In the wake of the tumultuous year 2020, the year 2021 brought its own set of challenges to the financial markets. One of the most significant events was the US stock collapse in early 2021. This article delves into the reasons behind this collapse, its impact on the market, and the lessons learned.

The Context of the Collapse

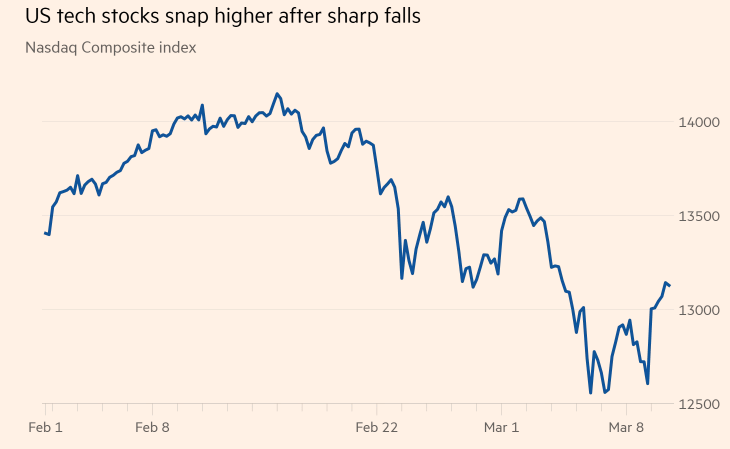

The US stock market experienced a dramatic downturn in early 2021, with several major indices, including the S&P 500, Dow Jones, and NASDAQ, plummeting. This collapse was particularly surprising given the strong recovery seen in the markets throughout 2020.

Reasons for the Stock Collapse

Several factors contributed to the stock market collapse in 2021. Here are some of the key reasons:

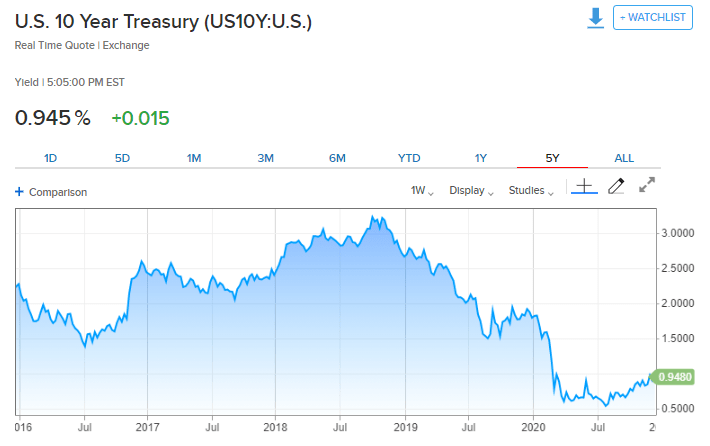

- Inflation Concerns: The Federal Reserve's monetary policy, which was designed to stimulate economic growth, also led to concerns about rising inflation. This uncertainty created volatility in the markets.

- COVID-19 Pandemic: Despite the progress made in vaccination campaigns, the pandemic continued to impact economic activity and consumer confidence.

- Geopolitical Tensions: Increased tensions between the United States and China, as well as other geopolitical issues, added to the uncertainty in the markets.

- Tech Stock Correction: The tech sector, which had been one of the major drivers of the stock market's growth in recent years, experienced a significant correction.

Impact on the Market

The stock market collapse in 2021 had several implications for the market:

- Volatility: The collapse led to increased volatility in the markets, with investors reacting to the various factors that contributed to the downturn.

- Sector Rotation: Investors began to shift their focus from growth stocks to value stocks, as concerns about inflation and economic uncertainty grew.

- Impact on Consumer Confidence: The stock market collapse contributed to a decline in consumer confidence, which can have a negative impact on consumer spending and economic growth.

Lessons Learned

The stock market collapse in 2021 provided several lessons for investors and market participants:

- Risk Management: It's important for investors to have a well-defined risk management strategy in place to protect their investments during times of market volatility.

- Diversification: Diversifying one's portfolio can help mitigate the impact of market downturns.

- Long-Term Perspective: It's crucial to maintain a long-term perspective when investing, as short-term market fluctuations can be misleading.

Case Studies

Several high-profile companies were affected by the stock market collapse in 2021. Here are a few examples:

- Tesla: Tesla's stock price plummeted by more than 20% in early 2021, amid concerns about the company's growth prospects and rising production costs.

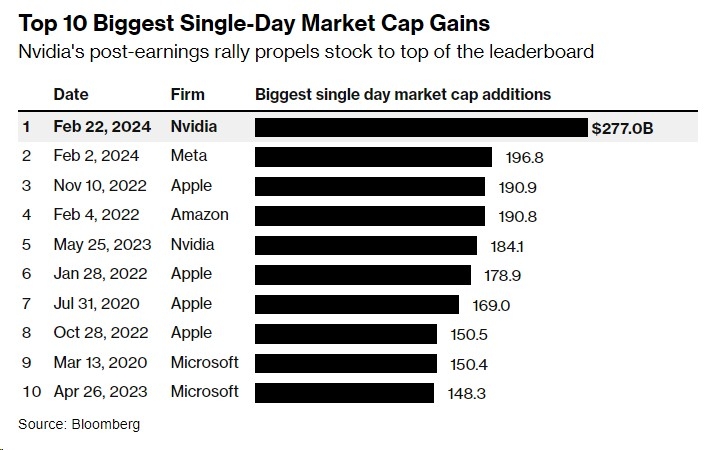

- Amazon: Amazon's stock price also experienced a significant decline, as investors grew concerned about the company's exposure to the retail sector and the potential impact of rising inflation.

- Meta Platforms (formerly Facebook): Meta Platforms' stock price dropped by more than 25% in early 2021, as investors grew concerned about the company's advertising revenue and its exposure to regulatory scrutiny.

In conclusion, the stock market collapse in 2021 was a complex event with several contributing factors. Understanding the reasons behind the collapse and the lessons learned can help investors navigate future market volatility.