In the ever-evolving world of finance, staying ahead of the curve is key. Recent upgrades from financial analysts have sent a clear signal to investors: it's time to take a closer look at US stocks. These upgrades, which have been widely reported by major financial news outlets, suggest that now could be the perfect time to invest in the American market.

Understanding the Analyst Upgrades

So, what exactly do these upgrades mean? Essentially, financial analysts have reviewed their research and have determined that certain stocks are now more valuable than they were previously thought. This reassessment is typically based on a variety of factors, including earnings reports, economic forecasts, and company-specific developments. When an analyst upgrades a stock, it's a strong indication that they believe the stock is poised for growth.

Why Now is the Time to Invest

There are several reasons why these latest analyst upgrades are particularly significant. For one, they come at a time when the US stock market has been experiencing a period of uncertainty. With geopolitical tensions and economic headwinds, many investors have been cautious about making new investments. However, these upgrades suggest that there are still opportunities to be found in the market.

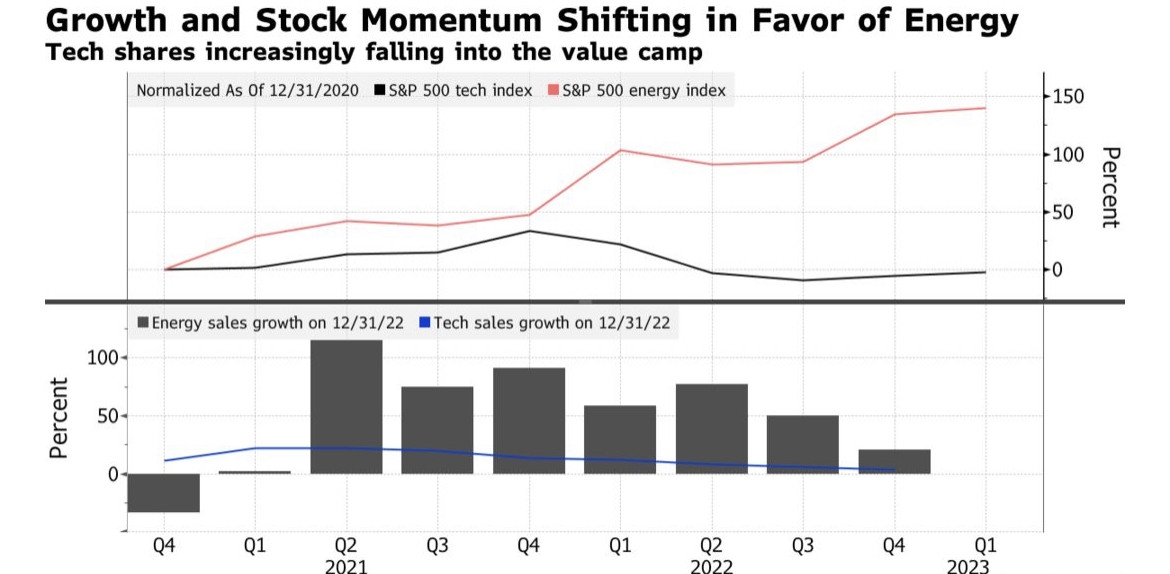

Additionally, these upgrades often target sectors that are expected to benefit from economic recovery. For example, tech stocks have been a major focus of these upgrades, with analysts noting the potential for growth in cloud computing, artificial intelligence, and 5G technology. This could be a sign that the market is starting to look past the current challenges and focusing on the long-term opportunities.

Key Stocks to Watch

Several stocks have received particularly notable upgrades from analysts. One such stock is Amazon (AMZN), which has been upgraded to "buy" from "hold." Analysts cited the company's strong earnings growth and expanding cloud computing business as key factors behind the upgrade. Another stock to keep an eye on is Microsoft (MSFT), which has been upgraded to "overweight" from "equal weight." The software giant's growing cloud computing business and strong earnings reports have caught the attention of analysts.

Case Study: Apple (AAPL)

A prime example of how these upgrades can impact investor sentiment is the case of Apple (AAPL). Last month, analysts upgraded the stock from "neutral" to "buy," citing the company's strong product pipeline and growing services business. This upgrade came just before Apple's earnings report, which showed robust revenue growth. As a result, the stock surged, demonstrating the power of these analyst upgrades to move the market.

Conclusion

The latest analyst upgrades to US stocks are a clear sign that the market is beginning to see opportunities in the current economic climate. By focusing on sectors with strong growth potential and individual stocks that have been upgraded by respected analysts, investors can position themselves for potential gains. Whether you're a seasoned investor or just starting out, these upgrades are worth paying attention to.