Introduction

The year 2025 marks a significant milestone in the United States stock market, characterized by rapid technological advancements, economic fluctuations, and evolving investor sentiments. In this article, we delve into the current outlook of the US stock market, examining key trends, potential risks, and investment opportunities that could shape the market in the upcoming years.

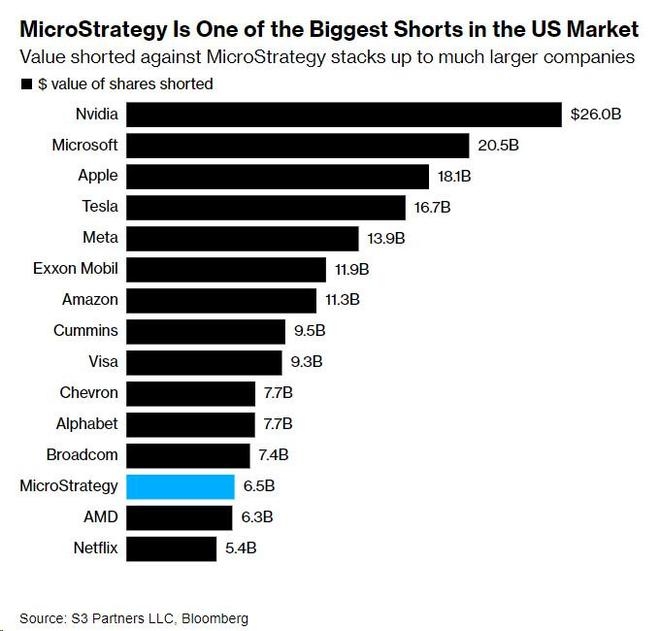

Rising Technology Stocks

Technology has been a driving force in the US stock market for decades, and 2025 is no exception. Companies like Apple, Microsoft, and Amazon have continued to dominate the sector, with their innovative products and robust financial performance. Additionally, emerging tech companies are capturing the attention of investors, particularly in areas like artificial intelligence, blockchain, and renewable energy.

Shift Towards Sustainable Investments

Investors are increasingly focusing on sustainability and ethical considerations in their investment decisions. The rise of ESG (Environmental, Social, and Governance) funds has led to a significant shift in the stock market. Companies that prioritize sustainability and social responsibility are gaining traction, while those with poor environmental records are facing increased scrutiny.

Economic Fluctuations and Interest Rates

The US economy is subject to fluctuations that can significantly impact the stock market. In 2025, the Federal Reserve's decision to adjust interest rates will play a crucial role in determining market trends. Higher interest rates can lead to increased borrowing costs, affecting companies' profitability and investor sentiment.

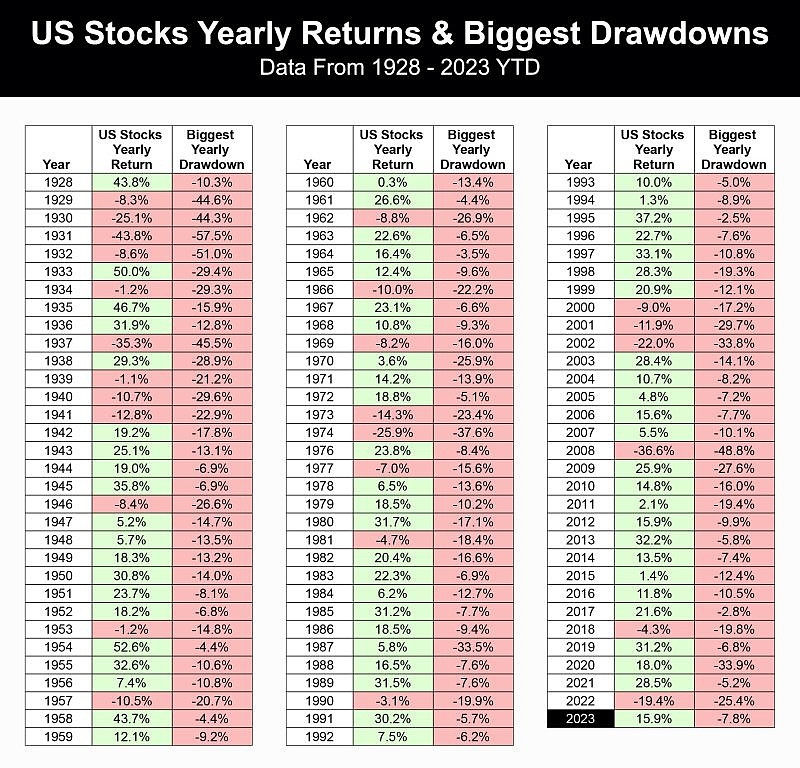

Market Volatility and Risk Management

Market volatility is a constant challenge for investors. Understanding and managing risks is essential for long-term success. Diversification, proper asset allocation, and staying informed about market trends are key strategies to navigate the unpredictable nature of the stock market.

Emerging Growth Sectors

In addition to technology, several emerging sectors are poised for growth in 2025. These include biotechnology, pharmaceuticals, and clean energy. Companies in these sectors are driving innovation and addressing critical global challenges, making them attractive investment opportunities.

Case Study: Tesla

A prime example of a company that has transformed the stock market is Tesla. Its innovative electric vehicles and renewable energy solutions have made it a market leader in the sustainable transportation and energy sectors. Tesla's stock has seen significant volatility, but its long-term potential remains promising.

Conclusion

The US stock market in 2025 is characterized by rapid technological advancements, a growing focus on sustainability, and evolving economic conditions. As investors navigate this dynamic landscape, understanding key trends, managing risks, and capitalizing on emerging growth sectors will be crucial for success. While the market is unpredictable, staying informed and adapting to changing conditions will be essential for long-term investment success.