In the volatile and dynamic world of aviation, the stock prices of major U.S. airlines are a critical indicator of the industry's health and the economic climate. This article delves into the current trends in US airline stock prices and examines the factors that influence them. We will also explore the potential future outlook for these stocks, taking into account the recent trends and the industry's ongoing transformation.

Understanding the US Airline Stock Market

The stock market for US airlines has experienced a rollercoaster ride over the past few years. Factors such as geopolitical events, fuel prices, and the COVID-19 pandemic have all played significant roles in shaping these stock prices. Understanding the key factors influencing airline stock prices is crucial for investors and industry observers alike.

Geopolitical Events

Geopolitical events, such as tensions in the Middle East or trade disputes, can have a profound impact on airline stock prices. For instance, the recent tensions between the United States and Iran have led to a rise in oil prices, which, in turn, have affected the profitability of airlines. Similarly, the trade war between the United States and China has caused disruptions in global supply chains, affecting the cost of aircraft parts and services.

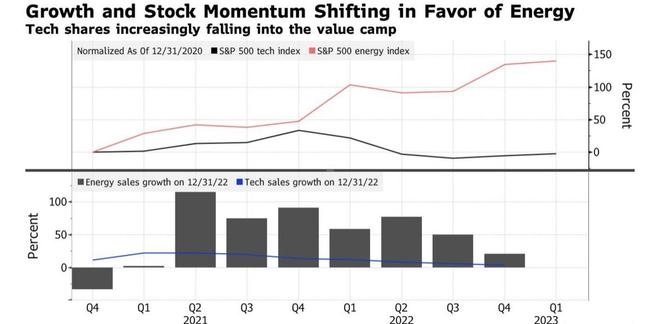

Fuel Prices

Fuel prices are one of the most significant costs for airlines, and they can fluctuate widely. A rise in fuel prices can lead to increased costs for airlines, which can be passed on to passengers or reduce profitability. Conversely, a decrease in fuel prices can boost airline profits and lead to higher stock prices.

COVID-19 Pandemic

The COVID-19 pandemic has been the most significant event affecting the airline industry and, by extension, airline stock prices. The pandemic led to widespread travel restrictions, causing a significant decline in passenger numbers and, consequently, a drop in airline stock prices. However, as vaccines become more widely available and travel restrictions are lifted, airlines are beginning to recover, and their stock prices are starting to rise.

Case Study: Delta Air Lines

Delta Air Lines is a prime example of how airline stock prices can be affected by various factors. In the wake of the COVID-19 pandemic, Delta's stock price plummeted, reflecting the industry's overall downturn. However, as vaccination rates increased and travel restrictions were lifted, Delta's stock price began to recover. This trend underscores the importance of keeping a close eye on the economic climate and vaccination rates when analyzing airline stock prices.

The Future Outlook for US Airline Stocks

The future outlook for US airline stocks is cautiously optimistic. As more people get vaccinated and travel restrictions are lifted, passenger numbers are expected to increase, leading to higher revenue and profits for airlines. However, challenges such as rising fuel prices and geopolitical tensions remain. Investors should consider these factors when evaluating airline stocks.

Conclusion

The stock prices of US airlines are a reflection of the industry's health and the economic climate. Understanding the key factors influencing these stock prices is crucial for investors and industry observers alike. As the aviation industry continues to recover from the COVID-19 pandemic, the future outlook for US airline stocks remains cautiously optimistic, with potential challenges to watch out for.