Are you a Canadian investor looking to diversify your portfolio with U.S. stocks? The good news is that it's entirely possible to invest in U.S. stocks from Canada. However, there are several factors you need to consider to ensure a smooth and successful investment process. In this article, we'll explore the steps you need to take and the key things to keep in mind.

Understanding the Process

Opening a U.S. Brokerage Account: The first step is to open a U.S. brokerage account. This can be done through a U.S.-based brokerage firm. Some popular options include TD Ameritrade, E*TRADE, and Fidelity. Ensure that the brokerage firm offers services to Canadian clients and that you're comfortable with their fees and services.

Understanding Currency Conversion: When you invest in U.S. stocks, you'll be dealing with U.S. dollars. This means that any returns you receive will be in USD. Be prepared for currency conversion when withdrawing funds or receiving dividends.

Tax Implications: While Canadian investors can invest in U.S. stocks, there are tax implications to consider. Dividends from U.S. stocks are subject to Canadian income tax. Additionally, if you sell a U.S. stock for a profit, you'll need to pay capital gains tax. It's advisable to consult a tax professional to understand your specific tax obligations.

Dollar Cost Averaging: This is a popular investment strategy where you invest a fixed amount of money at regular intervals. This method helps mitigate the impact of market volatility and can be particularly effective for Canadian investors looking to invest in U.S. stocks.

Tips for Successful Investing

Research and Diversify: As with any investment, thorough research is key. Look for companies with strong fundamentals, such as a good financial position, solid growth prospects, and a competitive advantage in the market. Diversifying your portfolio across different sectors and industries can help reduce risk.

Stay Informed: Keep up-to-date with market trends and news that could impact the performance of your U.S. stocks. This includes economic data, company earnings reports, and geopolitical events.

Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your investment goals and risk tolerance. Don't hesitate to make adjustments as needed.

Case Study: Canadian Investor Invests in U.S. Stocks

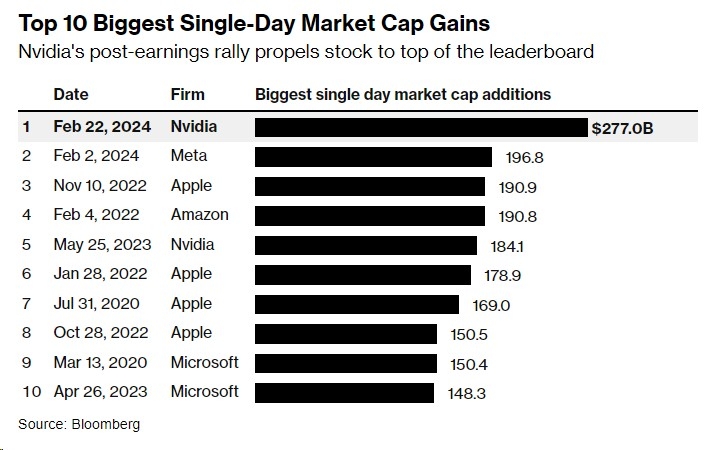

Consider John, a Canadian investor who opened a U.S. brokerage account with TD Ameritrade. He started by investing $10,000 in a diversified portfolio of U.S. stocks, including tech giants like Apple and Microsoft, as well as consumer goods companies like Procter & Gamble. Over the next five years, John monitored his investments, periodically rebalancing his portfolio to maintain his desired asset allocation. As a result, his investments grew significantly in value, allowing him to achieve his investment goals.

Conclusion

Investing in U.S. stocks from Canada is a viable option for Canadian investors looking to diversify their portfolios. By understanding the process, being mindful of tax implications, and conducting thorough research, you can successfully invest in U.S. stocks and potentially grow your wealth. Remember to stay informed and monitor your investments regularly to ensure they align with your financial objectives.