In the ever-evolving global financial landscape, investors are constantly seeking opportunities to diversify their portfolios. One of the most popular choices for investors is comparing Canadian stocks to those in the United States. This article delves into a comprehensive comparison of these two markets, highlighting key differences, strengths, and potential risks.

Market Size and Liquidity

One of the first aspects to consider when comparing Canadian stocks to those in the US is the market size and liquidity. The United States is the largest stock market in the world, with a market capitalization of over $33 trillion. This massive size provides investors with a wide range of investment options, including stocks from various sectors and industries.

In contrast, the Canadian stock market, with a market capitalization of approximately $2 trillion, is much smaller. However, it is still home to many well-established companies, including some of the world's largest mining and oil companies.

Sector Diversity

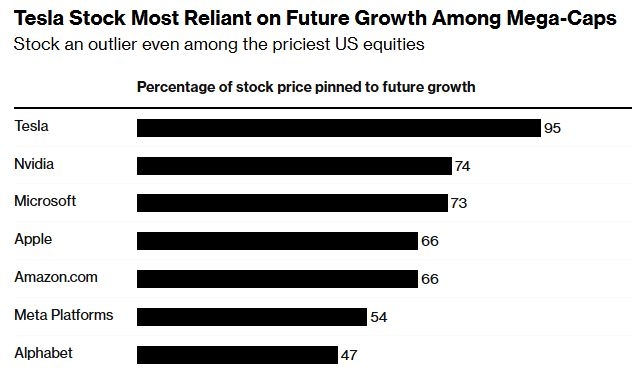

Another important factor to consider is the sector diversity of each market. The US stock market is highly diversified, with a significant presence in technology, healthcare, and consumer discretionary sectors. This diversity allows investors to gain exposure to a wide range of industries and avoid overexposure to a single sector.

On the other hand, the Canadian stock market is more concentrated in certain sectors, such as energy, materials, and financials. This concentration can be beneficial for investors looking to gain exposure to these specific sectors but may also result in higher volatility.

Economic Factors

Economic factors play a crucial role in the performance of stock markets. The US economy is the largest in the world, with a strong consumer base and a diversified industrial sector. This economic stability has historically made US stocks a safe haven for investors during times of global economic uncertainty.

In contrast, the Canadian economy is more closely tied to the global economy, particularly to the US. This can make Canadian stocks more sensitive to global economic trends and fluctuations.

Dividends and Yield

Dividends and yield are important considerations for income-oriented investors. The US stock market has a reputation for high dividend yields, with many companies offering quarterly dividends. This can be an attractive feature for investors seeking regular income.

In contrast, the Canadian stock market also offers attractive dividend yields, although they may be slightly lower than those in the US. However, Canadian companies tend to have a higher dividend payout ratio, which can be beneficial for income investors.

Case Studies

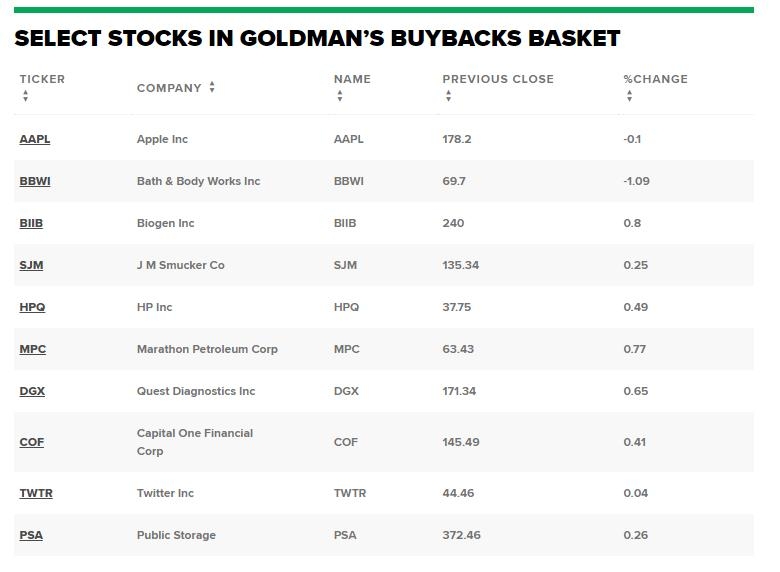

To illustrate the differences between Canadian and US stocks, let's consider two well-known companies: Apple Inc. (AAPL) and Royal Bank of Canada (RY).

Apple Inc., a US-based technology company, is one of the largest companies in the world by market capitalization. It operates in the technology sector, which is highly diversified and has a strong presence in the US stock market. Apple has a strong track record of dividend payments and reinvestment in growth opportunities.

Royal Bank of Canada, on the other hand, is a Canadian-based financial institution with a significant presence in the Canadian stock market. It operates in the financial sector, which is more concentrated in the Canadian market. Royal Bank of Canada has a strong dividend yield and is known for its stability and reliability.

In conclusion, comparing Canadian stocks to those in the US requires a comprehensive analysis of various factors, including market size, sector diversity, economic factors, and dividend yields. While the US stock market offers a wider range of investment options and economic stability, the Canadian stock market can provide attractive opportunities in specific sectors and dividend yields. Investors should carefully consider their investment goals and risk tolerance when choosing between these two markets.