In the world of investing, understanding the nuances of stock trading can be the difference between success and failure. One critical aspect of trading stocks is the concept of margin requirements. This article delves into the basics of margin requirements for US stocks, explaining what they are, how they work, and their implications for investors.

What Are Margin Requirements?

Margin requirements refer to the amount of money or securities that a trader must deposit with their brokerage firm to purchase stocks on margin. In other words, it's the collateral that ensures the broker that the investor has enough funds to cover any potential losses on the investment.

How Margin Requirements Work

When you buy stocks on margin, you're essentially borrowing money from your broker to purchase additional shares. The margin requirement is the percentage of the total value of the shares that you must pay upfront. For example, if the margin requirement is 50%, you would need to pay

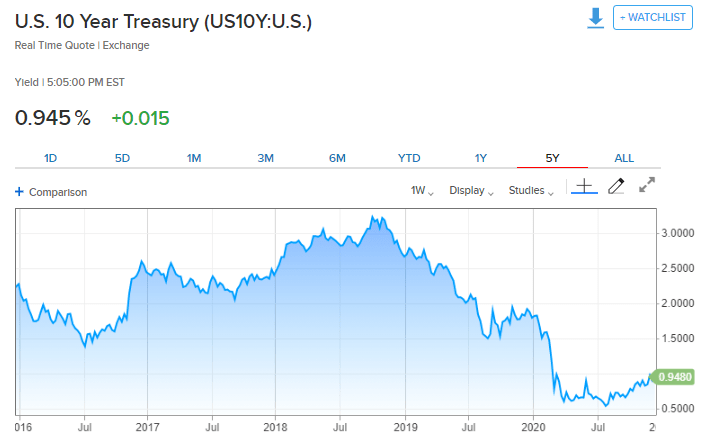

The remaining $5,000 is borrowed from the broker, and you'll be charged interest on this borrowed amount. It's important to note that the interest rate on margin loans can vary depending on the broker and the current market conditions.

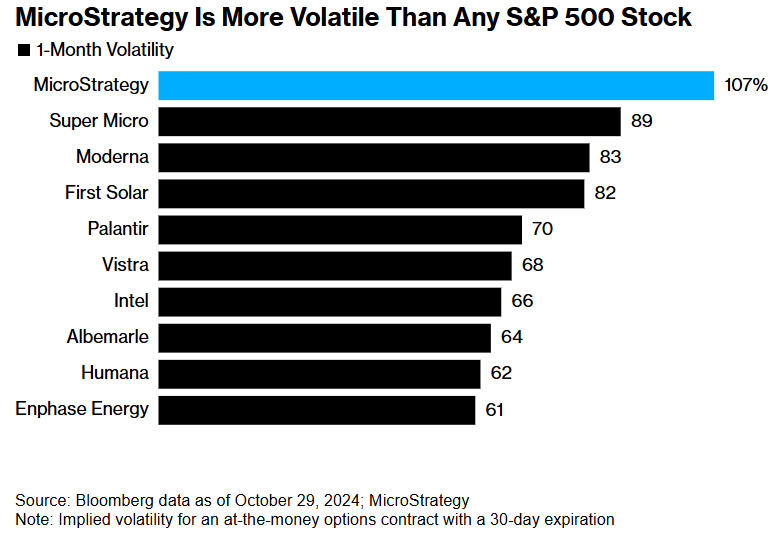

The Risks of Margin Trading

While margin trading can amplify your gains, it also increases your risk. If the stock you've purchased falls in value, you may be required to deposit additional funds to maintain your position, or you may face a margin call, which is when your broker demands that you repay the loan immediately.

Moreover, if the value of your stock drops below a certain level, known as the maintenance margin, your broker may sell your shares to cover the shortfall. This can result in significant losses, as you may not have any control over when or how your shares are sold.

Key Points to Remember

- Margin requirements are the amount of money or securities you must deposit to purchase stocks on margin.

- Margin trading allows you to borrow money from your broker to purchase additional shares.

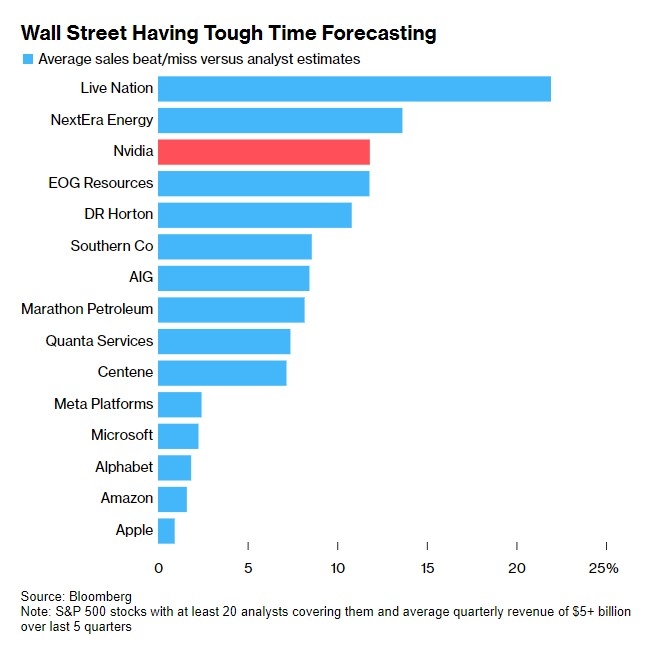

- Margin requirements can vary depending on the broker and the type of stock.

- Margin trading carries higher risks, including the potential for margin calls and forced liquidations.

Case Study: Margin Requirements in Action

Let's consider a hypothetical scenario. Imagine you have

If the stock you've purchased increases in value by 10%, you'll make a profit of

Conclusion

Understanding margin requirements is crucial for any investor looking to trade stocks on margin. By familiarizing yourself with the basics, you can mitigate risks and make informed decisions. Always remember to carefully consider your investment strategy and consult with a financial advisor if needed.