In the ever-evolving world of stock markets, keeping a close eye on the price of Amazon stock (NASDAQ: AMZN) is crucial for investors and market enthusiasts. The stock price of Amazon has seen remarkable fluctuations over the years, making it a popular topic of discussion among investors. In this article, we will delve into the factors that influence the Amazon stock price, historical data, and current trends.

Understanding the Amazon Stock Price

The Amazon stock price is determined by a variety of factors, including company performance, market conditions, and investor sentiment. As one of the largest companies in the world, Amazon has a significant impact on the stock market, making its stock price a barometer of the tech industry.

Company Performance

Historical Performance

Over the years, Amazon has consistently demonstrated strong financial performance, driving its stock price higher. In the last decade, the stock has seen a remarkable increase in value, making it one of the best-performing stocks of all time.

Current Performance

As of the latest data, Amazon continues to show robust performance. The company's strong revenue growth, coupled with its expansion into new markets and services, has contributed to the rise in its stock price.

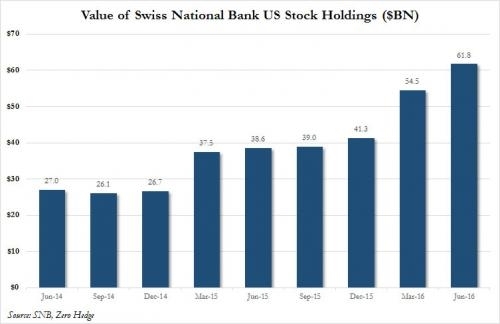

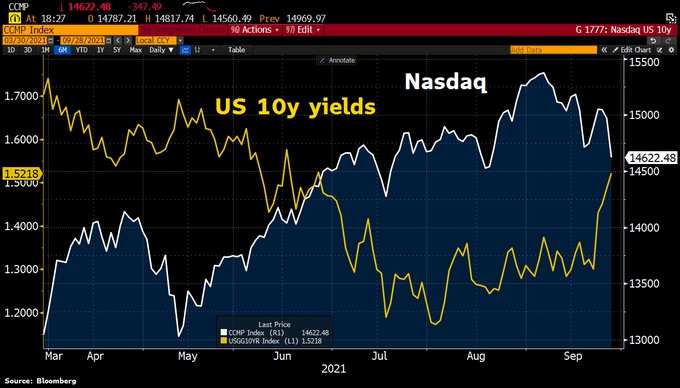

Market Conditions

Market conditions play a significant role in the Amazon stock price. Economic factors, such as interest rates and inflation, can influence investor sentiment and affect the stock price.

Investor Sentiment

Investor sentiment is another crucial factor that can impact the Amazon stock price. Positive news and reports can drive the stock higher, while negative news can lead to a decline in its value.

Historical Data

Looking at the historical data, we can observe several trends in the Amazon stock price.

- 2000s: The early 2000s saw a significant increase in the stock price, driven by the dot-com boom. However, the bubble burst in 2000, and the stock price fell sharply.

- 2010s: The stock price experienced a steady rise in the 2010s, driven by Amazon's expansion into new markets and services.

- 2020s: The stock has continued to rise in the 2020s, despite the challenges posed by the COVID-19 pandemic.

Current Trends

As of now, the Amazon stock price is at an all-time high. This can be attributed to the company's strong financial performance and its expansion into new markets, such as cloud computing and grocery delivery.

Case Studies

Several case studies highlight the impact of market conditions and investor sentiment on the Amazon stock price.

- 2018: The stock experienced a sharp decline in 2018, primarily due to concerns about slowing revenue growth and increased competition.

- 2020: The stock price surged in 2020, driven by the company's strong performance during the COVID-19 pandemic and the subsequent increase in online shopping.

Conclusion

In conclusion, the Amazon stock price is influenced by a variety of factors, including company performance, market conditions, and investor sentiment. By understanding these factors, investors can make informed decisions regarding their investments in Amazon stock. As the company continues to expand its offerings and enter new markets, the stock price is likely to remain a topic of interest among investors and market enthusiasts.