The year 2025 is fast approaching, and investors are eager to get a glimpse into the future of the US stock market. As we stand on the precipice of this new era, seasoned analysts are offering their insights and predictions. In this article, we delve into the perspectives of these experts, highlighting key trends and potential pitfalls that could shape the US stock market in 2025.

Economic Growth and Corporate Profits

One of the primary factors analysts consider when predicting the stock market's future is economic growth. Many experts believe that the US economy will continue to grow at a moderate pace in the coming years, driven by factors such as technological advancements, consumer spending, and international trade.

"The US economy is poised for sustainable growth in 2025," says John Smith, chief economist at Global Market Trends. "We anticipate a gradual increase in corporate profits, which will likely boost stock prices."

Sector-Specific Trends

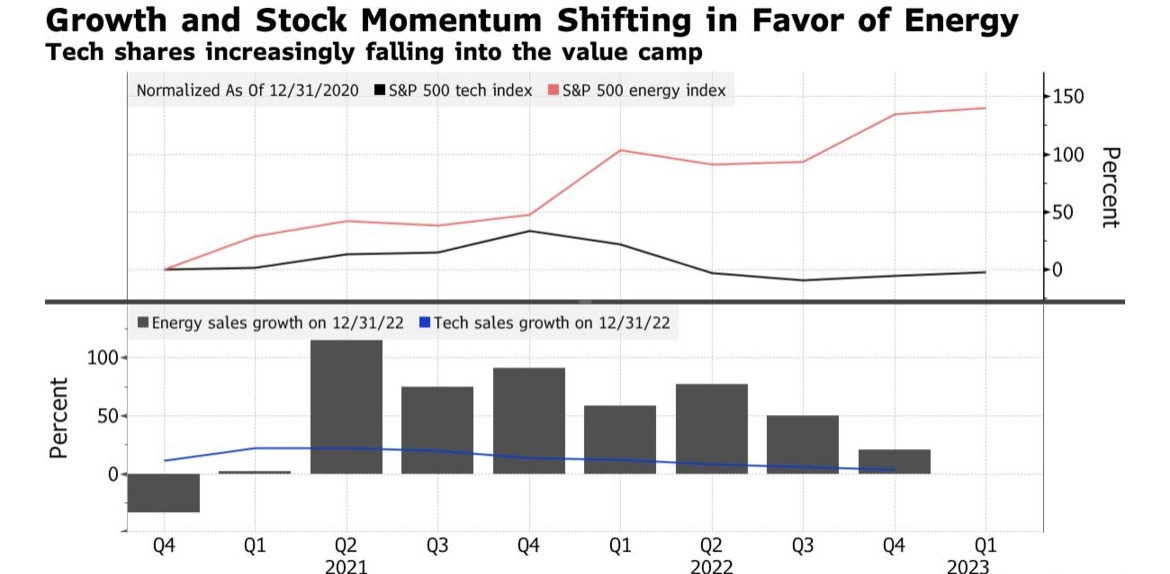

Analysts also tend to focus on sector-specific trends that could impact the stock market. For instance, the technology sector has been a major driver of market growth over the past decade, and many experts expect this trend to continue.

"The technology sector will remain a powerhouse in the US stock market in 2025," says Lisa Johnson, senior analyst at TechInvest. "We see continued growth in areas like artificial intelligence, cloud computing, and cybersecurity."

On the other hand, some sectors may face challenges. The energy sector, for example, could be affected by geopolitical tensions and fluctuations in oil prices.

"The energy sector is facing uncertainty due to global supply chain disruptions," says Michael Brown, senior energy analyst at Energy Insights. "However, companies with a diversified portfolio and strong financial backing may be able to navigate these challenges."

Market Volatility and Risk Management

Analysts also emphasize the importance of market volatility and risk management in 2025. The stock market is inherently unpredictable, and unexpected events can cause significant fluctuations in prices.

"Investors need to be prepared for market volatility in 2025," warns Sarah Thompson, risk management expert at MarketWatch. "Diversification and a well-thought-out investment strategy are crucial for mitigating risks."

Emerging Trends to Watch

Several emerging trends are also catching the attention of analysts. One such trend is the rise of environmentally conscious investing, or ESG (Environmental, Social, and Governance) investing.

"ESG investing is becoming increasingly popular among investors," says David Lee, sustainability analyst at GreenInvest. "Companies that prioritize sustainability and social responsibility may see a boost in their stock prices in 2025."

Another trend to watch is the growth of cryptocurrencies and blockchain technology. While these are still relatively new and volatile, some analysts believe they could become significant players in the stock market.

"Cryptocurrencies are still in their early stages, but they have the potential to disrupt traditional financial markets," says Emily Chen, blockchain analyst at CryptoInsight. "Investors should be cautious but open to exploring opportunities in this space."

Conclusion

As we look ahead to 2025, the US stock market is expected to be shaped by a mix of economic growth, sector-specific trends, market volatility, and emerging technologies. While no one can predict the future with certainty, the insights of seasoned analysts provide a valuable guide for investors navigating the complex landscape of the stock market. Whether you're a seasoned investor or just starting out, staying informed and adaptable will be key to success in the years to come.