The marijuana industry has seen a significant rise in recent years, with more states legalizing the use of cannabis for both medical and recreational purposes. This shift has sparked a surge in interest among investors, leading to the emergence of marijuana stocks. In this article, we will explore whether these stocks can be traded in the United States and what factors you should consider before investing.

Understanding the Legal Landscape

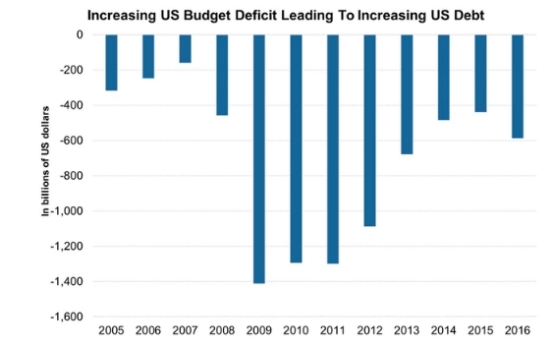

Before diving into the trading of marijuana stocks, it's crucial to understand the legal landscape. The United States has a complex system of state and federal laws governing the use and sale of marijuana. While some states have legalized cannabis, federal law still considers it an illegal substance.

This discrepancy has created a unique environment for marijuana stocks, with many companies listed on U.S. exchanges. However, it's important to note that these companies operate in a gray area, as they are subject to potential legal and regulatory risks.

The Rise of Marijuana Stocks

The rise of marijuana stocks can be attributed to several factors. Firstly, the increasing number of states legalizing cannabis has created a growing market for marijuana products. This has led to a surge in demand for companies involved in the production, distribution, and sale of cannabis.

Secondly, the industry's potential for growth has attracted significant investment from both retail and institutional investors. This has led to an increase in the number of marijuana stocks available for trading on U.S. exchanges.

Where to Trade Marijuana Stocks

Marijuana stocks can be traded on several U.S. exchanges, including the New York Stock Exchange (NYSE), the Nasdaq, and the over-the-counter (OTC) markets. Some of the most prominent marijuana companies, such as Canopy Growth Corporation (CGC) and Tilray, Inc. (TLRY), are listed on the NYSE and Nasdaq.

However, it's important to note that not all marijuana stocks are listed on major exchanges. Many smaller companies operate on the OTC market, which may not offer the same level of liquidity or regulatory oversight as the NYSE or Nasdaq.

Factors to Consider Before Investing

Investing in marijuana stocks can be risky, especially given the industry's legal and regulatory challenges. Here are some factors to consider before investing:

Legal and Regulatory Risks: As mentioned earlier, the discrepancy between state and federal laws can pose significant legal and regulatory risks for marijuana companies.

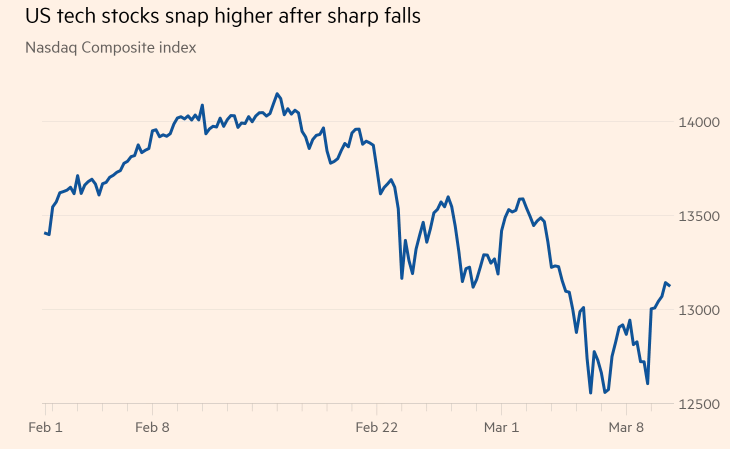

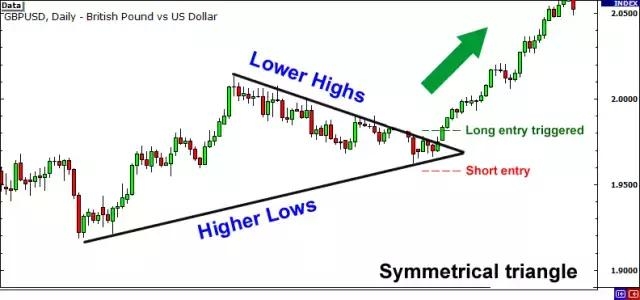

Market Volatility: The marijuana industry is still in its early stages, and the market can be highly volatile. This can lead to significant price swings in marijuana stocks.

Company Performance: It's crucial to research the financial health and business model of the company before investing. Look for companies with strong management, a solid business plan, and a track record of success.

Market Trends: Stay informed about the latest market trends and developments in the marijuana industry. This can help you make more informed investment decisions.

Case Studies

To illustrate the potential risks and rewards of investing in marijuana stocks, let's look at a few case studies:

Canopy Growth Corporation (CGC): Canopy Growth is one of the largest marijuana companies in the world, with a strong presence in both the Canadian and U.S. markets. While the company has seen significant growth, it has also faced challenges, including legal and regulatory risks.

Tilray, Inc. (TLRY): Tilray is another prominent marijuana company, known for its innovative approach to cannabis production and distribution. The company has experienced rapid growth but has also faced regulatory hurdles and market volatility.

In conclusion, marijuana stocks can be traded in the United States, but they come with significant risks. Before investing, it's crucial to conduct thorough research and consider the legal, regulatory, and market factors that can impact these stocks.