Introduction

In the dynamic world of finance, staying informed about macroeconomic news is crucial for investors. As we approach June 2025, several key economic indicators and news events are poised to significantly impact the stock market. This article delves into the most influential macroeconomic news that could affect stocks in the coming months.

Inflation and Interest Rates

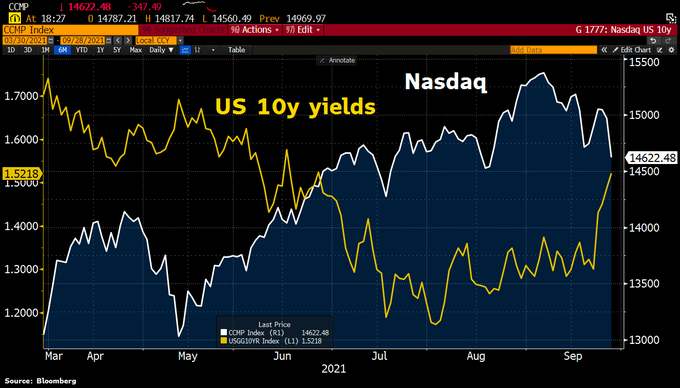

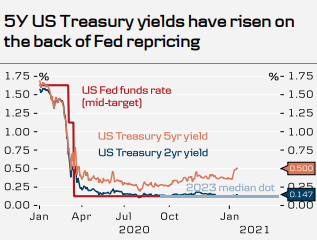

One of the most critical factors affecting the stock market is inflation and interest rates. The Federal Reserve's policies regarding interest rates have a direct impact on the cost of borrowing and, consequently, on corporate earnings. As of June 2025, if inflation remains high, the Fed may continue to raise interest rates, which could lead to a slowdown in economic growth and a potential bear market for stocks.

Economic Growth Indicators

Economic growth indicators, such as GDP, employment rates, and consumer spending, are closely watched by investors. In June 2025, if these indicators show signs of slowing down, it could be a red flag for the stock market. Conversely, if economic growth remains robust, it could lead to increased corporate earnings and a positive stock market environment.

Trade Policies and International Relations

Trade policies and international relations can have a significant impact on the stock market. In June 2025, any major trade agreements or disputes between the United States and other countries could lead to volatility in the stock market. For example, if the U.S. imposes tariffs on certain imports, it could lead to higher costs for companies and, ultimately, lower earnings.

Corporate Earnings Reports

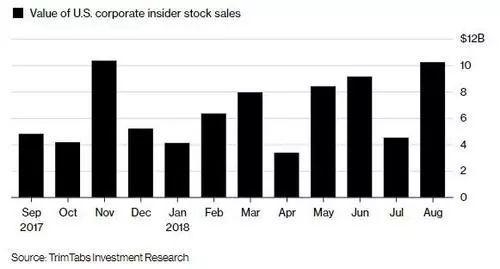

Corporate earnings reports are a key driver of stock prices. In June 2025, if companies report strong earnings, it could boost investor confidence and drive stock prices higher. Conversely, if earnings come in below expectations, it could lead to a sell-off in the stock market.

Case Study: Tech Sector

One sector that is particularly sensitive to macroeconomic news is the tech sector. In June 2025, if inflation and interest rates remain high, it could lead to increased borrowing costs for tech companies, which could negatively impact their earnings. As a result, tech stocks could experience downward pressure.

Conclusion

In conclusion, as we approach June 2025, several macroeconomic news events and indicators are likely to affect the stock market. Investors need to stay informed about these factors and adjust their portfolios accordingly. By keeping a close eye on inflation, interest rates, economic growth indicators, trade policies, and corporate earnings reports, investors can navigate the volatile stock market environment and make informed investment decisions.