The US stock market, often considered a bellwether for the global economy, is influenced by a myriad of factors. Understanding these factors can help investors make informed decisions and navigate the volatile landscape of the stock market. In this article, we will delve into the key factors that can impact the US stock market, including economic indicators, geopolitical events, and technological advancements.

Economic Indicators

One of the most critical factors affecting the US stock market is economic indicators. These indicators provide insights into the health of the economy and can influence investor sentiment. Key economic indicators include:

- GDP Growth: Gross Domestic Product (GDP) growth is a measure of the total value of goods and services produced in a country. A strong GDP indicates economic growth, which can boost stock prices.

- Inflation: Inflation refers to the rate at which the general level of prices for goods and services is rising. High inflation can erode purchasing power and negatively impact stock prices.

- Unemployment Rate: The unemployment rate measures the percentage of the labor force that is unemployed and actively seeking employment. A low unemployment rate suggests a strong labor market, which can positively impact stock prices.

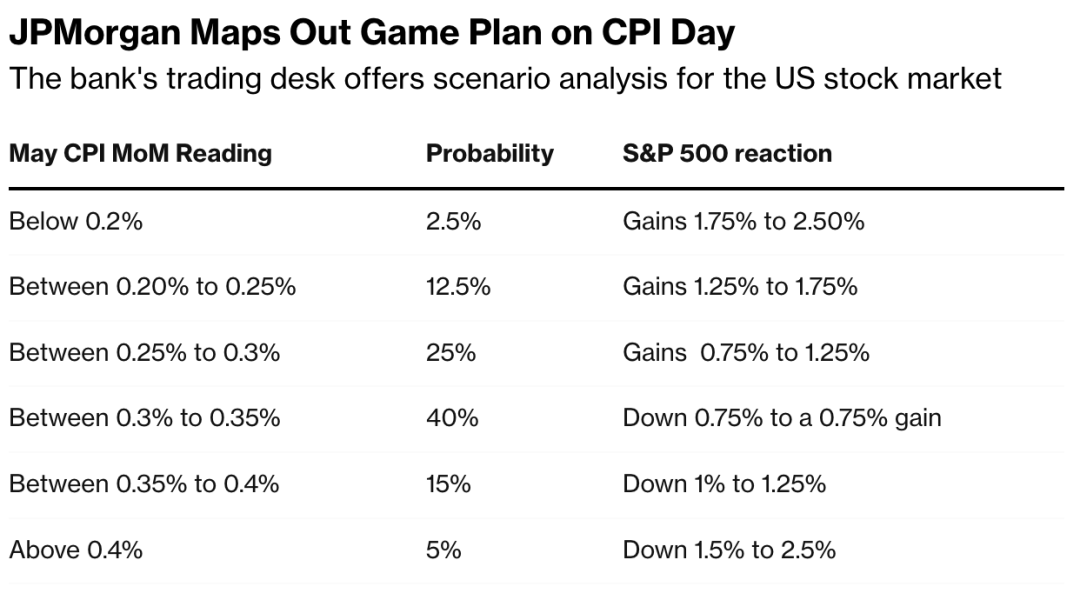

- Interest Rates: Interest rates set by the Federal Reserve can have a significant impact on the stock market. Lower interest rates can lead to increased borrowing and spending, which can boost stock prices, while higher interest rates can have the opposite effect.

Geopolitical Events

Geopolitical events, such as elections, trade wars, and international conflicts, can also impact the US stock market. These events can create uncertainty and volatility in the market. For example:

- Trade Wars: The US-China trade war, which began in 2018, led to increased tariffs and trade tensions between the two countries. This uncertainty caused volatility in the stock market, with many sectors experiencing significant declines.

- Elections: Political events, such as elections, can create uncertainty and volatility in the market. For example, the 2020 US presidential election led to increased market volatility as investors awaited the outcome.

Technological Advancements

Technological advancements can also impact the US stock market. Innovations in technology can create new industries and disrupt existing ones, leading to shifts in market dynamics. For example:

- Fintech: The rise of fintech companies, such as PayPal and Square, has disrupted the traditional banking industry. These companies have seen significant growth and have become key players in the stock market.

- Electric Vehicles (EVs): The shift towards electric vehicles is disrupting the automotive industry. Companies like Tesla have seen substantial growth as a result of this trend.

Case Studies

To illustrate the impact of these factors, let's consider a few case studies:

- 2008 Financial Crisis: The 2008 financial crisis was primarily caused by the bursting of the housing bubble and the subsequent collapse of the financial sector. This event led to a significant downturn in the stock market, with the S&P 500 index falling by nearly 50% from its peak in 2007.

- COVID-19 Pandemic: The COVID-19 pandemic led to a global economic downturn and significant market volatility. However, companies in the technology and healthcare sectors, which were seen as essential during the pandemic, saw significant growth.

In conclusion, the US stock market is influenced by a variety of factors, including economic indicators, geopolitical events, and technological advancements. Understanding these factors can help investors navigate the volatile landscape of the stock market and make informed decisions.