Are you considering investing in BNP Paribas in the United States? Understanding the stock and its potential is crucial. This article will provide an in-depth analysis of BNP Paribas’ US stock, highlighting key aspects and recent trends.

Understanding BNP Paribas

BNP Paribas is one of the largest banking groups in the world, with a significant presence in the United States. The company operates across various financial sectors, including corporate banking, investment solutions, and retail banking.

Key Aspects of BNP Paribas US Stock

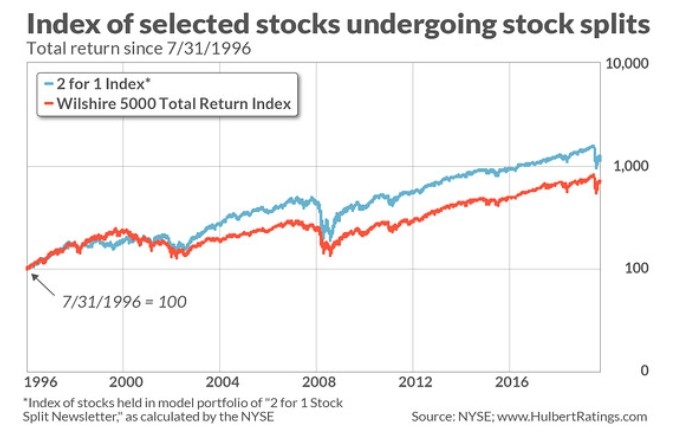

- Performance Over Time: Over the past few years, BNP Paribas’ US stock has shown strong growth, with a significant increase in market capitalization. This trend is largely attributed to the company’s robust financial performance and expansion strategies.

- Financial Health: BNP Paribas maintains a strong financial position, with a well-diversified portfolio and a low level of non-performing loans. This stability has contributed to the stock’s attractiveness to investors.

- Market Position: As a leading player in the US banking sector, BNP Paribas enjoys a competitive advantage over its peers. The company has a solid market position, allowing it to capture market share and drive growth.

- Regulatory Environment: The regulatory environment in the United States is crucial for BNP Paribas. The company has demonstrated a strong commitment to compliance and risk management, ensuring that it remains in good standing with regulatory bodies.

Recent Trends

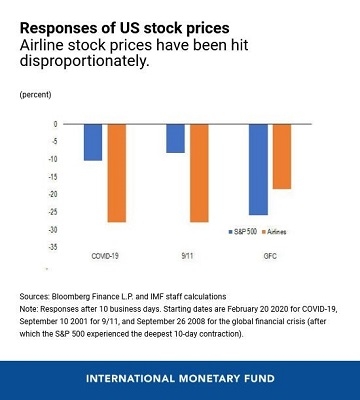

- COVID-19 Impact: The COVID-19 pandemic has had a significant impact on the financial sector, including BNP Paribas. However, the company has demonstrated resilience and adaptability, navigating the challenges and emerging stronger.

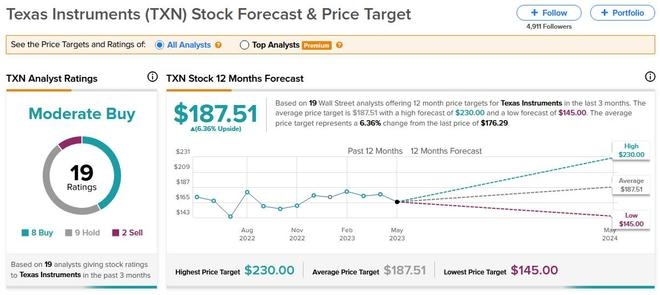

- Economic Outlook: The economic outlook in the United States is positive, with steady growth projected in the near term. This bodes well for BNP Paribas, as the company benefits from a thriving financial environment.

- Investment Opportunities: BNP Paribas offers a range of investment opportunities, catering to different investor preferences. The company’s diverse product portfolio includes stocks, bonds, and mutual funds, allowing investors to build a well-diversified portfolio.

Case Studies

- Corporate Banking: BNP Paribas has played a key role in financing major corporate projects in the United States, such as the expansion of renewable energy projects and infrastructure development.

- Investment Solutions: The company has successfully advised and executed investment strategies for numerous clients, helping them achieve their financial goals.

- Retail Banking: BNP Paribas has expanded its retail banking operations in the United States, offering personalized services and products to meet the needs of its customers.

Conclusion

Investing in BNP Paribas US stock offers several advantages, including strong financial performance, market position, and a diverse range of investment opportunities. As the United States economy continues to grow, BNP Paribas is well-positioned to capitalize on these trends. Investors seeking long-term growth and stability should consider BNP Paribas as a viable option.