Are you contemplating selling your US stocks? The decision to sell can be daunting, especially in a volatile market. In this article, we delve into the factors you should consider before making this pivotal move. We will explore market trends, economic indicators, and personal financial goals to help you make an informed decision.

Understanding Market Trends

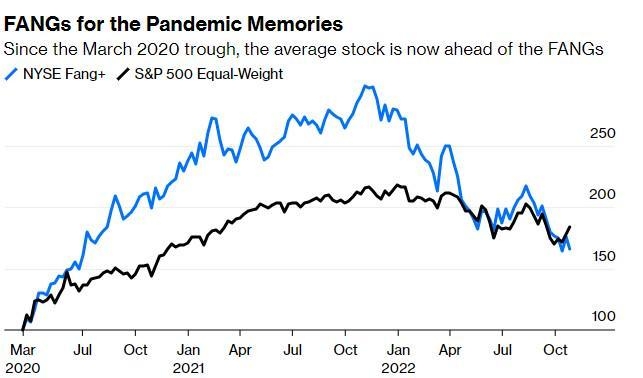

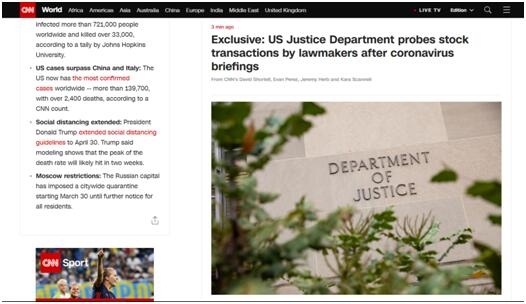

One of the first things to consider is the current state of the market. Historically, the stock market has experienced ups and downs. Understanding the current trends can provide valuable insights into whether it's the right time to sell.

- Historical Performance: Look at the performance of the US stock market over the past few years. Has it been on an upward trend, or has it been experiencing significant volatility?

- Economic Indicators: Pay attention to economic indicators such as unemployment rates, inflation, and GDP growth. These factors can impact the stock market's performance.

Analyzing Economic Indicators

Economic indicators play a crucial role in determining the health of the stock market. Here are some key indicators to consider:

- Unemployment Rates: Lower unemployment rates typically indicate a strong economy, which can positively impact stock prices.

- Inflation: High inflation can erode purchasing power and negatively impact stock prices.

- GDP Growth: A strong GDP growth rate suggests economic stability, which can be beneficial for the stock market.

Personal Financial Goals

Your personal financial goals should also guide your decision to sell US stocks. Consider the following:

- Short-Term vs. Long-Term Goals: If you have short-term goals, such as paying off debt or purchasing a home, selling stocks may be a viable option. However, if you have long-term goals, such as retirement, it may be beneficial to hold onto your stocks.

- Risk Tolerance: Assess your risk tolerance. If you are risk-averse, you may want to consider selling stocks to reduce your exposure to market volatility.

Case Studies

Let's look at a few case studies to provide real-world context:

- Case Study 1: A retiree with a low risk tolerance decides to sell their US stocks to provide a stable income source for their retirement. This decision aligns with their long-term financial goals.

- Case Study 2: An investor with a high risk tolerance decides to sell a portion of their US stocks to reinvest in emerging markets, which they believe will offer higher returns.

Conclusion

In conclusion, deciding whether to sell US stocks is a complex decision that requires careful consideration of market trends, economic indicators, and personal financial goals. By analyzing these factors, you can make an informed decision that aligns with your financial objectives. Remember, it's crucial to consult with a financial advisor before making any significant investment decisions.