In today's volatile stock market, staying informed about the US 30 stock price is crucial for investors. The US 30, also known as the Dow Jones Industrial Average (DJIA), is a widely followed index that tracks the performance of 30 large companies in the United States. This article delves into what the US 30 stock price represents, how it is calculated, and what it means for investors.

Understanding the US 30 Stock Price

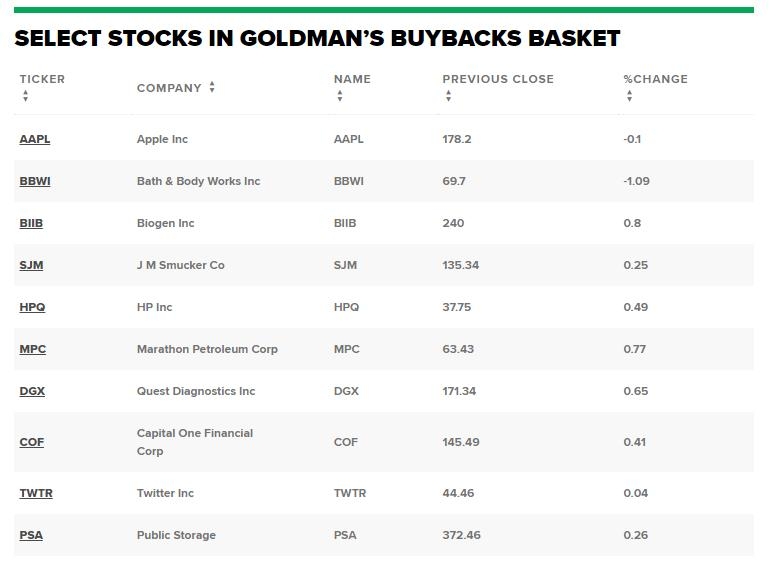

The US 30 stock price reflects the aggregate value of the 30 stocks included in the Dow Jones Industrial Average. These companies are some of the most prominent and influential in the American economy, including giants like Apple, Microsoft, and Visa. The stock price is calculated by adding up the share prices of all 30 companies and dividing by the number of companies, resulting in a single figure that represents the overall value of the index.

How the US 30 Stock Price is Calculated

To calculate the US 30 stock price, financial analysts add up the share prices of the 30 companies in the index and then divide by the divisor. The divisor is a figure that is adjusted periodically to account for stock splits, dividends, and other corporate actions that can affect the index.

For example, if the sum of the 30 companies' stock prices is

What the US 30 Stock Price Means for Investors

The US 30 stock price serves as a benchmark for investors to gauge the overall health of the stock market. A rising US 30 stock price often indicates a strong market, while a falling price can signal market uncertainty or economic downturns. Investors use the US 30 stock price to make informed decisions about their portfolios and to track the performance of their investments.

Case Study: The US 30 Stock Price in 2020

One notable example of how the US 30 stock price can fluctuate is the unprecedented market downturn in 2020 due to the COVID-19 pandemic. As the virus spread globally, fear and uncertainty led to a significant drop in the US 30 stock price. However, as the economy began to recover, the stock price rebounded, demonstrating the volatility and potential for growth in the stock market.

Factors Influencing the US 30 Stock Price

Several factors can influence the US 30 stock price, including economic indicators, political events, and corporate earnings reports. Economic indicators such as unemployment rates, inflation, and GDP growth can impact investor sentiment and lead to fluctuations in the stock price. Additionally, political events, such as elections or policy changes, can create uncertainty and cause the stock price to fluctuate.

Conclusion

Understanding the US 30 stock price is essential for investors looking to stay informed about the stock market. By tracking the performance of the Dow Jones Industrial Average, investors can gain insights into market trends and make informed decisions about their portfolios. Whether you're a seasoned investor or just starting out, knowing how the US 30 stock price is calculated and what it means for the market is crucial for success in the financial world.