As we delve into the depths of June 2025, the US stock market stands as a testament to the resilience and adaptability of the global economy. This article aims to provide a comprehensive analysis of the US stock market, highlighting key trends, sectors, and potential investment opportunities.

Market Overview

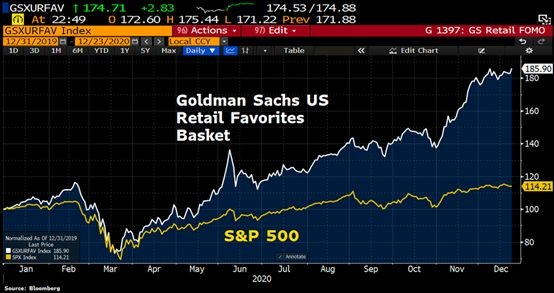

The US stock market has experienced a remarkable recovery since the downturn of 2020. With the easing of pandemic-related restrictions and the implementation of stimulus measures, the market has seen a surge in investor confidence. The S&P 500, a widely followed benchmark index, has reached new highs, reflecting the strong performance of the overall market.

Trends to Watch

Technology Sector: The technology sector remains a major driver of the US stock market. Companies like Apple, Microsoft, and Amazon have continued to grow, driven by increasing demand for their products and services. Artificial intelligence and cloud computing are expected to be key growth areas within this sector.

Healthcare: The healthcare sector has also seen significant growth, driven by advancements in medical technology and an aging population. Companies specializing in biotechnology and pharmaceuticals have been particularly strong, with several new drug approvals and breakthroughs in cancer treatment.

Energy Sector: The energy sector has experienced a resurgence, thanks to the increased focus on renewable energy sources and the decline in oil prices. Companies involved in solar energy and wind energy have seen substantial growth, while traditional oil and gas companies have adapted to the changing landscape.

Sector Analysis

Technology: The technology sector is expected to continue its strong performance, with a particular focus on 5G technology and cybersecurity. Companies that are well-positioned to benefit from these trends, such as Cisco Systems and Palo Alto Networks, are likely to see significant growth.

Healthcare: The healthcare sector is poised for continued growth, with a focus on telemedicine and digital health. Companies like Teladoc Health and Fitbit have seen strong performance, driven by the increasing demand for remote healthcare solutions.

Energy: The energy sector is expected to see a shift towards renewable energy sources, with a particular focus on sustainable energy and green technology. Companies involved in geothermal energy and hydroelectric power are likely to see significant growth.

Case Studies

Tesla: Tesla, the electric vehicle manufacturer, has seen remarkable growth in recent years. The company's focus on innovation and sustainability has attracted a large following of investors. With the increasing demand for electric vehicles, Tesla is well-positioned for continued growth.

Moderna: Moderna, a biotechnology company, has gained significant attention for its mRNA vaccine technology. The company's COVID-19 vaccine, mRNA-1273, has played a crucial role in the global fight against the pandemic. Moderna's strong pipeline of vaccine candidates and partnerships with pharmaceutical companies make it a promising investment opportunity.

In conclusion, the US stock market in June 2025 presents a promising landscape for investors. With a focus on technology, healthcare, and energy sectors, there are numerous opportunities for growth and investment. As always, it is important for investors to conduct thorough research and consider their own risk tolerance before making investment decisions.