In the dynamic world of financial markets, US stock futures have emerged as a powerful tool for investors and traders. These financial instruments allow participants to speculate on the future price movements of stocks, providing an avenue for hedging risks and capitalizing on market trends. In this article, we will delve into the basics of US stock futures, their importance, and how they can be utilized effectively.

What Are US Stock Futures?

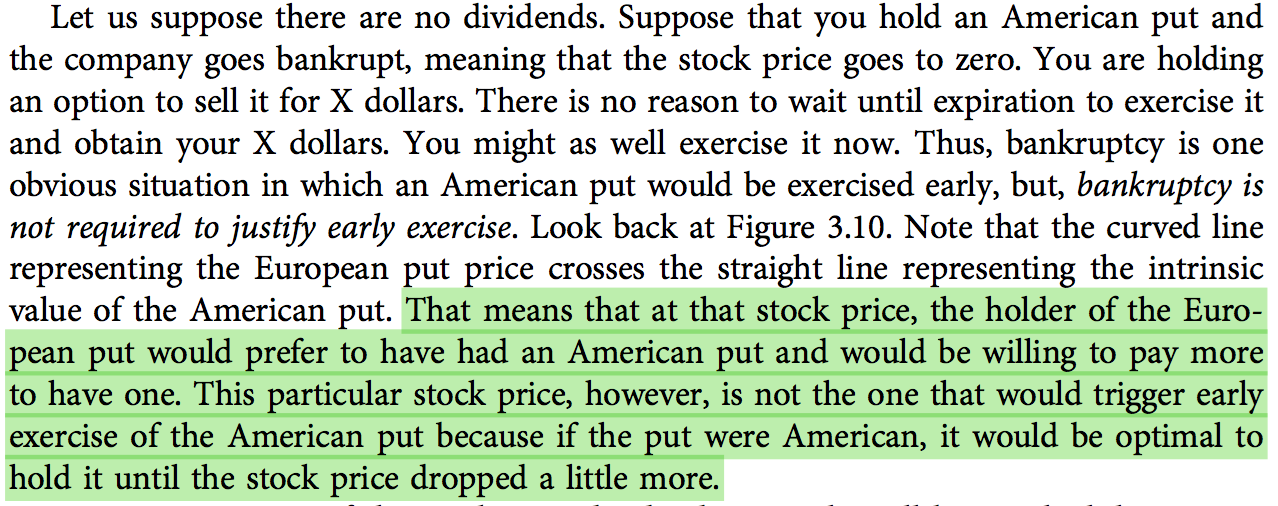

US stock futures are financial contracts that obligate the buyer to purchase and the seller to sell a specified quantity of a stock at a predetermined price on a specified future date. They are similar to stock options but with a few key differences. While stock options give the buyer the right, but not the obligation, to buy or sell a stock, futures require the buyer to take delivery of the stock on the specified date.

The Importance of US Stock Futures

Hedging Risks: Hedging is a strategy used to mitigate potential losses in a portfolio. By purchasing US stock futures, investors can protect their investments from adverse market movements. For instance, if an investor owns shares of a particular company and anticipates a decline in its stock price, they can buy futures contracts to offset potential losses.

Speculating on Market Trends: Speculating involves taking positions in the market with the expectation of making a profit. US stock futures allow investors to profit from both rising and falling markets. This flexibility makes them an attractive option for active traders and investors seeking to capitalize on market trends.

Enhancing Portfolio Diversification: Diversification is a key strategy for reducing risk in a portfolio. By including US stock futures in their investment strategy, investors can gain exposure to various sectors and industries, thereby enhancing their portfolio diversification.

How to Trade US Stock Futures

Trading US stock futures involves several steps:

Choose a Broker: Select a reputable online broker that offers US stock futures trading. Ensure that the broker provides access to real-time market data, analytical tools, and customer support.

Open a Trading Account: Sign up for a trading account with the selected broker. This process typically requires providing personal and financial information.

Understand Margin Requirements: Margin is the amount of money required to open and maintain a position in the futures market. It's crucial to understand the margin requirements and ensure that your account has sufficient funds to cover potential losses.

Place a Trade: Decide whether you want to go long (buy futures contracts) or short (sell futures contracts). Place your trade by specifying the quantity, price, and order type (market or limit).

Monitor Your Positions: Keep a close eye on your positions and make adjustments as needed. Utilize stop-loss orders to limit potential losses.

Case Studies

Example 1: An investor holds shares of Company X and anticipates a decline in its stock price. To hedge against potential losses, the investor buys US stock futures on Company X. If the stock price falls, the investor can offset their losses in the stock market with gains in the futures market.

Example 2: A trader believes that the technology sector will experience a significant rally. The trader buys US stock futures on a major tech company, speculating on a rise in its stock price. If the market moves in the anticipated direction, the trader can profit from the futures position.

Conclusion

US stock futures offer a valuable tool for investors and traders seeking to manage risks and capitalize on market trends. Understanding the basics of US stock futures and implementing a well-defined trading strategy can help investors navigate the dynamic world of financial markets.