In recent years, the United States has imposed tariffs on various goods and services, causing a ripple effect throughout the global economy. One of the most significant areas affected by these tariffs is the stock market. This article delves into the impact of US tariffs on the stock market, examining how these policies have influenced investor sentiment and market performance.

Understanding Tariffs

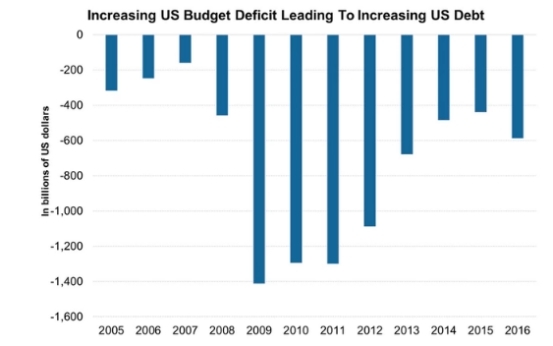

To grasp the impact of US tariffs on the stock market, it's crucial to understand what tariffs are. A tariff is a tax imposed on imported goods, which is intended to protect domestic industries and raise revenue for the government. However, tariffs can also lead to higher prices for consumers, reduced international trade, and retaliatory measures from other countries.

The Stock Market and Tariffs

The stock market is a barometer of the overall health of the economy, and tariffs have a profound impact on its performance. Here's how:

- Increased Costs: Tariffs can lead to increased costs for companies that rely on imported goods. This can lead to lower profit margins and reduced stock prices.

- Supply Chain Disruptions: Tariffs can disrupt supply chains, causing delays and increased costs for companies. This can also lead to reduced production and higher prices for consumers.

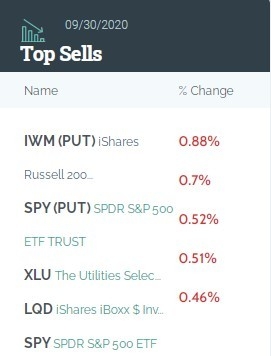

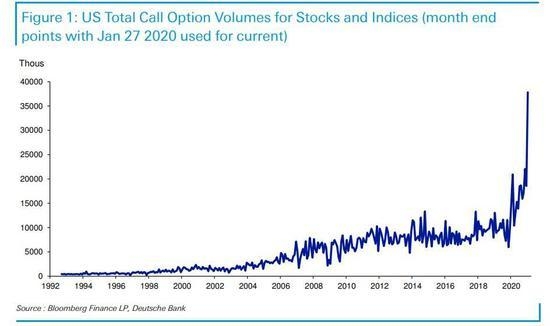

- Investor Sentiment: Tariffs can create uncertainty and volatility in the stock market. Investors may become wary of investing in companies that are exposed to tariffs, leading to sell-offs and falling stock prices.

- Retaliatory Measures: When the US imposes tariffs on foreign goods, other countries may retaliate by imposing their own tariffs on US goods. This can further exacerbate the negative impact on the stock market.

Case Studies

Several case studies illustrate the impact of US tariffs on the stock market:

- Steel Tariffs: In 2018, the US imposed tariffs on steel imports, which led to increased costs for companies that rely on steel. This caused a sell-off in steel-related stocks and a decline in the broader stock market.

- China Trade War: The ongoing trade war between the US and China has had a significant impact on the stock market. The uncertainty and volatility caused by tariffs have led to sell-offs and falling stock prices, particularly in companies that are exposed to the US-China trade relationship.

Conclusion

In conclusion, the impact of US tariffs on the stock market is undeniable. Tariffs can lead to increased costs, supply chain disruptions, investor sentiment, and retaliatory measures, all of which can have a negative impact on the stock market. As the US continues to impose tariffs, it's crucial for investors to understand the potential risks and implications for the stock market.