The US stock market has always been a barometer of the nation's economic health. As of the latest data, the market's performance reflects a mix of optimism and caution. This article delves into the current state of the US stock market, analyzing key indicators and providing insights into what investors should expect in the near future.

Market Performance

The S&P 500, a widely followed benchmark index, has seen significant growth over the past year. As of the end of Q3 2023, the index was up over 20% from its previous year's low. This upward trend can be attributed to several factors, including strong corporate earnings, low interest rates, and a robust economic recovery from the COVID-19 pandemic.

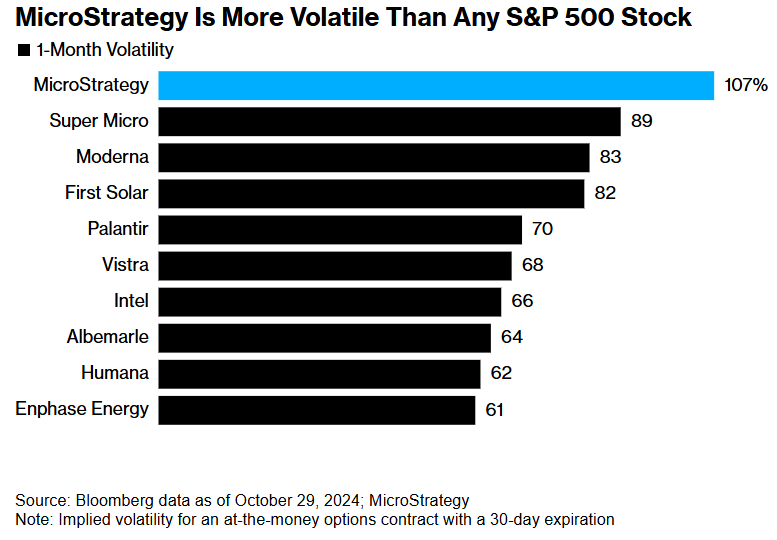

However, the market has also experienced periods of volatility. In early 2023, the market saw a sharp decline due to concerns about rising inflation and the potential for a Federal Reserve rate hike. Despite these challenges, the market has largely recovered, with many investors remaining optimistic about the long-term outlook.

Sector Performance

Different sectors within the US stock market have performed differently over the past year. Technology and healthcare stocks have been among the strongest performers, driven by strong earnings growth and innovation. On the other hand, energy and financial stocks have seen mixed results, with energy stocks benefiting from higher oil prices and financial stocks facing challenges due to regulatory changes and rising interest rates.

Key Indicators

Several key indicators provide insights into the current health of the US stock market. The unemployment rate, for example, has continued to decline, reaching a 50-year low. This suggests a strong labor market, which is generally positive for the stock market. Consumer confidence has also remained high, indicating that consumers are spending and investing more.

Economic Outlook

The economic outlook for the US remains cautiously optimistic. Growth is expected to slow slightly in the coming years, but the economy is expected to continue expanding. This outlook is supported by strong consumer spending, business investment, and a low unemployment rate.

Case Studies

To illustrate the current state of the US stock market, let's consider a few case studies:

Apple Inc.: As one of the largest companies in the world, Apple has seen significant growth in its stock price over the past year. This can be attributed to strong sales of its products, particularly the iPhone and iPad, as well as its successful expansion into new markets such as services and wearables.

Tesla, Inc.: Tesla has been a standout performer in the automotive sector, with its stock price skyrocketing over the past few years. This growth can be attributed to the company's innovative electric vehicles and its aggressive expansion into new markets.

Amazon.com, Inc.: Amazon has been a leader in the e-commerce sector, with its stock price also experiencing significant growth. This growth can be attributed to the company's strong market position, continued expansion into new markets, and successful diversification into areas such as cloud computing and streaming.

Conclusion

The current state of the US stock market reflects a mix of optimism and caution. While the market has seen strong growth in recent months, investors should remain vigilant about potential risks, including rising inflation and geopolitical tensions. By staying informed and maintaining a diversified portfolio, investors can navigate the current market conditions and position themselves for future success.