Introduction: The recent US attacks on Iran have sent shockwaves through the global market, particularly the stock market. This article delves into the immediate reaction of the stock market following the US attacks and analyzes the potential long-term implications.

Immediate Stock Market Reaction

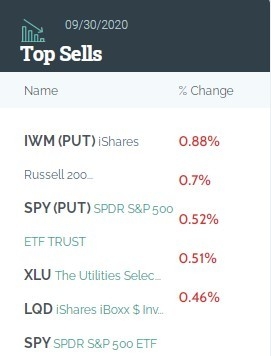

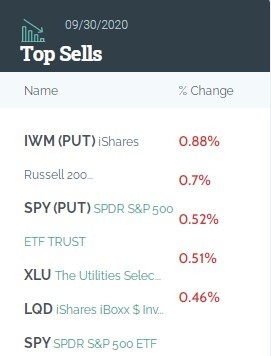

The stock market's reaction to the US attacks on Iran was swift and dramatic. As soon as the news broke, there was a significant sell-off across various sectors. The S&P 500, a widely followed index of 500 large companies, dropped by over 2% in the first few minutes of trading. Similarly, the NASDAQ and the Dow Jones Industrial Average also experienced significant declines.

Energy Sector

The energy sector was among the most affected, with oil prices skyrocketing. As Iran is a major oil producer, the attack raised concerns about the stability of global oil supplies. This led to a surge in oil prices, with WTI crude oil futures jumping by over 5%. Companies in the energy sector, such as ExxonMobil and Chevron, saw their stock prices decline significantly.

Tech Sector

The tech sector, on the other hand, experienced a contrasting reaction. Companies like Apple and Microsoft, which have significant operations in the Middle East, saw their stock prices rise. This can be attributed to the fact that these companies have been investing heavily in the region and are well-positioned to benefit from the increased demand for technology products in the wake of the conflict.

Global Markets

The US attacks on Iran also had a ripple effect on global markets. Stock markets in Europe and Asia experienced similar sell-offs, with the Nikkei 225 in Japan and the FTSE 100 in the UK witnessing significant declines. This highlights the interconnected nature of the global economy and how events in one region can have a widespread impact.

Long-Term Implications

While the immediate reaction of the stock market was dramatic, the long-term implications of the US attacks on Iran are still uncertain. Here are a few potential scenarios:

Increased Geopolitical Risk: The attacks could lead to a prolonged conflict in the region, increasing geopolitical risk. This could have a negative impact on global markets, particularly those heavily reliant on Middle Eastern oil.

Economic Sanctions: The US may impose economic sanctions on Iran, which could further disrupt global trade and affect the global economy.

Increased Oil Prices: As mentioned earlier, the attack has already led to a surge in oil prices. This could have a negative impact on inflation and economic growth in the long run.

Investment Opportunities: On the flip side, the conflict could create investment opportunities in sectors such as defense, energy, and technology.

Conclusion:

The US attacks on Iran have had a significant impact on the stock market, with immediate reactions including sell-offs and increased volatility. While the long-term implications are still uncertain, the conflict is likely to have a lasting impact on global markets. Investors should remain vigilant and stay informed about the evolving situation in the Middle East.