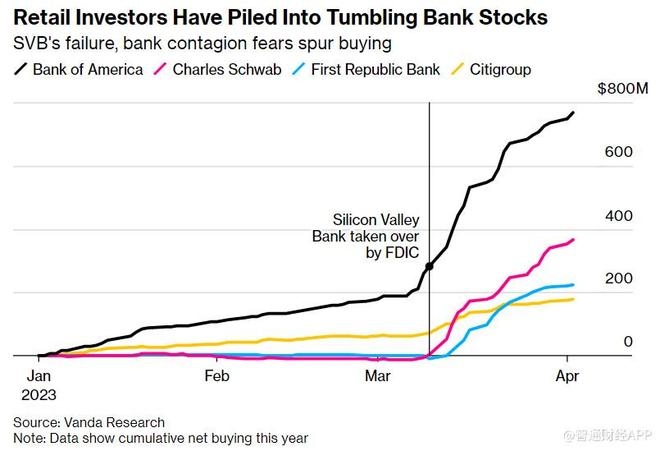

The stock market is often a reflection of the economic and political climate, and Tuesday's sharp decline in US stocks is a testament to the volatility that investors are currently experiencing. In this article, we will delve into the reasons behind the sudden downturn and analyze its potential impact on the market and the broader economy.

Reasons for the Downturn

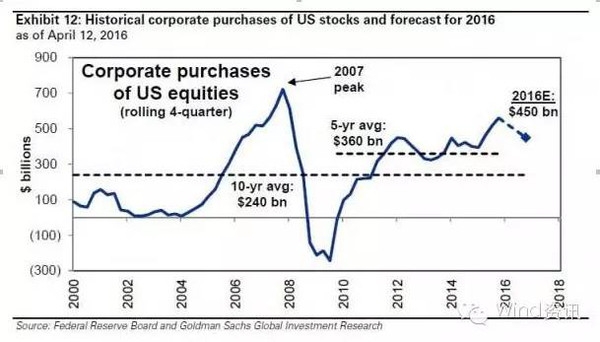

Several factors contributed to the sharp drop in US stocks on Tuesday. One of the primary reasons was the release of weaker-than-expected economic data. For instance, the Consumer Price Index (CPI) showed that inflation is still a concern, which can lead to higher interest rates, making borrowing more expensive for companies and consumers alike.

Market Sentiment and Geopolitical Tensions

Market sentiment was also negatively impacted by geopolitical tensions. The ongoing conflict in Eastern Europe and the Middle East has caused uncertainty and volatility in global markets. Investors are concerned about the potential for higher energy prices and disruptions in global supply chains.

Impact on Key Sectors

The downturn in US stocks affected various sectors, with technology and energy stocks being particularly hard hit. Tech giants like Apple and Microsoft saw their shares plummet, while energy companies faced pressure due to concerns about oil prices and geopolitical risks.

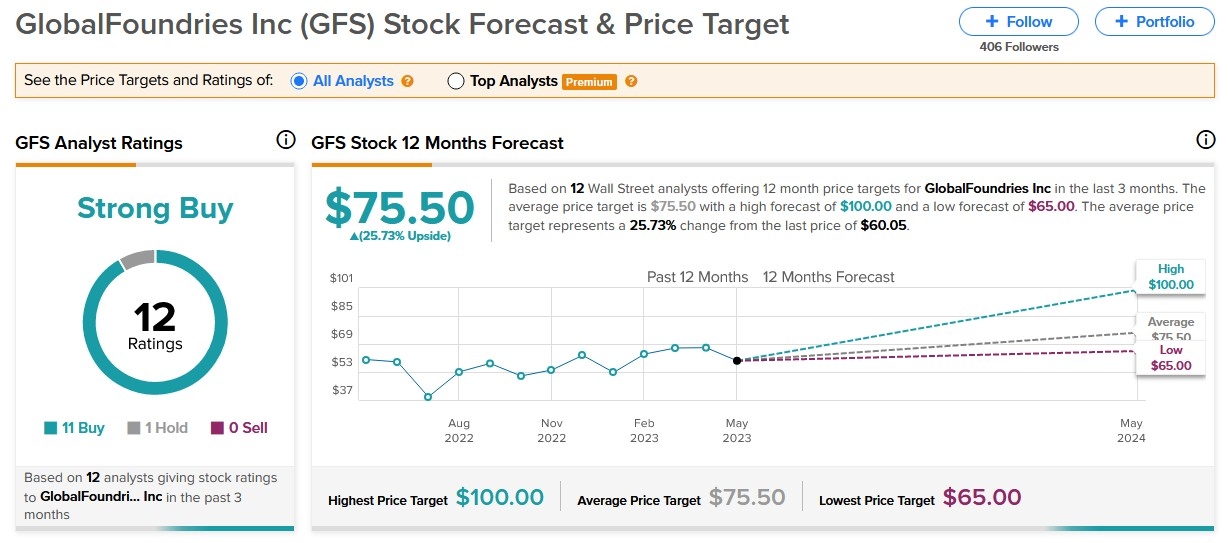

Analyst Perspectives

Several financial analysts have weighed in on the situation. Some believe that the recent downturn is a temporary correction, while others are more cautious and predict a prolonged period of market volatility. Analysts at JPMorgan Chase & Co. noted that the current market conditions are reminiscent of the dot-com bubble in the early 2000s, suggesting that investors should be prepared for a bumpy ride.

Case Studies

To illustrate the impact of the downturn, let's consider two case studies. The first involves a technology company that had seen its stock soar in recent months. However, after the recent downturn, the company's share price plummeted by 20%, erasing billions of dollars in market value. The second case study involves an energy company that had been benefiting from rising oil prices. However, the recent downturn has caused the company's stock to fall by 15%, as investors worry about the potential for higher energy prices and geopolitical risks.

Conclusion

In conclusion, the sharp decline in US stocks on Tuesday is a reminder of the volatility that investors are currently experiencing. The reasons behind the downturn are multifaceted, including economic data, market sentiment, and geopolitical tensions. As investors navigate this uncertain environment, it is crucial to stay informed and consider the potential risks and opportunities that lie ahead.