In the world of stock trading, short interest is a crucial metric that investors and traders closely monitor. It provides insights into market sentiment and potential price movements. This article delves into the concept of average short interest in US stocks, its implications, and how it can be a valuable tool for investors.

What is Short Interest?

Short interest refers to the number of shares that investors have sold short but have not yet covered or bought back. When an investor sells a stock short, they are essentially borrowing shares from a broker with the intention of buying them back at a lower price in the future. This practice is often used as a speculative strategy to profit from falling stock prices.

The Average Short Interest in US Stocks

The average short interest in US stocks is a metric that calculates the average number of shares that are currently sold short over a specific period, typically a month. This figure is crucial because it provides a snapshot of market sentiment and potential future price movements.

Implications of Average Short Interest

Market Sentiment: A high average short interest suggests that a significant number of investors are betting on a stock's price to decline. This can indicate bearish sentiment and potential downward pressure on the stock price.

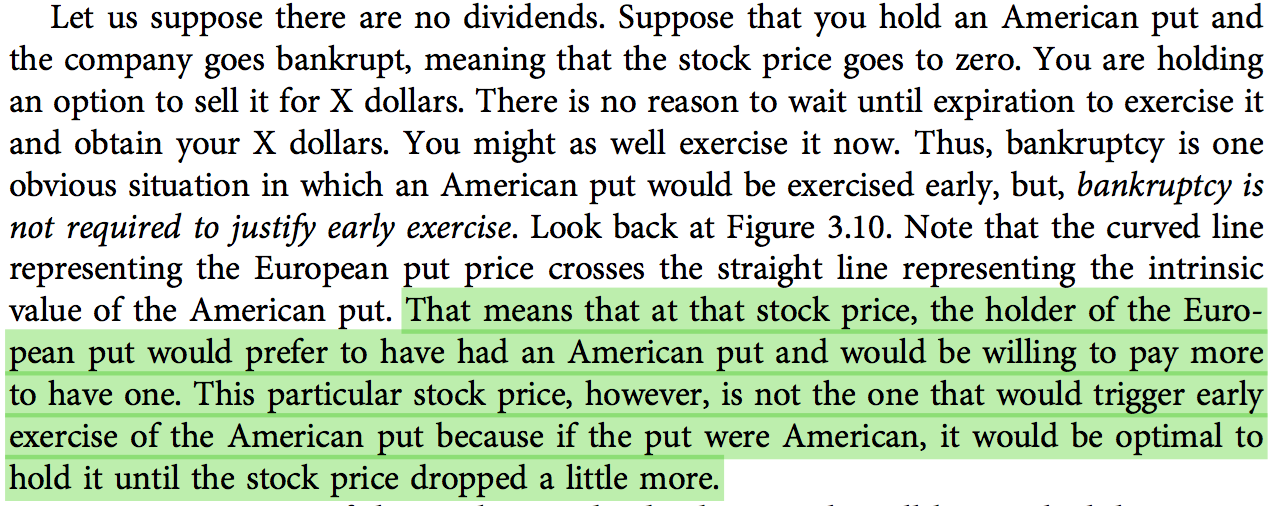

Potential Price Movements: When a stock's short interest increases, it can lead to a squeeze, where the price of the stock spikes higher as short sellers rush to cover their positions. Conversely, if short interest decreases, it may suggest that bearish sentiment is waning.

Market Manipulation: High short interest can sometimes be a sign of market manipulation, where traders use short selling to drive down stock prices.

Case Study: Tesla (TSLA)

A prime example of the impact of average short interest is Tesla (TSLA). In the first half of 2021, Tesla's short interest reached an all-time high of over 30% of its float. Despite this, the stock continued to rise, reaching new all-time highs. This situation highlighted the potential for short interest to be a contrarian indicator, as bearish sentiment did not prevent the stock from appreciating.

How to Use Average Short Interest

Investors can use the average short interest as a tool to gauge market sentiment and potential price movements. However, it's important to consider other factors, such as the company's fundamentals, industry trends, and overall market conditions.

Combine with Other Metrics: Use average short interest in conjunction with other metrics, such as trading volume and price momentum, to get a more comprehensive view of the stock's potential.

Be Cautious of Manipulation: Be aware of potential market manipulation, especially in highly speculative stocks.

Long-Term Perspective: Consider the average short interest as part of a long-term investment strategy, rather than a short-term trading signal.

In conclusion, understanding the average short interest in US stocks can provide valuable insights into market sentiment and potential price movements. By combining this metric with other factors, investors can make more informed decisions and potentially capitalize on market trends.