Are you looking to maximize your returns in the volatile US stock market? Swing trading, a strategy that focuses on capturing short-term price movements, can be a powerful tool for investors. In this article, we'll explore some of the best swing trading strategies for US stocks, helping you make informed decisions and potentially boost your portfolio.

Understanding Swing Trading

Swing trading involves holding stocks for a few days to a few weeks, aiming to capture gains from short-term price fluctuations. This strategy requires a keen eye for market trends and the ability to analyze price charts effectively. Let's dive into some of the top swing trading strategies for US stocks.

1. Technical Analysis

Technical analysis is a key component of successful swing trading. By analyzing historical price and volume data, traders can identify patterns and trends that indicate potential price movements. Some popular technical indicators include:

- Moving Averages: These averages help identify the trend direction and provide buy/sell signals.

- Bollinger Bands: This indicator measures volatility and helps identify overbought or oversold conditions.

- Relative Strength Index (RSI): RSI measures the speed and change of price movements and can signal overbought or oversold conditions.

Example: Let's say a stock has been trading above its 50-day moving average, indicating an uptrend. If the RSI falls below 30, it may be an opportunity to buy, as the stock could be oversold.

2. Fundamental Analysis

Fundamental analysis involves evaluating a company's financial health, industry position, and overall business prospects. This approach can help identify undervalued or overvalued stocks.

- Earnings Reports: Pay attention to earnings reports and look for companies that are consistently beating analyst expectations.

- Dividend Yields: Companies with high dividend yields can be attractive for swing traders looking for consistent income.

- Market Capitalization: Larger companies with strong fundamentals may offer more stability and less volatility.

Example: If a company in a growing industry has strong fundamentals and a high dividend yield, it may be a good swing trading opportunity.

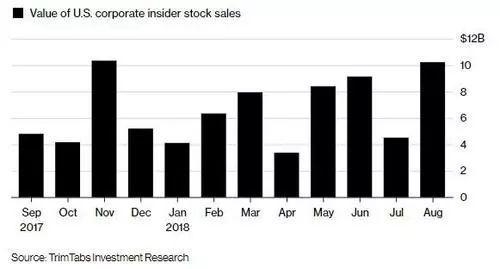

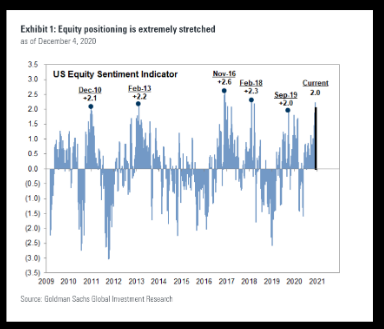

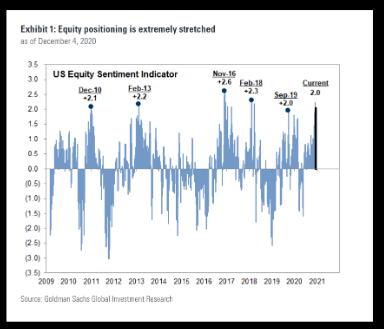

3. Market Sentiment Analysis

Market sentiment plays a crucial role in swing trading. By understanding the mood of the market, traders can make informed decisions about buying or selling stocks.

- News and Economic Indicators: Keep an eye on economic indicators, such as unemployment rates and GDP growth, as well as news that could impact the market.

- Sentiment Indicators: Tools like the VIX (Volatility Index) can provide insights into market sentiment.

Example: If the VIX is high, indicating fear in the market, it may be a good time to look for opportunities to buy undervalued stocks.

4. Risk Management

Risk management is essential for successful swing trading. Here are some key risk management strategies:

- Stop Loss Orders: Set a stop loss to limit potential losses.

- Position Sizing: Only risk a small percentage of your portfolio on each trade.

- Diversification: Diversify your portfolio to reduce risk.

Conclusion

Swing trading can be a lucrative strategy for investors looking to capitalize on short-term price movements in the US stock market. By combining technical and fundamental analysis, understanding market sentiment, and implementing effective risk management, you can increase your chances of success. Remember, swing trading requires discipline and patience, so stay focused and stay informed.