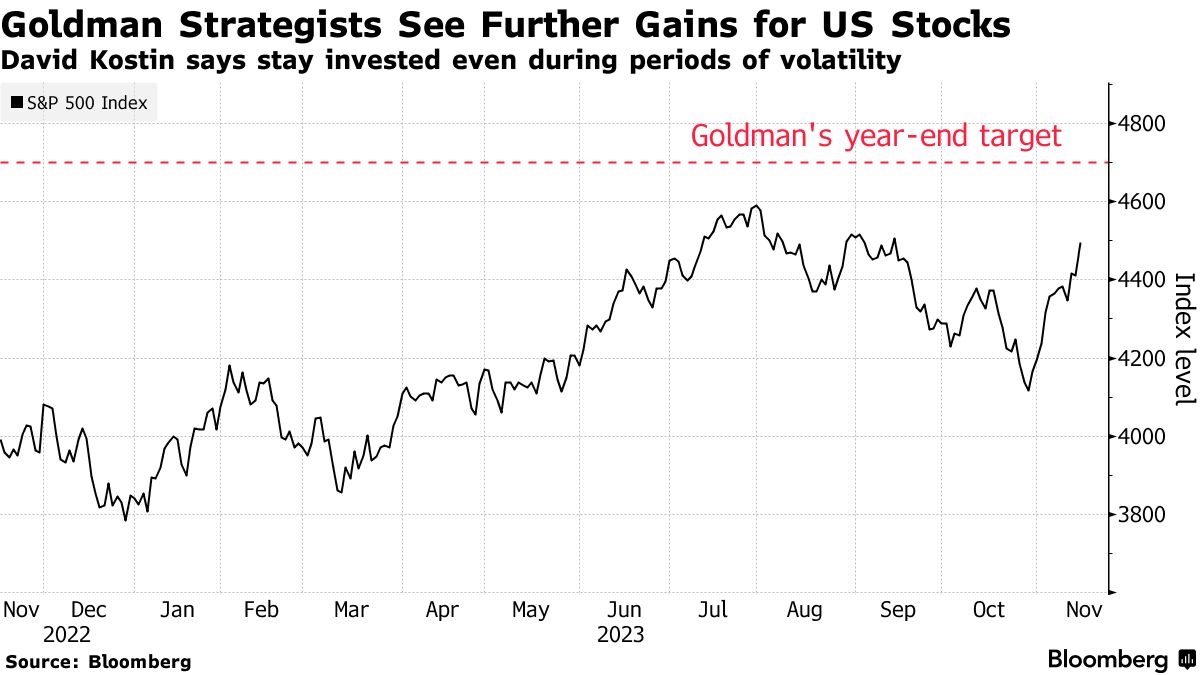

In a recent move that has sent ripples through the financial markets, Citigroup has downgraded its outlook for U.S. stocks. This article delves into what this downgrade means for investors, and the potential implications for the broader market.

Understanding the Downgrade

Citi's downgrade of U.S. stocks is not a trivial matter. As one of the world's largest banks, Citigroup's views on the market are closely watched by investors and analysts alike. The downgrade suggests that Citi believes the U.S. stock market is facing challenges that could lead to a downturn.

What Are the Underlying Factors?

According to Citi, several factors have contributed to their decision to downgrade U.S. stocks. These include rising inflation, slowing economic growth, and increased geopolitical tensions. Here's a closer look at each of these factors:

- Rising Inflation: Inflation has been on the rise in recent months, and it's expected to continue to do so. This is a concern for investors, as rising inflation can erode the purchasing power of their investments.

- Slowing Economic Growth: Economic growth has been slowing in recent quarters, and this trend is expected to continue. Slower economic growth can lead to lower corporate profits, which can negatively impact stock prices.

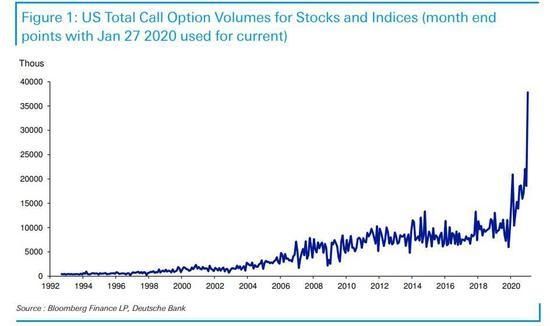

- Increased Geopolitical Tensions: The world is becoming increasingly unpredictable, with tensions rising between major powers. This uncertainty can lead to volatility in the markets, making it difficult for investors to make informed decisions.

Implications for Investors

The downgrade by Citigroup is a stark reminder that investing in the stock market is not without risks. Investors should take note of the following implications:

- Risk Management: It's crucial to manage risk effectively. This means diversifying your portfolio across different asset classes and sectors, and being prepared to adjust your strategy as market conditions change.

- Long-Term Perspective: While short-term market fluctuations are a concern, it's important to maintain a long-term perspective. The stock market has historically delivered strong returns over the long term, but it's essential to stay patient and avoid making impulsive decisions based on short-term volatility.

- Diversification: Diversifying your portfolio can help mitigate the impact of market downturns. Consider including a mix of stocks, bonds, and other asset classes to spread out your risk.

Case Study: The Tech Sector

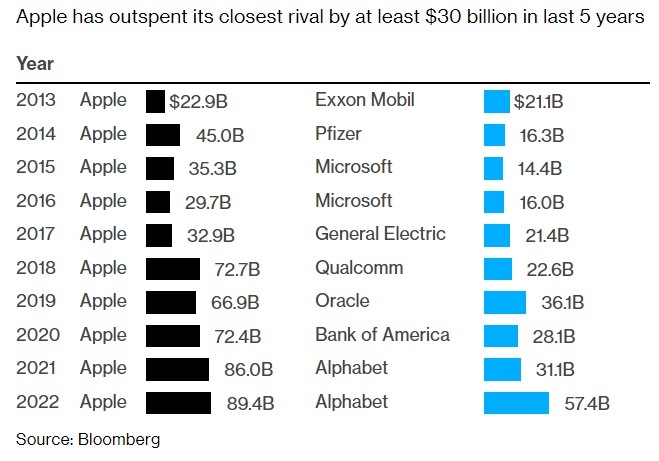

One area that has been particularly affected by the downgrade is the tech sector. Companies like Apple, Google, and Microsoft have been among the most prominent victims of the downgrade. This is due to their significant exposure to the global economy, as well as their reliance on consumer spending.

As an example, consider the recent decline in Apple's stock price. The company's earnings report revealed that demand for its products had softened, which raised concerns about the company's future growth prospects. This is just one example of how the downgrade by Citigroup can impact individual stocks.

Conclusion

The downgrade of U.S. stocks by Citigroup is a cause for concern, but it's not the end of the world. By understanding the underlying factors and taking appropriate steps to manage risk, investors can navigate the current market conditions and position themselves for long-term success.