Introduction

In the dynamic world of investing, having a well-thought-out home stock plan is crucial for any investor looking to navigate the complexities of the US stock market. Whether you're a seasoned investor or just starting out, understanding the various strategies and options available can make all the difference in your investment journey. In this article, we'll delve into the essentials of home stock plans and how to effectively utilize them in the US market.

Understanding Home Stock Plans

A home stock plan refers to a structured approach to investing in stocks, tailored to an individual's investment goals, risk tolerance, and financial situation. This plan serves as a roadmap that outlines the types of stocks to invest in, the amount to invest, and the timeline for investing and selling.

Key Components of a Home Stock Plan

Investment Goals: Clearly define your financial objectives. Are you investing for retirement, to finance a child's education, or to generate income? Your goals will shape the strategy you adopt.

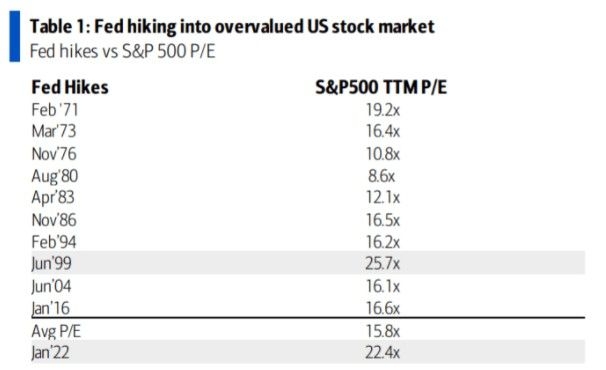

Risk Tolerance: Assess how much risk you're willing to take. Younger investors typically have a higher risk tolerance than those closer to retirement, as they have more time to recover from market downturns.

Asset Allocation: Determine the mix of stocks, bonds, and other assets in your portfolio. This allocation should align with your risk tolerance and investment goals.

Stock Selection: Research and identify stocks that align with your investment strategy. Consider factors like the company's financial health, market position, and growth potential.

Investment Timeline: Decide how frequently you plan to invest and the timeline for buying and selling stocks. Some investors prefer a buy-and-hold strategy, while others may opt for more active trading.

Strategies for Home Stock Plans in the US Market

Dividend Investing: Focus on companies with a history of paying dividends. This strategy can provide a steady income stream and potentially protect your investment during market downturns.

Growth Investing: Invest in companies with high growth potential. These companies often reinvest profits back into the business, leading to increased share prices over time.

Value Investing: Look for undervalued stocks that have the potential to increase in value. This strategy requires thorough research and a long-term perspective.

Sector Rotation: Adjust your portfolio based on market trends and economic forecasts. For example, you might invest in technology stocks during a tech boom and move to healthcare stocks during a recession.

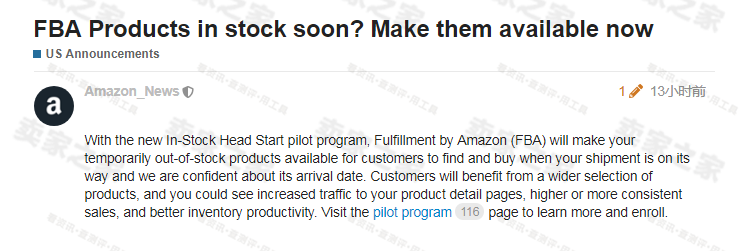

Case Study: Amazon's Home Stock Plan

Consider Amazon, a company that exemplifies the power of a well-executed home stock plan. An investor who bought Amazon stock in 1997 and held onto it until 2020 would have seen a substantial return on investment. This success story underscores the importance of long-term investing and the benefits of sticking to a structured plan.

Conclusion

Creating a home stock plan is a critical step in navigating the complexities of the US stock market. By defining your investment goals, understanding your risk tolerance, and adopting a strategic approach, you can achieve your financial objectives. Whether you choose dividend investing, growth investing, or value investing, remember that patience and discipline are key to long-term success.