In the ever-evolving financial landscape, the stock market remains a pivotal component for investors seeking growth and stability. Among the numerous banking institutions across the United States, US Bank stands out as a formidable player. This article delves into the intricacies of US Bank stock, exploring its performance, market trends, and investment opportunities.

What is US Bank Stock?

US Bank, or U.S. Bancorp, is a financial holding company based in Minneapolis, Minnesota. The company's stock, traded under the ticker symbol "USB," represents ownership in the company and provides shareholders with voting rights and a portion of the company's profits. Investing in US Bank stock means participating in the growth and success of one of the nation's largest banks.

Performance Overview

Over the years, US Bank has demonstrated a strong track record of performance. The company has consistently generated robust earnings and returned substantial value to its shareholders. As of the latest financial reports, US Bank has a market capitalization of over $300 billion, making it one of the largest banks in the United States.

Market Trends and Factors Influencing USB Stock

Several factors influence the performance of US Bank stock. Here are some key trends and factors to consider:

- Economic Conditions: The health of the economy plays a crucial role in the banking sector. During periods of economic growth, banks like US Bank tend to experience higher demand for loans and improved profitability. Conversely, during economic downturns, banks may face challenges such as rising default rates and reduced earnings.

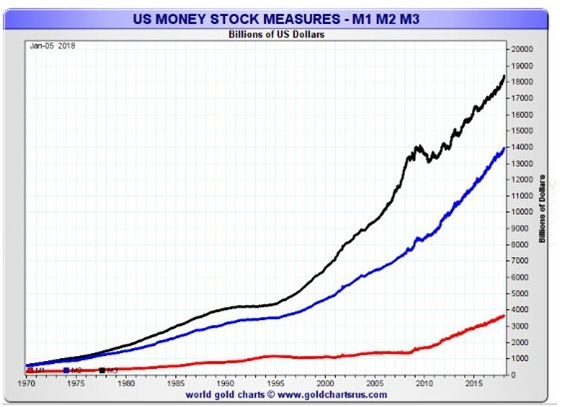

- Interest Rates: The Federal Reserve's decisions on interest rates significantly impact the banking industry. Higher interest rates can boost banks' net interest margins, while lower rates can put downward pressure on profitability.

- Regulatory Environment: The regulatory landscape for banks is continually evolving. Changes in regulations can affect the cost of capital, lending practices, and profitability for financial institutions.

Investment Opportunities in US Bank Stock

Investing in US Bank stock offers several opportunities for investors:

- Dividends: US Bank has a long history of paying dividends to its shareholders. The company has increased its dividend payments consistently over the years, providing investors with a steady income stream.

- Growth Potential: As one of the largest banks in the United States, US Bank has significant growth potential. The company continues to expand its footprint, offering a wide range of financial services to its customers.

- Diversification: US Bank operates in various business segments, including retail banking, commercial banking, and wealth management. This diversification helps mitigate risks associated with specific market sectors.

Case Studies

To illustrate the potential of US Bank stock, let's consider a few case studies:

- 2008 Financial Crisis: During the 2008 financial crisis, many banks faced significant challenges. However, US Bank managed to navigate the crisis relatively unscathed, demonstrating its resilience and stability.

- COVID-19 Pandemic: The COVID-19 pandemic has presented unprecedented challenges to the financial sector. Despite the uncertainty, US Bank has continued to perform well, adapting to the changing economic landscape and supporting its customers.

Conclusion

Investing in US Bank stock can be a wise decision for investors seeking stability, growth, and dividends. By understanding the factors influencing the stock and considering the company's performance, investors can make informed decisions regarding their investments. As the financial landscape continues to evolve, US Bank remains a formidable player, offering attractive opportunities for investors.