In recent years, the Indian mutual fund industry has seen a surge in interest, with investors increasingly seeking global exposure. One of the most popular avenues for diversification has been investing in US stocks. This article explores the opportunities and considerations for Indian mutual funds venturing into the US stock market.

Understanding Indian Mutual Funds

Indian mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. These funds are managed by fund managers who make investment decisions on behalf of the investors. The primary goal of mutual funds is to generate capital appreciation or income for their investors.

The US Stock Market: A Diversification Haven

The US stock market is the largest and most diversified in the world, offering exposure to a wide range of industries and sectors. It is home to many of the world's largest and most influential companies, including technology giants like Apple and Microsoft, as well as traditional industry leaders like General Electric.

Why Indian Mutual Funds are Investing in US Stocks

- Diversification: By investing in US stocks, Indian mutual funds can diversify their portfolios, reducing exposure to domestic market risks.

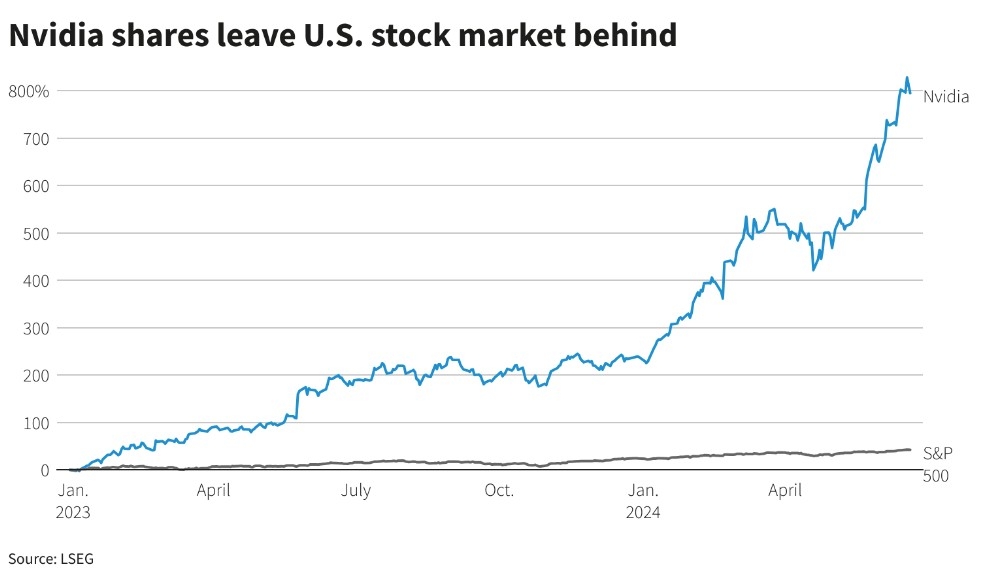

- High Growth Potential: The US economy has historically shown robust growth, offering Indian investors potential for significant returns.

- Currency Advantage: When the Indian rupee strengthens against the US dollar, Indian investors in US stocks can benefit from higher returns when converted back to rupees.

- Access to Innovation: The US is at the forefront of technological innovation, providing Indian investors with access to cutting-edge companies and industries.

Considerations for Indian Mutual Funds

- Regulatory Compliance: Indian mutual funds need to adhere to strict regulatory requirements when investing in foreign markets. This includes compliance with the Foreign Account Tax Compliance Act (FATCA).

- Currency Risk: Fluctuations in exchange rates can impact returns. Indian mutual funds must manage currency risk effectively.

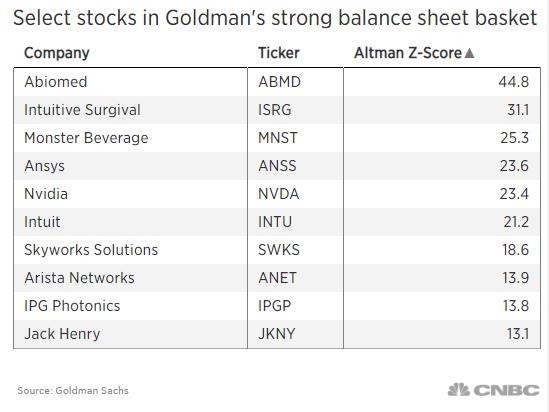

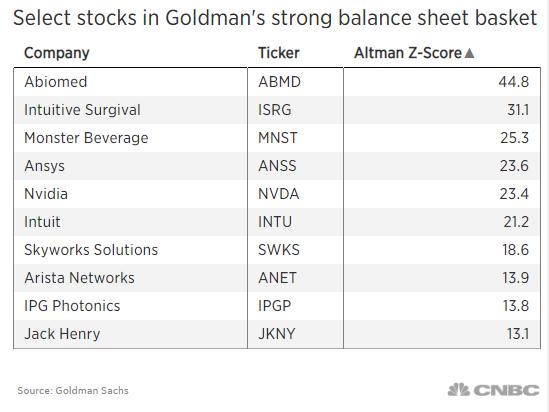

- Research and Analysis: Thorough research and analysis are crucial to identify the most promising US stocks and sectors.

- Tax Implications: Tax considerations are important for Indian investors. It is essential to understand the tax implications of investing in US stocks through Indian mutual funds.

Case Study: HDFC Mutual Fund’s Investment in Apple Inc.

One notable example is HDFC Mutual Fund's investment in Apple Inc. HDFC Mutual Fund, one of India's leading mutual fund companies, has allocated a significant portion of its portfolio to Apple stock. This investment has proven to be beneficial for the fund, as Apple has consistently delivered strong financial results and has been a significant contributor to the fund's overall performance.

Conclusion

Investing in US stocks through Indian mutual funds presents a strategic opportunity for diversification and capital appreciation. However, it is essential for investors to be aware of the risks and complexities involved. With proper research and management, Indian mutual funds can leverage the potential of the US stock market to enhance the returns for their investors.