In the vast landscape of the American financial market, stock market indexes play a pivotal role in reflecting the performance of the stock market. These indexes are essential tools for investors, analysts, and traders to gauge the overall health of the market and to make informed decisions. But how many stock market indexes exist in the US? This article delves into this question, exploring the most prominent indexes and their significance.

The Major Stock Market Indexes in the US

The S&P 500 (Standard & Poor's 500 Index)

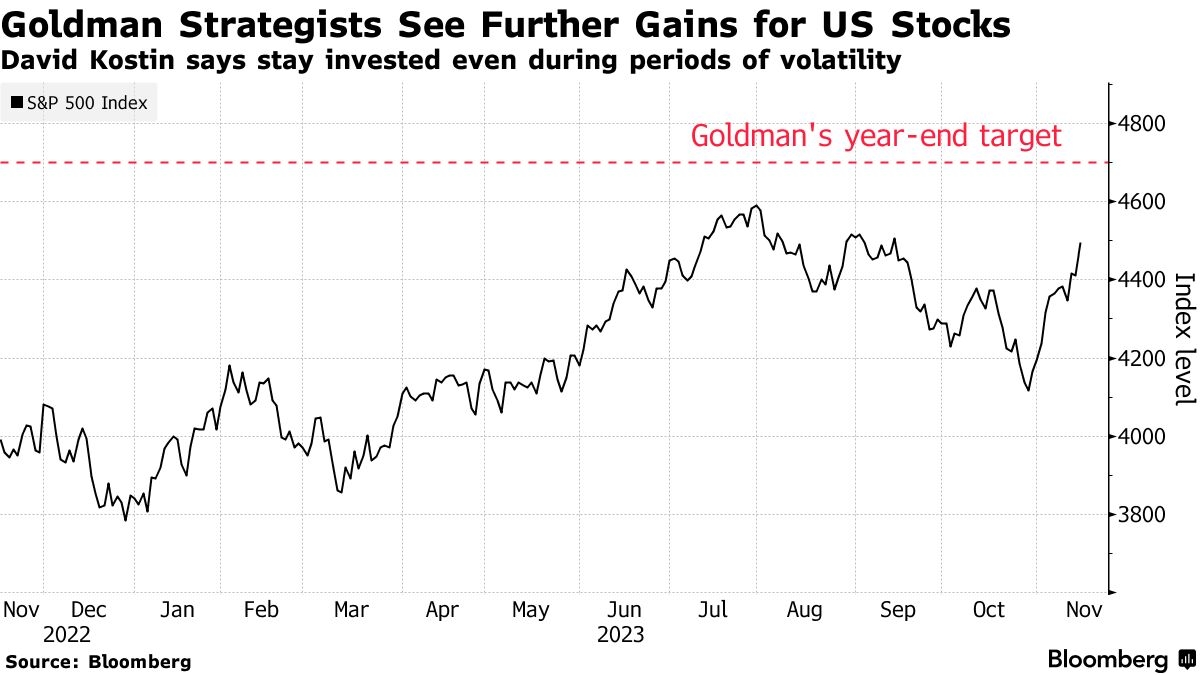

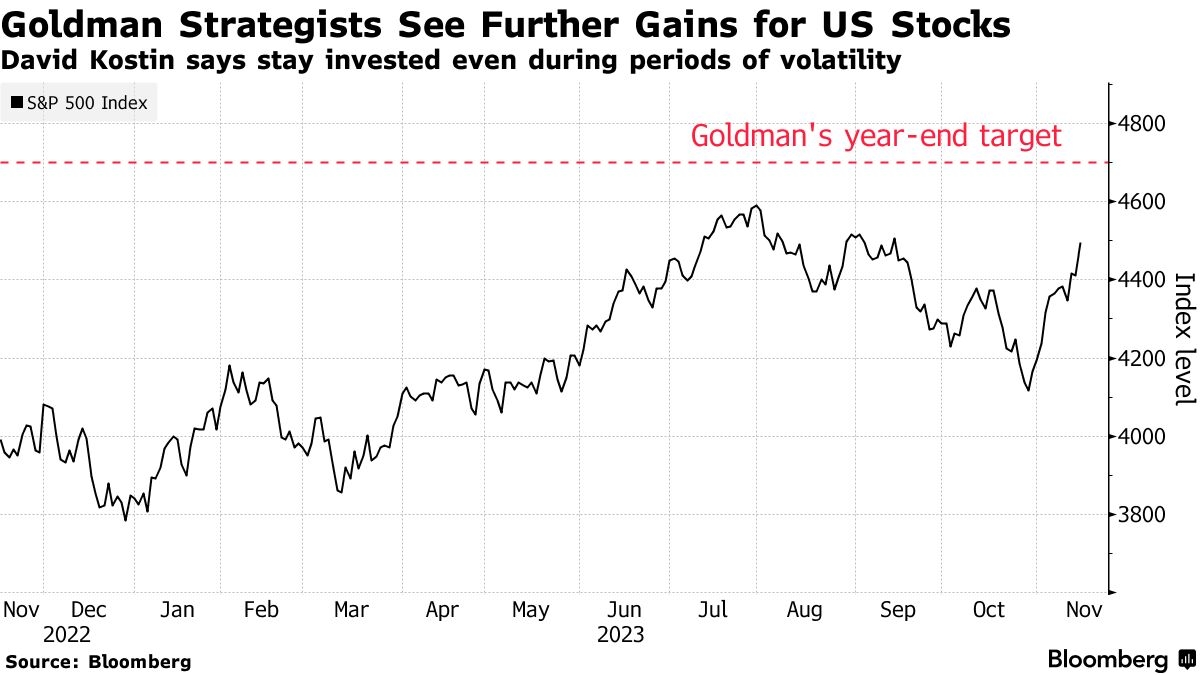

- The S&P 500 is one of the most widely followed stock market indexes in the US. It tracks the performance of 500 large companies listed on the New York Stock Exchange and the NASDAQ.

- Key Characteristics: The S&P 500 represents approximately 80% of the total market capitalization of all US stocks, making it a significant indicator of the US economy.

The Dow Jones Industrial Average (DJIA)

- The DJIA, also known as "The Dow," is a price-weighted average of 30 large publicly-owned companies in the United States. It includes companies from various industries such as finance, transportation, and technology.

- Key Characteristics: The DJIA is one of the oldest and most recognized stock market indexes, providing a snapshot of the overall performance of the US stock market.

The NASDAQ Composite

- The NASDAQ Composite is a market index that includes all common stocks listed on the NASDAQ stock exchange. It represents a broad spectrum of companies, including technology, biotech, and retail.

- Key Characteristics: The NASDAQ Composite is often considered a bellwether for the technology sector and has gained significant popularity among tech investors.

The Russell 3000

