In the dynamic world of investment, the question "how much US Apple stock" is one that many investors grapple with. With the tech giant's influence spanning across multiple industries, understanding the value and potential of Apple stock is crucial for anyone looking to diversify their portfolio. This guide delves into the intricacies of Apple's stock, providing you with essential information to make informed decisions.

Understanding Apple's Stock Market Performance

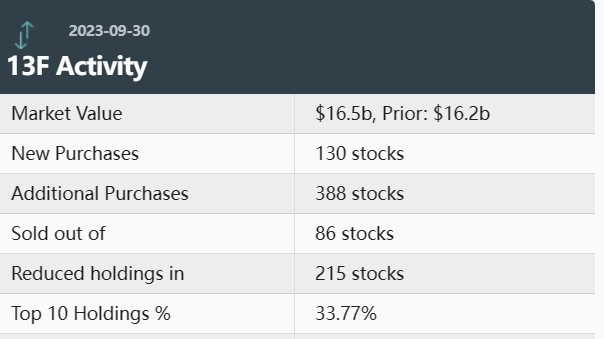

Apple Inc. (AAPL) is a publicly-traded company listed on the NASDAQ Global Select Market. The stock has seen significant growth over the years, making it one of the most sought-after tech stocks in the market. Understanding how much US Apple stock you should own involves a thorough analysis of its market performance.

Historical Stock Performance

Since its initial public offering (IPO) in 1980, Apple's stock has seen both ups and downs. However, over the long term, the stock has consistently demonstrated strong growth. In the past decade alone, Apple's stock has seen a compound annual growth rate (CAGR) of approximately 20%.

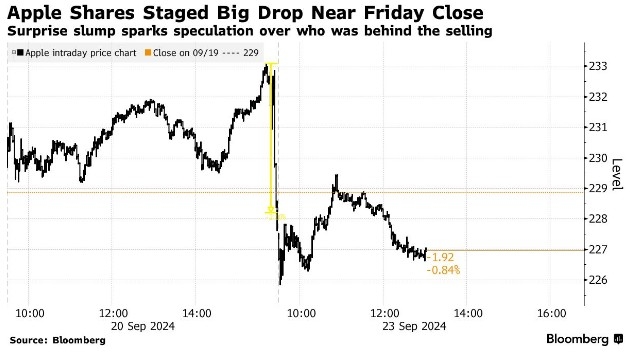

Current Stock Price

As of the latest data, Apple's stock is trading at around $150 per share. However, it's essential to note that stock prices fluctuate daily based on market conditions and investor sentiment. Monitoring the stock's performance and understanding its valuation is crucial when deciding how much US Apple stock to invest in.

Factors Influencing Apple's Stock Price

Several factors can influence Apple's stock price, including:

- Product Launches: Apple's annual product launches, especially the iPhone, can significantly impact the stock price.

- Economic Indicators: Economic indicators such as GDP growth, inflation, and consumer spending can also influence the stock.

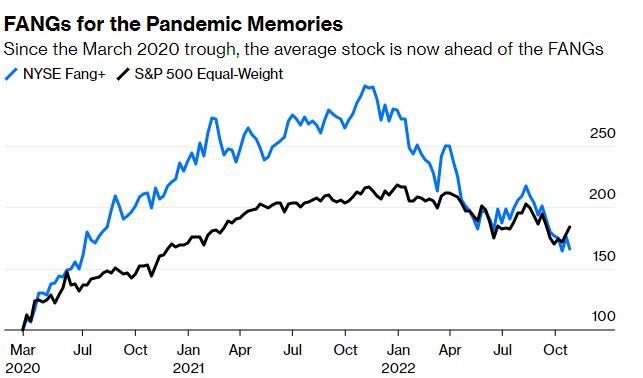

- Competition: Apple's competitors in the tech industry, such as Samsung and Huawei, can impact its market share and, subsequently, its stock price.

Diversifying Your Portfolio with Apple Stock

One of the advantages of investing in Apple stock is its ability to diversify your portfolio. Here's how you can incorporate Apple stock into your investment strategy:

- Long-term Investment: Apple stock is suitable for long-term investors looking to benefit from the company's consistent growth and market dominance.

- Income Generation: Apple pays a dividend, which can generate income for investors.

- Market Capitalization: With a market capitalization of over $2 trillion, Apple is a stable and well-established company in the tech industry.

Case Study: Investing in Apple Stock

Consider an investor who purchased 100 shares of Apple stock at

Conclusion

Deciding how much US Apple stock to invest in involves a thorough analysis of the company's stock performance, market conditions, and your investment goals. By understanding the factors influencing Apple's stock price and incorporating it into a diversified investment strategy, you can potentially benefit from its long-term growth and stability.