The ongoing trade negotiations between the United States and China have been a hot topic in financial markets, particularly concerning stocks and futures. As these discussions unfold, investors are keen to understand the potential impact on their portfolios. This article delves into the key aspects of these negotiations and their repercussions on the stock and futures markets.

Understanding the Trade Talks

The trade tensions between the US and China have been brewing for several years. The Trump administration has imposed tariffs on Chinese goods, while China has retaliated with its own tariffs on American products. These actions have caused significant disruptions in global trade and have raised concerns about the economic impact on both countries.

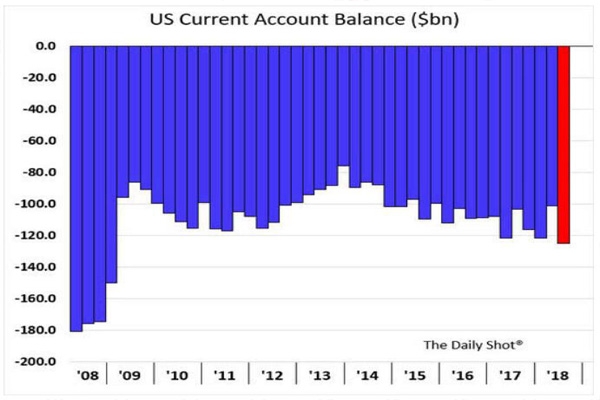

The trade talks between the two nations are aimed at resolving these issues and reaching a mutually beneficial agreement. The negotiations involve discussions on various topics, including intellectual property rights, market access, and the reduction of trade deficits.

Impact on Stocks

The outcome of the trade talks has a significant impact on the stock market. A positive resolution is likely to boost investor confidence and lead to a surge in stocks. Conversely, a breakdown in negotiations could lead to increased uncertainty and a sell-off in the market.

Stocks Sensitive to Trade Tensions

Several sectors of the stock market are particularly sensitive to trade tensions. These include:

- Technology Stocks: Companies like Apple and Microsoft, which rely heavily on Chinese manufacturing, could be negatively affected by increased tariffs.

- Automotive Stocks: Automakers like Ford and General Motors face higher costs due to tariffs on steel and aluminum imports from China.

- Agricultural Stocks: Farmers in the US have been hit hard by China's retaliatory tariffs on American agricultural products.

Impact on Futures

Futures markets are also heavily influenced by the trade talks. The prices of futures contracts on various commodities, such as oil and agricultural products, can be affected by the trade tensions between the US and China.

Case Study: Soybean Futures

One notable example is the impact of the trade tensions on soybean futures. China is a major importer of soybeans, and the retaliatory tariffs imposed by the Chinese government have led to a decrease in demand for American soybeans. This has resulted in a decline in soybean futures prices.

Conclusion

The US China trade talks continue to be a significant factor in the stock and futures markets. Investors need to stay informed about the negotiations and their potential impact on their portfolios. As the talks progress, it's essential to remain vigilant and adapt investment strategies accordingly.