Are you a Malaysian investor looking to expand your portfolio into the US stock market? With its vast array of opportunities and stable market, investing in US stocks can be a smart move. In this article, we will guide you through the process of buying US stocks as a Malaysian investor. From understanding the basics to executing your investment strategy, we've got you covered.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world. It's home to some of the most well-known and successful companies, such as Apple, Microsoft, and Amazon. As a Malaysian investor, you can gain exposure to these companies and potentially benefit from their growth and profitability.

Opening a Brokerage Account

To buy US stocks, you'll need to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are many brokerage firms available, both online and offline, that cater to international investors.

When choosing a brokerage firm, consider factors such as fees, customer service, and the range of investment options they offer. Some popular brokerage firms for international investors include TD Ameritrade, E*TRADE, and Charles Schwab.

Understanding the Risks

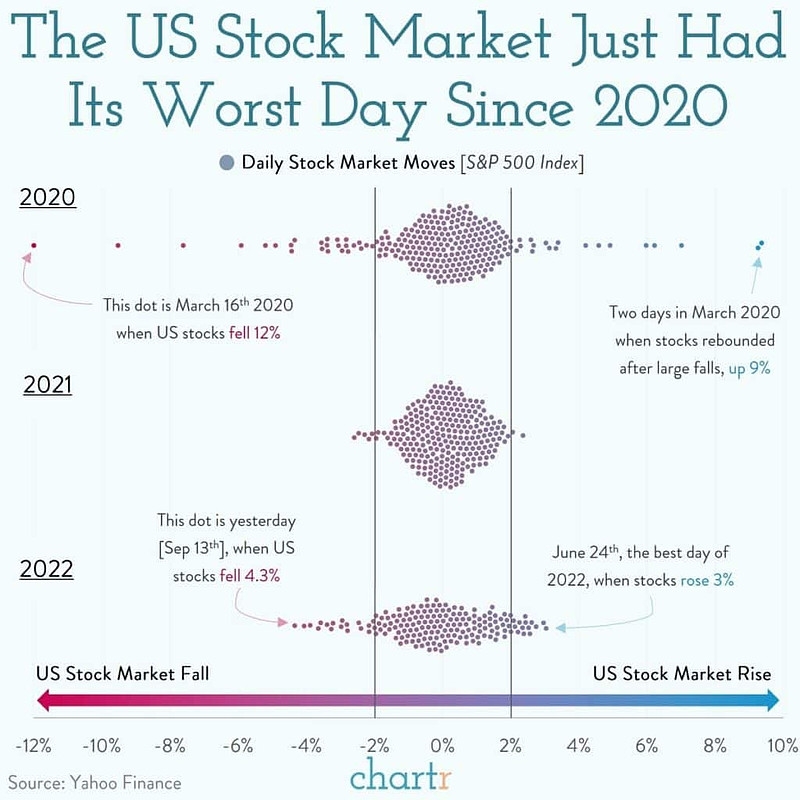

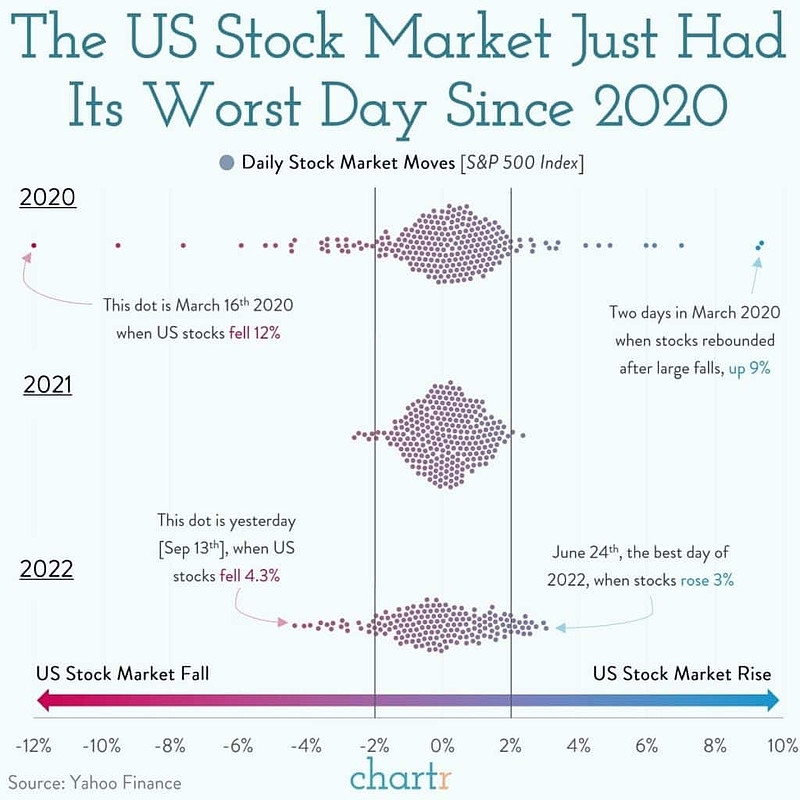

Before investing in US stocks, it's important to understand the risks involved. The US stock market can be volatile, and the value of your investments can fluctuate significantly. Additionally, currency exchange rates can impact your returns.

To mitigate these risks, it's crucial to do thorough research on the companies you're considering investing in. Look for companies with strong financials, a solid track record, and a clear growth strategy.

Using a Foreign Exchange Broker

To buy US stocks, you'll need to convert your Malaysian Ringgit (MYR) to US Dollars (USD). This is where a foreign exchange broker comes in handy. A foreign exchange broker can help you exchange currencies at competitive rates and provide valuable insights into currency movements.

Some popular foreign exchange brokers include OANDA, XTB, and Currensee. When choosing a foreign exchange broker, consider factors such as fees, customer service, and the range of currency pairs they offer.

Investing in US Stocks

Once you've opened a brokerage account and chosen a foreign exchange broker, you can start investing in US stocks. Here are some tips to help you get started:

- Research: Conduct thorough research on the companies you're considering investing in. Look for companies with strong financials, a solid track record, and a clear growth strategy.

- Diversify: Diversify your portfolio by investing in different sectors and geographic regions. This can help mitigate risk and potentially increase your returns.

- Set Goals: Set clear investment goals and stick to your strategy. Avoid making impulsive decisions based on short-term market movements.

Case Study: Investing in Apple

Let's say you've done your research and decided to invest in Apple. As of the time of writing, Apple's stock price is around $150 per share. To buy 100 shares, you would need to convert approximately 2,400 MYR to USD using your foreign exchange broker.

After a few months, the stock price of Apple increases to $160 per share. If you decide to sell your shares, you would convert the USD back to MYR, potentially earning a profit of 560 MYR.

By following these steps and conducting thorough research, you can successfully buy US stocks as a Malaysian investor. Remember to stay informed, manage your risks, and make informed decisions to achieve your investment goals.