In recent years, the stock market has been a hot topic of discussion, with many people questioning whether it's truly beneficial or if it's actually causing more harm than good. The phrase "is the stock market killing us all" encapsulates the concerns of many investors and average citizens alike. This article delves into the potential downsides of the stock market and examines whether it's truly a force for destruction or simply a tool that can be misused.

The Volatility of the Stock Market

One of the primary concerns regarding the stock market is its volatility. The stock market is known for its unpredictable nature, with prices fluctuating wildly in a short period of time. This volatility can lead to significant financial losses for investors, especially those who are not well-informed or who do not understand the risks involved.

The Impact on Retirement Savings

Retirement savings are often invested in the stock market, with the hope of generating substantial returns. However, the volatility of the stock market can severely impact these savings, leaving many retirees with less money than they anticipated. This can lead to financial hardship and a decreased quality of life in retirement.

The Role of Speculation

Speculation plays a significant role in the stock market, with many investors focusing on short-term gains rather than long-term investment strategies. This speculative behavior can lead to market bubbles, which eventually burst, causing widespread financial damage. The 2008 financial crisis is a prime example of the destructive power of speculation in the stock market.

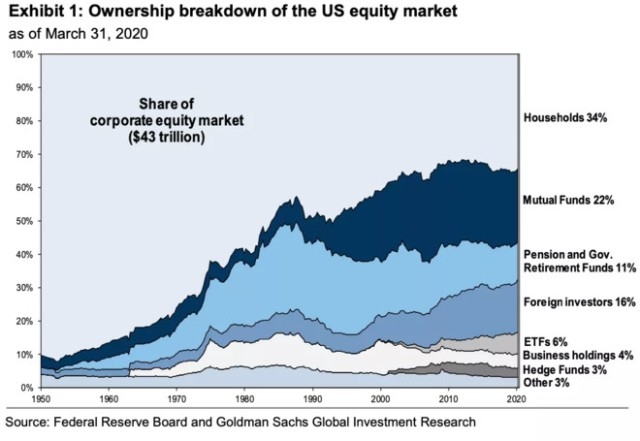

The Widening Wealth Gap

The stock market has also been criticized for contributing to the widening wealth gap. While some individuals and institutions have benefited greatly from the stock market's growth, others have been left behind. This disparity can lead to social and economic instability, as the rich become richer and the poor become poorer.

Case Study: The 2008 Financial Crisis

The 2008 financial crisis serves as a stark reminder of the potential dangers of the stock market. The crisis was triggered by the collapse of the housing market, which in turn led to the failure of several major financial institutions. This collapse had a ripple effect throughout the global economy, leading to widespread job losses, foreclosures, and a severe economic downturn.

The Importance of Education and Diversification

To mitigate the risks associated with the stock market, it's crucial for investors to educate themselves and understand the various investment options available. Diversification is also key, as it helps to spread out risk and reduce the impact of market volatility.

Conclusion

While the stock market can be a powerful tool for wealth creation, it also carries significant risks. The phrase "is the stock market killing us all" highlights the potential dangers of the stock market, particularly for those who are not well-informed or who are not prepared for the volatility that comes with investing. By understanding the risks and taking appropriate precautions, investors can make more informed decisions and minimize the potential harm that the stock market can cause.