are concerned about the global economic slowdown and the impact on consumer spending.

- Tesla Inc.: The electric vehicle manufacturer has experienced rapid growth, but its stock price has been volatile. Some investors believe that Tesla's high valuation is justified, while others are skeptical about the company's long-term prospects.

- Walmart Inc.: The retail giant has seen its stock price decline as competition from online retailers continues to grow. However, the company's strong fundamentals and commitment to e-commerce suggest that it may be able to weather the storm.

Conclusion

In conclusion, the US stock market is currently experiencing volatility, but it's not necessarily falling. While there are concerns about economic uncertainty and corporate profits, the market's historical performance and strong economic indicators suggest that the current downturn may be temporary. As investors, it's important to stay informed and make decisions based on sound analysis.