Are you a non-US citizen looking to invest in the US stock market? If so, you've come to the right place. Investing in stocks can be a great way to grow your wealth, but it's important to understand the rules and regulations that apply to non-US citizens. In this comprehensive guide, we'll cover everything you need to know about buying stocks as a non-US citizen.

Understanding the Basics

First, let's clarify what it means to be a non-US citizen. A non-US citizen is anyone who is not a citizen of the United States. This includes permanent residents, temporary residents, and individuals who are not residents at all.

Opening a Brokerage Account

The first step in buying stocks is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are many brokerage firms to choose from, so it's important to find one that meets your needs.

When opening a brokerage account, you'll need to provide some personal information, such as your name, address, and tax identification number. If you're not a US citizen, you may also need to provide additional documentation, such as a passport or visa.

Understanding Tax Implications

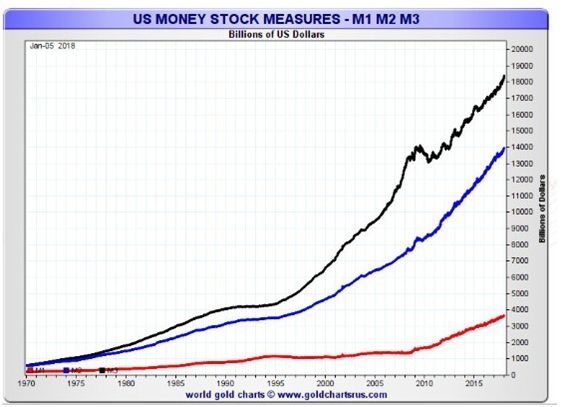

One of the most important considerations for non-US citizens buying stocks is the tax implications. The US government requires non-US citizens to pay taxes on any income earned from investments in the US stock market. This includes capital gains, dividends, and interest.

It's important to understand that the tax rate for non-US citizens can be different from the rate for US citizens. Additionally, non-US citizens may be subject to withholding taxes on dividends and interest.

Types of Stocks to Consider

When investing in the US stock market, there are several types of stocks to consider. Here are a few of the most popular:

- Common Stock: This is the most common type of stock, and it gives you ownership in the company. Common stockholders have voting rights and can receive dividends, but they are the last to receive any proceeds in the event of bankruptcy.

- Preferred Stock: Preferred stockholders have a higher claim on assets and earnings than common stockholders. They typically receive fixed dividends and have priority over common stockholders in the event of bankruptcy.

- Blue-Chip Stocks: These are stocks of well-established companies with a strong history of profitability and stability. They are often considered to be safe investments.

- Growth Stocks: These are stocks of companies that are expected to grow at a faster rate than the market average. They may not pay dividends, but they can offer significant capital gains.

Case Study: John, the Non-US Citizen Investor

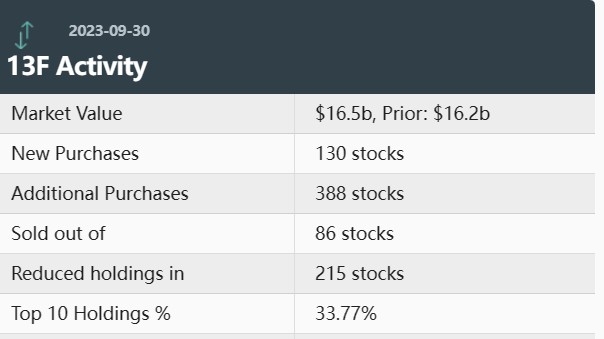

Let's consider a hypothetical case study to illustrate the process of buying stocks as a non-US citizen. John is a non-US citizen living in Europe. He wants to invest in the US stock market to diversify his portfolio.

John starts by researching brokerage firms that accept non-US citizens. He finds a reputable firm and opens a brokerage account. He provides all the necessary documentation, including his passport and tax identification number.

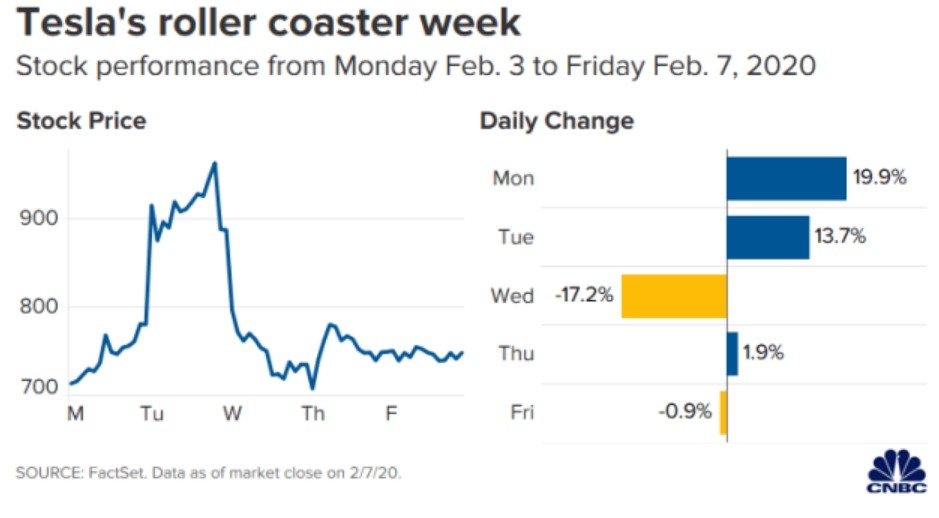

Once his account is open, John decides to invest in a few blue-chip stocks, such as Apple and Microsoft. He also invests in some growth stocks, such as Tesla and Netflix.

Over the next few years, John's investments grow significantly. He earns dividends from his preferred stocks and capital gains from his growth stocks. He also pays taxes on his earnings, as required by US law.

Conclusion

Investing in the US stock market as a non-US citizen can be a great way to grow your wealth. By understanding the basics, opening a brokerage account, and understanding the tax implications, you can make informed decisions and achieve your investment goals. Remember to do your research and consult with a financial advisor if needed.