In recent years, the stock market has seen a surge in investor confidence, with many questioning whether US stocks are currently overvalued. This article delves into the factors contributing to the current market conditions and examines whether the sky-high valuations are sustainable. By analyzing historical data, economic indicators, and market trends, we aim to provide a well-rounded perspective on the current state of US stocks.

Historical Perspective

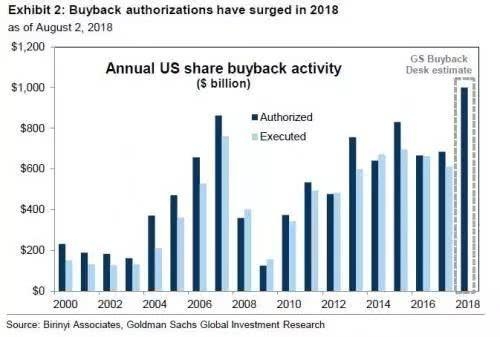

To understand the current market conditions, it's essential to look at historical data. Over the past decade, the S&P 500 has experienced significant growth, with the index reaching record highs. However, this growth has been accompanied by a rise in stock valuations, raising concerns about overvaluation.

Economic Indicators

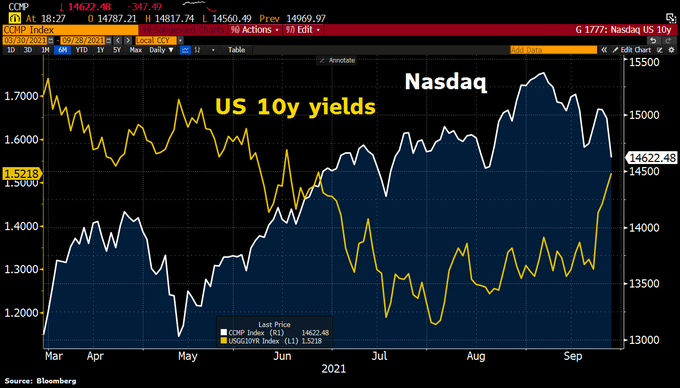

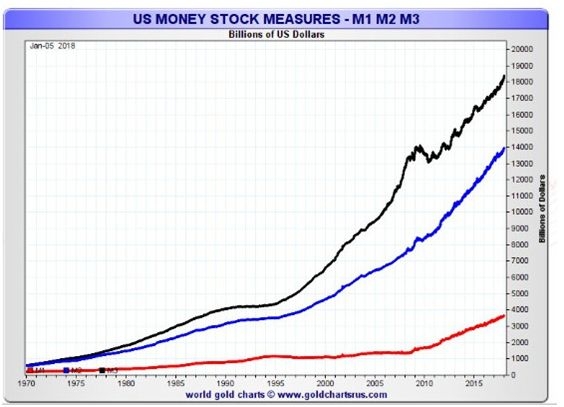

One of the primary factors contributing to the overvaluation of US stocks is the low-interest-rate environment. The Federal Reserve has kept interest rates at historic lows to stimulate economic growth, which has led to increased borrowing and investment in the stock market. Additionally, the strong dollar has made US stocks more attractive to foreign investors, further driving up prices.

Market Trends

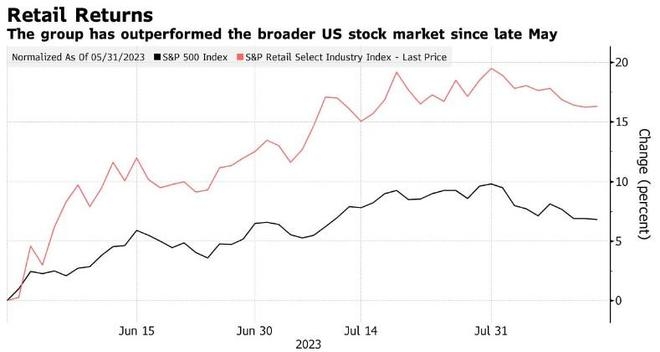

Another factor contributing to the overvaluation of US stocks is the rise of passive investing, particularly in exchange-traded funds (ETFs). As more investors turn to passive strategies, the demand for popular ETFs has surged, pushing up stock prices.

Case Studies

To illustrate the potential risks associated with overvalued stocks, let's examine a few case studies:

Tech Stocks: The tech sector has been a significant driver of the stock market's growth over the past few years. However, some analysts argue that tech stocks are overvalued, with valuations reaching unsustainable levels. For example, Apple's market capitalization has reached $2.5 trillion, making it the most valuable company in the world.

Real Estate Investment Trusts (REITs): REITs have also seen significant growth, with some analysts questioning whether the sector is overvalued. For instance, the Vanguard Real Estate ETF (VNQ) has seen its price-to-earnings (P/E) ratio rise to over 30, which is considered high by historical standards.

Conclusion

While the current market conditions may seem favorable, it's crucial to recognize the potential risks associated with overvalued stocks. By analyzing historical data, economic indicators, and market trends, we can see that the stock market may be approaching bubble territory. As investors, it's essential to remain vigilant and consider diversifying your portfolio to mitigate potential risks.

In conclusion, while US stocks may seem overvalued at the moment, it's essential to consider the various factors contributing to this trend. By remaining informed and taking a cautious approach, investors can navigate the current market conditions and protect their investments.