The stock market is a crucial indicator of the economic health and activity in the United States. When the US stock exchanges close, it often has significant implications for investors, traders, and the general public. In this article, we'll explore the importance of the closing of US stock exchanges and what it means for the market and the economy.

Understanding Stock Exchanges

Stock exchanges are organized marketplaces where shares of publicly-traded companies are bought and sold. The primary stock exchanges in the United States are the New York Stock Exchange (NYSE), the NASDAQ, and the Chicago Stock Exchange (Chicago Stock Exchange). These exchanges are vital for the functioning of the US economy and the global financial system.

When Do US Stock Exchanges Close?

The NYSE and NASDAQ typically close at 4:00 PM Eastern Time (ET). The Chicago Stock Exchange closes at 3:30 PM CT. These hours may vary slightly during certain times of the year, such as daylight saving time, but the standard closing times are generally consistent.

Why Do Stock Exchanges Close?

Stock exchanges close for several reasons. The most obvious reason is to provide a break for investors and traders to rest and recharge. However, there are other important factors:

- Market Regulation: Closing times allow regulators to monitor and enforce compliance with market rules and regulations.

- Security: Closing times help prevent unauthorized trading and other fraudulent activities.

- Data Processing: Exchanges use the closing period to process transactions and update prices, ensuring accurate and reliable information for all participants.

What Happens When the Market Closes?

When the US stock exchanges close, there are a few key things that happen:

- Orders are Processed: Any pending orders from the day's trading are processed during the closing period.

- Prices are Updated: The closing price for each stock is determined, which can have a significant impact on the value of investor portfolios.

- Market Indices are Calculated: The major market indices, such as the S&P 500 and the Dow Jones Industrial Average, are calculated based on the closing prices of the stocks included in the index.

Implications of Stock Exchanges Closing

The closing of US stock exchanges has several implications for the market and the economy:

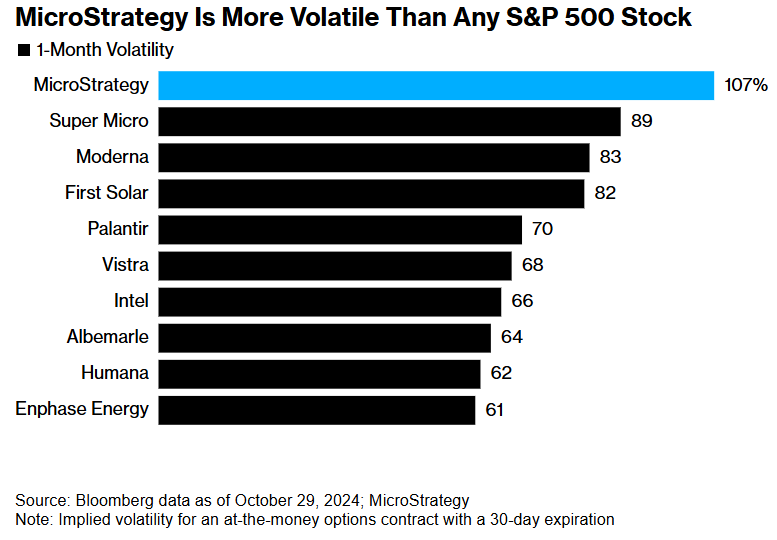

- Volatility: The closing of the stock exchanges can lead to volatility in stock prices, especially on days when significant news or events occur.

- Investor Sentiment: The closing price can influence investor sentiment and expectations for future market performance.

- Economic Indicators: The stock market is a leading indicator of economic health. The closing of the exchanges can provide insight into the overall state of the economy.

Case Study: The 2010 Flash Crash

One notable event that occurred during trading hours was the 2010 Flash Crash. The stock market experienced a sudden and dramatic drop in prices, which was later attributed to a combination of factors, including high-frequency trading and human error. This event highlighted the importance of having a robust and reliable stock market system, as well as the need for effective regulation and oversight.

In conclusion, the closing of US stock exchanges is a critical event with significant implications for investors, traders, and the economy. Understanding the reasons behind the closure and the impact it has on the market can help investors make informed decisions and navigate the complexities of the stock market.