In the ever-evolving world of biotechnology and pharmaceuticals, Celgene Corporation has long been a notable player. With its U.S. stock price reflecting the company's market performance and strategic moves, investors and industry watchers are keen to understand the current trends and future projections. This article delves into the key aspects that influence Celgene's stock price and offers insights into what the future might hold.

Understanding Celgene's Stock Price Dynamics

Celgene's stock price is influenced by a variety of factors, including market sentiment, company performance, and broader industry trends. Here are some of the critical factors to consider:

1. Company Performance Celgene's financial results, including revenue and earnings reports, are closely monitored by investors. A strong performance, marked by increased sales of key drugs and positive clinical trial results, can drive the stock price higher. Conversely, disappointing results can lead to a decline in share value.

2. Pipeline and Pipeline Developments Celgene has a robust pipeline of new drug candidates, and the progress of these drugs through clinical trials is a major driver of stock price movements. Positive outcomes from late-stage trials or regulatory approvals can significantly boost investor confidence and the stock price.

3. Market Sentiment The overall sentiment in the biotechnology and pharmaceutical sectors can have a substantial impact on Celgene's stock price. Positive news from peers or the industry as a whole can positively influence Celgene's stock, while negative news can have the opposite effect.

4. Acquisitions and Partnerships Celgene has a history of acquiring smaller biotech companies and forming strategic partnerships. These moves can enhance the company's pipeline and market position, potentially leading to an increase in stock price.

Current Trends

As of the latest data, Celgene's U.S. stock price has been experiencing a mix of upward and downward trends. Key factors contributing to these movements include:

- Positive Clinical Trial Results: Recent successes in clinical trials for certain drug candidates have provided a positive outlook for the company's future.

- Strategic Acquisitions: Celgene's recent acquisition of Juno Therapeutics has added to its pipeline and could potentially drive future growth.

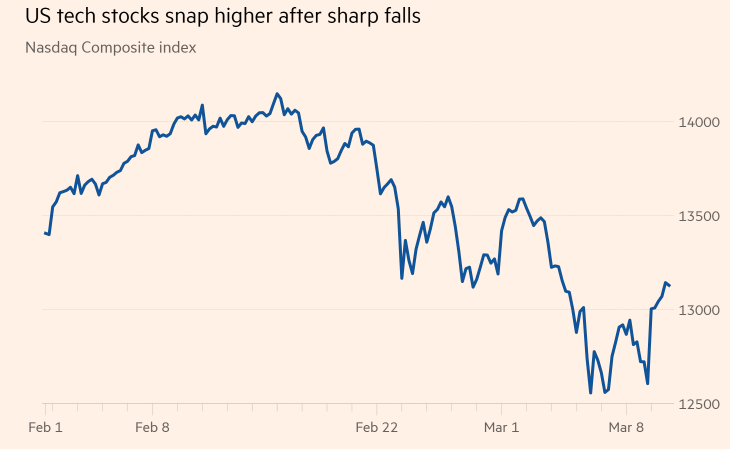

- Market Volatility: The broader market has been experiencing increased volatility, which can impact stock prices across sectors, including biotechnology.

Future Projections

Looking ahead, several factors could influence Celgene's stock price:

- Regulatory Approvals: The approval of new drugs is crucial for Celgene's growth. Positive regulatory decisions could lead to significant revenue increases and boost the stock price.

- Pipeline Progress: The progress of drug candidates currently in development will be closely watched by investors.

- Economic Factors: The overall economic climate and investor sentiment can impact Celgene's stock price.

Case Study: Celgene's Acquisition of Juno Therapeutics

One notable event that could have a lasting impact on Celgene's stock price is its acquisition of Juno Therapeutics. This move not only expanded Celgene's pipeline but also brought in a new team of scientists and drug candidates with potential in the oncology space. The stock price experienced a significant boost following the announcement of the acquisition, reflecting investors' optimism about the potential synergies and future growth prospects.

In conclusion, Celgene's U.S. stock price is influenced by a combination of company-specific factors and broader market dynamics. By staying informed about the company's performance, pipeline developments, and industry trends, investors can make more informed decisions about their investment in Celgene Corporation.