Are you a Canadian investor looking to expand your portfolio by investing in US stocks? With the global financial markets becoming increasingly interconnected, it's now easier than ever to invest in US stocks from Canada. This article will guide you through the process, highlighting key considerations and steps to get started.

Understanding the Basics

Before diving into the investment process, it's crucial to understand the basics. US stocks are shares of ownership in a company listed on a US stock exchange, such as the New York Stock Exchange (NYSE) or the NASDAQ. Investing in US stocks can offer several benefits, including diversification, potential for higher returns, and exposure to a wide range of industries and sectors.

Choosing a Brokerage

The first step in investing in US stocks from Canada is to choose a brokerage firm. There are several reputable brokerage firms that offer services to Canadian investors, including TD Ameritrade, E*TRADE, and Questrade. When selecting a brokerage, consider factors such as fees, customer service, platform features, and available investment options.

Opening an Account

Once you've chosen a brokerage, you'll need to open an account. This process typically involves providing personal information, verifying your identity, and funding your account. Be sure to carefully review the brokerage's account opening process and requirements to ensure a smooth experience.

Understanding US Stock Market Hours

It's important to be aware of US stock market hours, as trading is conducted during specific times. The US stock market operates from 9:30 AM to 4:00 PM Eastern Time (ET) on weekdays. Keep this in mind when planning your investments and monitoring your portfolio.

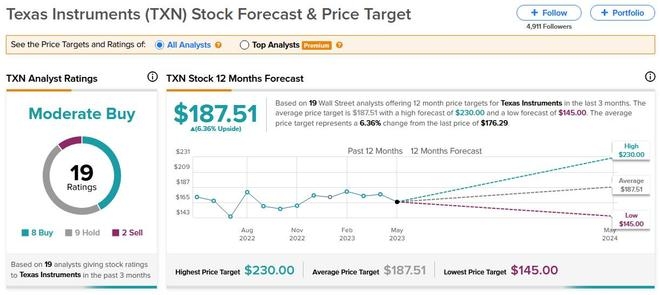

Researching and Analyzing Stocks

Before investing in US stocks, it's crucial to conduct thorough research and analysis. This includes examining the company's financial statements, industry trends, and market conditions. Consider using fundamental analysis to evaluate a company's financial health and technical analysis to identify potential trading opportunities.

Understanding Risks and Taxes

Investing in US stocks from Canada comes with its own set of risks and tax considerations. It's important to understand the potential risks, such as currency exchange rates and political instability, as well as the tax implications of investing in foreign stocks. Consult with a financial advisor or tax professional to ensure you're fully informed.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical scenario where a Canadian investor decides to invest in Apple Inc. (AAPL), one of the world's largest and most successful companies. After conducting thorough research, the investor determines that Apple is a strong investment opportunity due to its strong financial performance and market position.

The investor opens an account with a brokerage firm, funds the account, and places an order to purchase shares of Apple. As the stock price fluctuates, the investor monitors their investment and adjusts their strategy as needed.

Conclusion

Investing in US stocks from Canada can be a rewarding way to diversify your portfolio and potentially achieve higher returns. By following these steps and conducting thorough research, you can make informed investment decisions and take advantage of the opportunities offered by the US stock market. Remember to consult with a financial advisor or tax professional to ensure you're fully informed and prepared for the investment process.