In the vast and dynamic world of the United States stock market, understanding the different sectors is crucial for investors looking to diversify their portfolios. The stock market is divided into 11 primary sectors, each representing a distinct area of the economy. In this article, we'll explore these sectors in detail, providing insights into what they encompass and how they can impact your investment decisions.

1. Consumer Discretionary The Consumer Discretionary sector includes companies that produce goods and services that are not essential for daily living. This sector is highly sensitive to economic cycles and includes industries such as retail, automotive, and leisure. Companies like Disney and Amazon are prominent players in this sector.

2. Consumer Staples Consumer Staples consist of companies that produce goods and services that are considered necessities, such as food, beverages, and household products. This sector is often seen as a defensive play during economic downturns. Procter & Gamble and Coca-Cola are leading companies in this category.

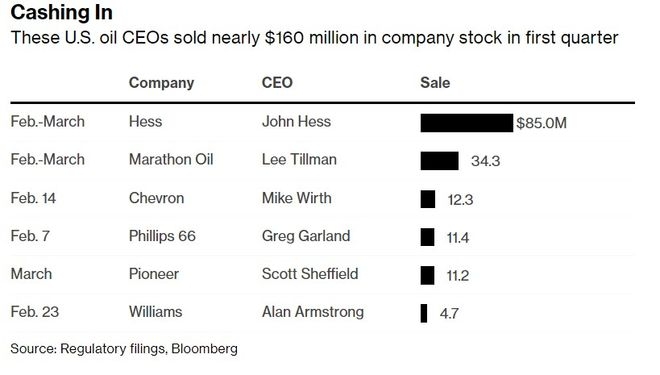

3. Energy The Energy sector encompasses companies involved in the exploration, production, and distribution of oil, natural gas, and coal. This sector can be volatile, especially due to fluctuations in commodity prices. ExxonMobil and Chevron are among the top players in this sector.

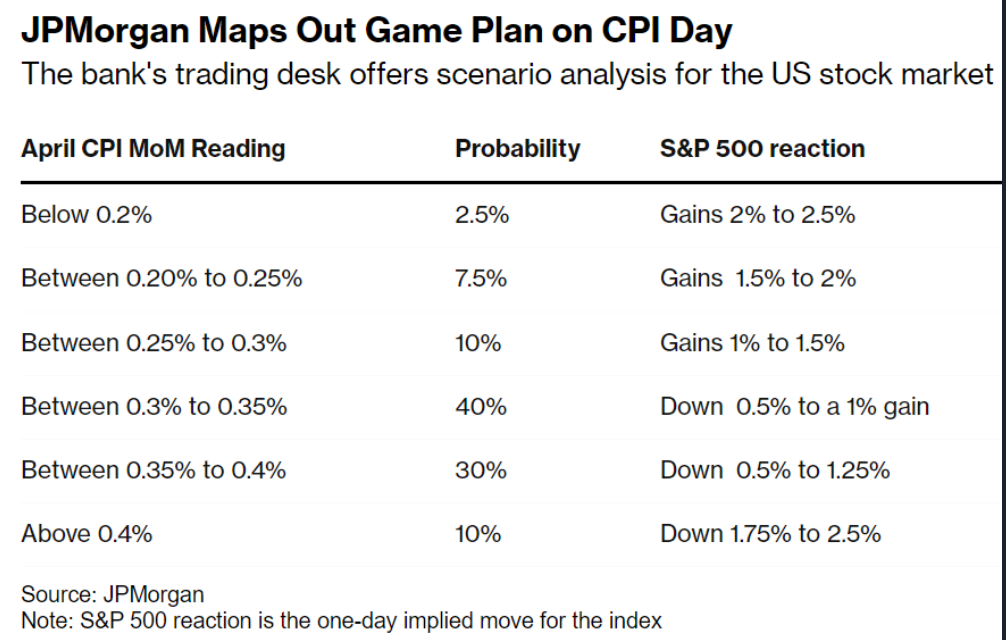

4. Financials Financials include banks, insurance companies, and other financial services providers. This sector is sensitive to interest rate changes and economic conditions. JPMorgan Chase and Wells Fargo are major players in the financial sector.

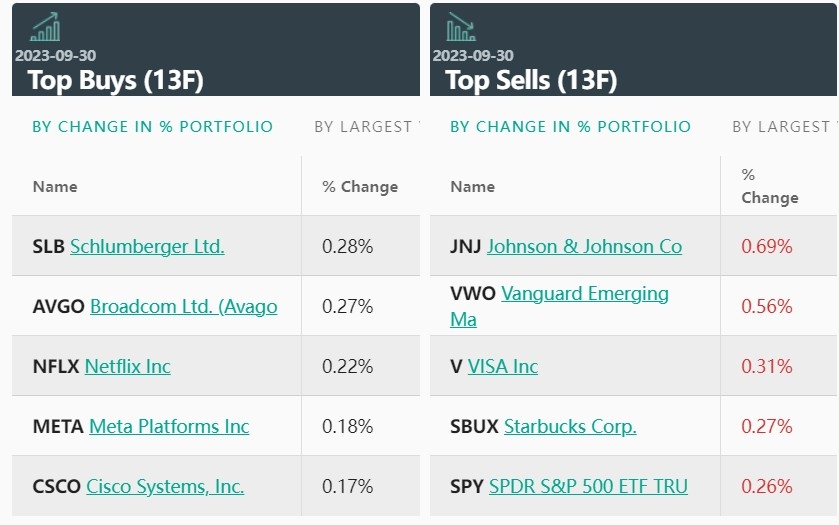

5. Health Care The Health Care sector covers pharmaceutical companies, biotech firms, medical device manufacturers, and healthcare providers. This sector is often seen as a long-term growth area due to the aging population and advancements in medical technology. Pfizer and Johnson & Johnson are leading companies in this sector.

6. Industrials Industrials include companies involved in the production of goods and services, such as manufacturing, construction, and transportation. This sector can be cyclical and is sensitive to economic conditions. 3M and United Technologies are notable companies in this sector.

7. Information Technology The Information Technology sector covers companies involved in the production of technology goods and services. This sector is known for its rapid growth and innovation. Apple and Microsoft are among the most influential companies in this sector.

8. Materials The Materials sector includes companies involved in the production of raw materials, such as metals, mining, and chemicals. This sector is sensitive to global economic conditions and commodity prices. Aluminum Corporation of China (Chalco) and Rio Tinto are major players in this sector.

9. Real Estate Real Estate includes companies involved in the development, management, and investment in real estate properties. This sector can be cyclical and is sensitive to interest rates and economic conditions. Real estate investment trusts (REITs) like Public Storage and Realty Income are prominent in this sector.

10. Telecommunications The Telecommunications sector includes companies involved in the provision of telecommunication services, such as wireless and wireline communications. This sector is known for its stability and dividends. AT&T and Verizon are leading companies in this sector.

11. Utilities Utilities include companies involved in the generation, transmission, and distribution of electricity, natural gas, and water. This sector is known for its stability and dividends, often considered a defensive play during economic downturns. Duke Energy and Southern Company are major players in this sector.

Understanding these sectors is essential for investors looking to make informed decisions. By diversifying across these sectors, investors can mitigate risks and potentially maximize returns. Whether you're a seasoned investor or just starting out, knowing the ins and outs of the 11 US stock market sectors can help you navigate the complex world of investing.