The US-China trade war has been a defining event of the 21st century, affecting global markets and economies in profound ways. The ongoing conflict between the world's two largest economies has had a significant impact on the stock market, creating both opportunities and challenges for investors. In this article, we delve into the effects of the US-China trade war on the stock market, exploring the key developments and their implications.

The Escalation of Trade Tensions

The trade war between the US and China began in 2018 when President Trump imposed tariffs on Chinese goods. China responded with its own tariffs, and the conflict escalated rapidly. The two countries have been engaged in a series of negotiations and tit-for-tat measures, with no clear resolution in sight.

Impact on Stock Market Performance

The stock market has been volatile throughout the trade war, reflecting the uncertainty and risk associated with the conflict. Here are some key impacts:

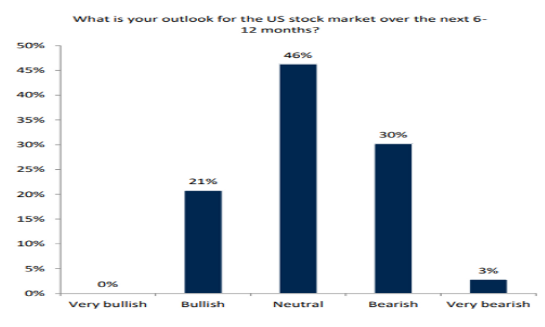

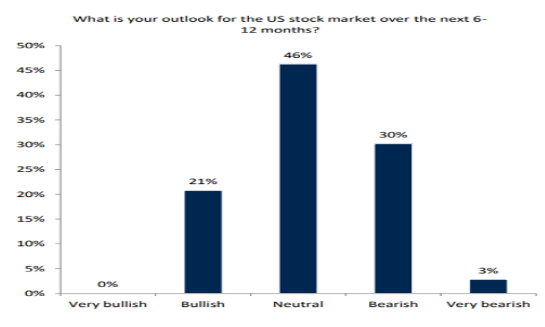

- Equities Volatility: The US stock market has experienced significant volatility, with sharp ups and downs in stock prices. This is due to the uncertainty surrounding the trade war's outcome and its potential impact on the global economy.

- Sector Performance: Certain sectors have been hit harder than others. For example, technology companies, which rely heavily on Chinese markets, have seen their stocks decline. Conversely, sectors like agriculture and energy have benefited from the trade war, as they have received protectionist measures from the US government.

- Global Stock Market Impact: The US-China trade war has had a ripple effect on global stock markets, with many markets experiencing similar volatility and performance trends.

Investor Sentiment and Market Dynamics

The trade war has had a profound impact on investor sentiment and market dynamics. Here are some key points:

- Risk Aversion: Investors have become increasingly risk-averse, leading to a preference for safer assets like bonds and gold. This has pushed down stock prices and increased volatility.

- Dividend Yields: As investors seek safer investments, dividend yields have risen, making certain stocks more attractive.

- Long-Term Investment Strategies: Some investors have shifted their focus to long-term investment strategies, seeking to benefit from the eventual resolution of the trade war and its positive impact on the global economy.

Case Studies

To illustrate the impact of the trade war on the stock market, let's consider a few case studies:

- Apple Inc.: As a major manufacturer and exporter to China, Apple has been affected by the trade war. Its stock price has experienced significant volatility, reflecting the uncertainty surrounding the conflict.

- Tesla Inc.: Tesla, which relies heavily on Chinese markets, has seen its stock price decline amidst the trade war. However, the company has also benefited from the Chinese government's recent push for electric vehicles.

- Caterpillar Inc.: As a manufacturer of heavy equipment, Caterpillar has seen its stocks rise amidst the trade war. This is due to the company's exposure to the agriculture and energy sectors, which have benefited from protectionist measures.

Conclusion

The US-China trade war has had a significant impact on the stock market, creating both challenges and opportunities for investors. While the conflict remains unresolved, it is clear that the trade war will continue to shape market dynamics and investor sentiment. As the global economy adjusts to the new reality, investors must stay informed and adapt their strategies accordingly.