In the ever-evolving automotive industry, FCA US LLC has emerged as a key player. With a diverse portfolio of vehicles and a strong market presence, investing in FCA US stocks could be a strategic move for investors looking to capitalize on the automotive sector. This article delves into the details of FCA US stocks, providing insights into their performance, potential, and the factors that influence their market value.

Understanding FCA US LLC

FCA US LLC, formally known as Fiat Chrysler Automobiles N.V., is an American multinational automotive manufacturer headquartered in Auburn Hills, Michigan. The company was established in 2014 through the merger of Fiat S.p.A. and Chrysler Group LLC. FCA US LLC is responsible for producing and distributing a wide range of vehicles, including cars, SUVs, and trucks, under various brands such as Dodge, Jeep, Ram, and Chrysler.

Performance of FCA US Stocks

The performance of FCA US stocks is a critical factor for potential investors. Over the years, the company has shown a consistent growth trend, which can be attributed to its diverse product portfolio and strategic expansion. In the last fiscal year, FCA US reported a revenue of

Factors Influencing FCA US Stock Value

Several factors influence the value of FCA US stocks. These include:

- Market demand: The demand for FCA US vehicles plays a significant role in determining stock value. For instance, the popularity of Jeep SUVs has positively impacted the company's stock performance.

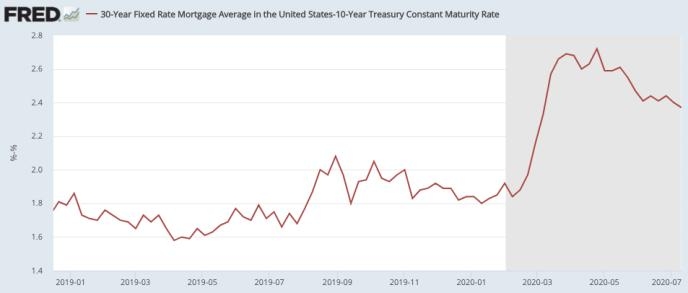

- Economic conditions: Economic downturns can negatively affect the automotive industry, leading to a decline in stock value.

- Product launches: New product launches, such as the recent Jeep Grand Cherokee L, can boost stock value as they attract new customers and increase market share.

- Regulatory changes: Changes in automotive regulations, such as stricter emissions standards, can impact the company's operations and, consequently, its stock value.

Case Study: FCA US Stock Performance in 2020

In 2020, the automotive industry faced unprecedented challenges due to the COVID-19 pandemic. Despite the global crisis, FCA US stocks demonstrated resilience. The company's strategic focus on cost reduction and operational efficiency helped mitigate the impact of the pandemic. In the first quarter of 2020, FCA US reported a net income of $1.2 billion, showcasing its ability to navigate through challenging times.

Conclusion

Investing in FCA US stocks can be a lucrative opportunity for investors looking to capitalize on the automotive sector. With a strong market presence, a diverse product portfolio, and a history of financial stability, FCA US LLC presents a compelling investment case. However, it is essential to conduct thorough research and consider the various factors that influence stock value before making any investment decisions.