In the ever-evolving world of finance, trading US stocks from within the United States has become a popular investment choice for both seasoned traders and newcomers alike. This guide will delve into the intricacies of trading US stocks, highlighting the key aspects you need to know to make informed decisions and maximize your returns.

Understanding the Basics

Before diving into the nitty-gritty of trading US stocks, it's crucial to understand the basics. US stocks refer to shares of publicly-traded companies listed on American stock exchanges, such as the New York Stock Exchange (NYSE) and the NASDAQ. These exchanges offer a wide range of investment opportunities, from established blue-chip companies to emerging growth stocks.

Opening a Brokerage Account

To start trading US stocks, you'll need to open a brokerage account. A brokerage account is a financial account that allows you to buy and sell stocks, bonds, and other securities. There are numerous brokerage firms to choose from, each offering varying fees, services, and platforms. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Research and Analysis

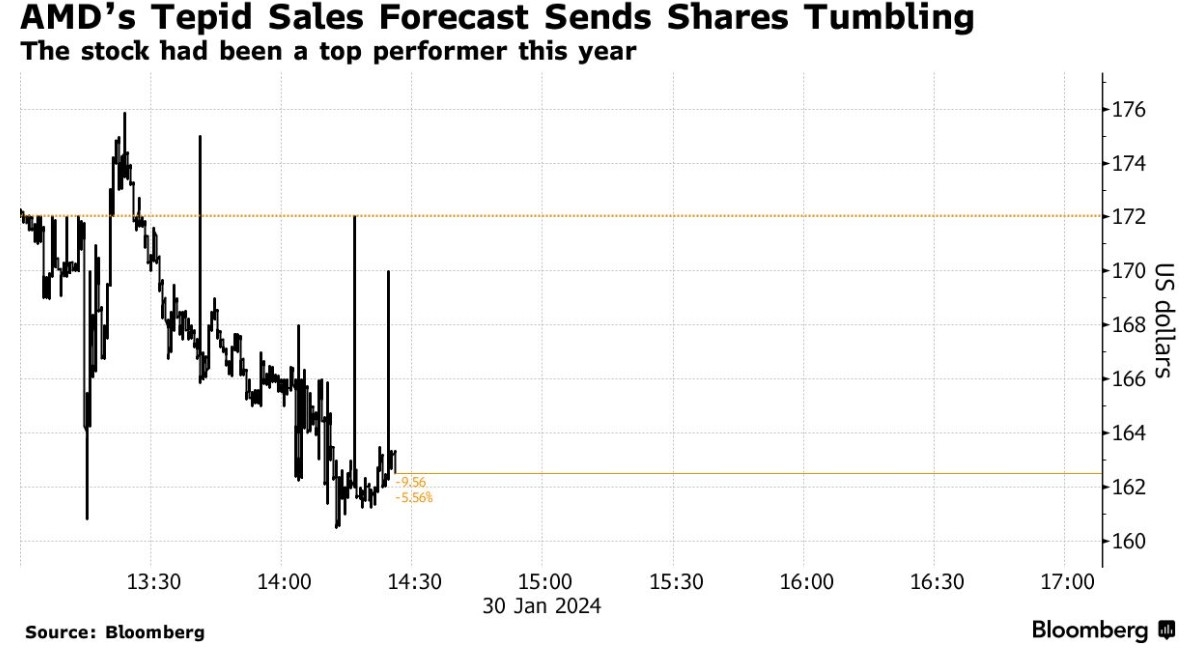

Successful trading requires thorough research and analysis. This involves studying financial statements, news, and market trends to identify potential investment opportunities. Technical analysis involves analyzing past price movements and market indicators to predict future stock prices. Fundamental analysis, on the other hand, focuses on evaluating a company's financial health, industry position, and management team.

Risk Management

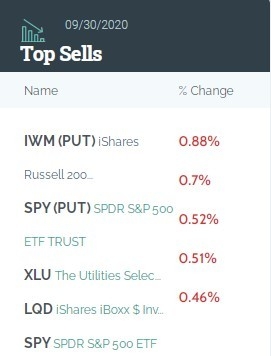

One of the most critical aspects of trading is risk management. This involves setting stop-loss orders to limit potential losses and diversifying your portfolio to reduce exposure to any single stock. It's also essential to only invest money you can afford to lose and to avoid over-leverage.

Top US Stocks to Watch

When it comes to trading US stocks, there are several companies that have consistently performed well over the years. Here are a few top US stocks to consider:

- Apple (AAPL): As the world's largest technology company, Apple has a strong presence in the consumer electronics, software, and services sectors.

- Microsoft (MSFT): Microsoft is a leading player in the software industry, offering products and services such as Windows, Office, and Azure.

- Amazon (AMZN): Amazon is a dominant force in the e-commerce and cloud computing markets, with a vast product range and innovative business model.

- Facebook (META): Facebook's parent company, Meta, is a key player in the social media and virtual reality industries.

Case Study: Tesla (TSLA)

A prime example of a US stock that has seen significant growth is Tesla (TSLA). Founded in 2003, Tesla has revolutionized the electric vehicle (EV) market and become a leader in sustainable energy solutions. By focusing on innovation and continuous improvement, Tesla has seen its stock price skyrocket over the years.

Conclusion

Trading US stocks in the USA can be a rewarding investment opportunity, provided you do your homework and manage risks effectively. By understanding the basics, conducting thorough research, and employing sound risk management strategies, you can increase your chances of success in the stock market.