In the dynamic world of financial markets, large cap stocks often serve as a bellwether for broader market trends. As investors, understanding the current momentum of these stocks can provide valuable insights into potential investment opportunities. This article delves into the current momentum analysis of US large cap stocks, offering a comprehensive overview of the latest trends and factors influencing these market leaders.

Understanding Large Cap Stocks

Large cap stocks are shares of companies with a market capitalization of over $10 billion. These companies are typically well-established, with a strong track record of profitability and stability. Some of the most well-known large cap stocks in the US include Apple, Microsoft, and Johnson & Johnson.

Current Trends in US Large Cap Stocks

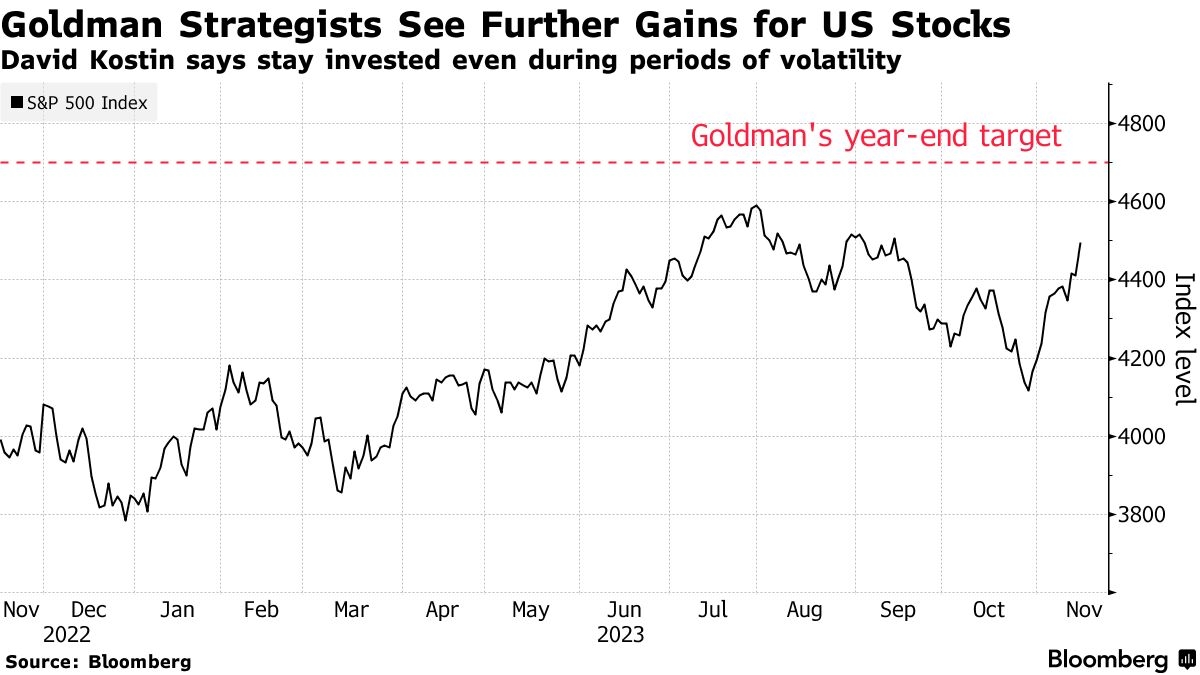

Market Performance: Over the past year, US large cap stocks have demonstrated strong performance, driven by factors such as robust economic growth, low interest rates, and favorable corporate earnings. The S&P 500, a benchmark index for large cap stocks, has seen significant gains, reflecting the overall strength of this segment.

Sector Diversification: The current momentum in US large cap stocks is characterized by sector diversification. While technology and healthcare have traditionally been strong performers, sectors such as consumer discretionary and financials have also seen significant growth. This diversification suggests a well-balanced market landscape.

Dividend Yields: Large cap stocks often offer attractive dividend yields, making them appealing to income-oriented investors. The current dividend yields for many large cap stocks are at or near historical highs, providing a compelling reason for investors to consider these stocks.

Factors Influencing Large Cap Stocks

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in shaping the momentum of large cap stocks. Positive economic indicators tend to boost investor confidence and drive stock prices higher.

Corporate Earnings: The earnings reports of large cap companies are closely monitored by investors. Strong earnings can lead to increased optimism and higher stock prices, while weak earnings can have the opposite effect.

Global Events: Global events, such as geopolitical tensions and trade disputes, can also impact the momentum of large cap stocks. These events can lead to volatility and uncertainty in the market, affecting investor sentiment and stock prices.

Case Studies

To illustrate the current momentum of US large cap stocks, let's consider two case studies:

Apple Inc.: As the world's largest technology company, Apple has consistently demonstrated strong momentum. Its robust product lineup, strong financial performance, and attractive dividend yield have made it a favorite among investors. In the past year, Apple's stock has seen significant gains, reflecting its strong position in the market.

Johnson & Johnson: As a leading healthcare company, Johnson & Johnson has a diversified product portfolio and a strong presence in various markets. Its strong financial performance and attractive dividend yield have made it a stable investment option. In the current market environment, Johnson & Johnson's stock has remained resilient, offering investors a sense of security.

Conclusion

The current momentum of US large cap stocks is characterized by strong performance, sector diversification, and attractive dividend yields. By understanding the factors influencing these stocks and analyzing the latest trends, investors can make informed decisions and identify potential investment opportunities. As always, it's important to conduct thorough research and consult with a financial advisor before making any investment decisions.