- The Russell 3000 is a widely recognized benchmark that measures the performance of 3000 large, mid, and small-cap US companies. It is considered a comprehensive gauge of the US stock market.

- Key Characteristics: The Russell 3000 includes approximately 98% of the investable US equity market, making it an essential index for diversified investors.

The Wilshire 5000 Total Market Index

- The Wilshire 5000 Total Market Index is the broadest index of the US stock market, including all publicly traded US companies. It covers approximately 100% of the investable US equity market.

- Key Characteristics: This index provides a comprehensive view of the US stock market, making it an excellent tool for investors seeking a diversified portfolio.

The Importance of Stock Market Indexes

Stock market indexes are crucial for investors and traders as they provide a benchmark for evaluating the performance of their investments. By tracking the performance of a basket of companies, these indexes offer valuable insights into market trends and economic conditions.

For example, the S&P 500 is often used as a proxy for the overall US stock market. If the S&P 500 is rising, it generally indicates a strong market, while a falling S&P 500 suggests a weakening market.

Moreover, stock market indexes serve as a reference for various financial instruments, such as exchange-traded funds (ETFs) and options. Investors can use these indexes to gain exposure to specific sectors or market capitalizations without having to directly buy individual stocks.

Conclusion

In conclusion, the US stock market is home to a variety of stock market indexes, each with its unique characteristics and significance. Understanding these indexes can help investors make informed decisions and gain a better understanding of the market's overall health. Whether you're a seasoned investor or just starting out, familiarizing yourself with these indexes is an essential step in your investment journey.