The global economy is interconnected like never before, and one of the most notable examples is the relationship between the Japanese stock market and the US. This article delves into how the performance of the Japanese market can impact the US, exploring various aspects such as economic ties, investor sentiment, and market correlation.

Economic Ties and Interdependence

Japan and the US are two of the world's largest economies, and their stock markets are closely linked. The US imports a significant amount of goods from Japan, including cars, electronics, and machinery. This trade relationship creates a mutual dependency, where changes in the Japanese stock market can directly affect the US economy.

Impact on Corporate Profits

Many American companies have substantial investments in Japan, particularly in the automotive and technology sectors. When the Japanese stock market performs well, these companies see increased revenue and higher profits. Conversely, a downturn in the Japanese market can lead to reduced earnings, impacting the bottom lines of these companies and, in turn, the US stock market.

Investor Sentiment and Market Correlation

Investor sentiment plays a crucial role in driving stock market performance. When the Japanese stock market is thriving, it often boosts investor confidence globally. This positive sentiment can lead to increased investment in US stocks, potentially driving up their prices. Conversely, a struggling Japanese market can cause investors to become cautious, leading to a sell-off in US stocks and potentially causing a market correction.

Case Studies

One notable example of the Japanese stock market's impact on the US is the 2011 earthquake and tsunami. Following the disaster, the Japanese stock market plummeted, leading to widespread concerns about the impact on the global economy. This caused a temporary sell-off in US stocks, as investors feared the potential for a global economic downturn.

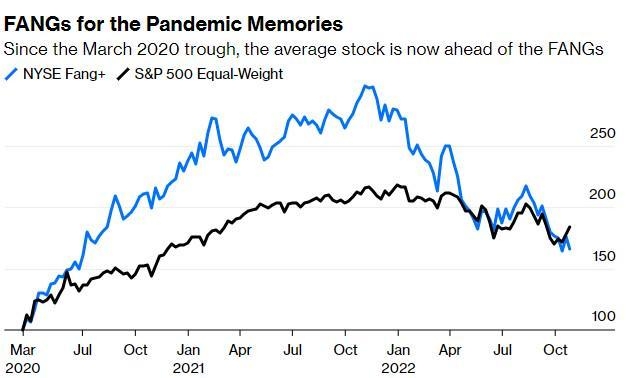

Another example is the 2020 pandemic, which initially led to a sharp decline in the Japanese stock market. However, as Japan's government and central bank implemented aggressive stimulus measures, the market recovered quickly. This swift recovery had a positive impact on investor sentiment in the US, leading to a strong rally in the US stock market.

Conclusion

In conclusion, the Japanese stock market has a significant impact on the US, primarily through economic ties, corporate profits, investor sentiment, and market correlation. Understanding this relationship is crucial for investors and policymakers alike, as it can provide valuable insights into potential market movements and economic trends.