Introduction: The recent imposition of tariffs by the United States government has sent shockwaves through the stock market, causing a surge in uncertainty and volatility. In this article, we delve into how tariffs have impacted U.S. stock futures and the implications for investors.

Understanding Tariffs and Their Impact on Stock Futures

Tariffs are taxes imposed on imported goods and services. When the U.S. government imposes tariffs on specific products, it increases the cost of these goods, leading to higher prices for consumers and businesses. This, in turn, affects the profits of companies that rely on these imported goods, causing their stock prices to plummet.

How Tariffs Affect Stock Futures

Stock futures are contracts that allow investors to buy or sell stocks at a predetermined price on a future date. When tariffs are announced, the market often reacts immediately, leading to a drop in stock futures. This is because investors anticipate that the tariffs will negatively impact the earnings of companies involved in international trade.

Volatility in Stock Futures

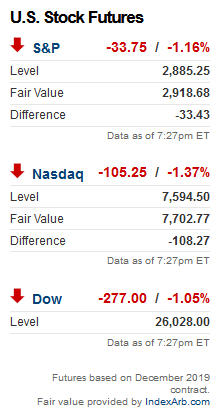

The recent tariffs have caused significant volatility in stock futures. For instance, when the U.S. government announced tariffs on steel and aluminum imports, the S&P 500 futures dropped sharply. Similarly, when China responded with its own tariffs, the futures market reacted accordingly, leading to further declines.

Impact on Specific Sectors

Certain sectors are more vulnerable to tariffs than others. For example, companies in the technology, automotive, and agriculture sectors have been particularly affected by the recent tariffs. This is because these sectors rely heavily on imported goods and face higher production costs as a result of the tariffs.

Case Studies

To illustrate the impact of tariffs on stock futures, let's consider two case studies:

Walmart: As one of the largest retailers in the United States, Walmart relies on imported goods to maintain its inventory. When tariffs were imposed on certain goods, Walmart's stock futures dropped, reflecting concerns about higher costs and potential losses in sales.

Apple: Apple, a major technology company, has been affected by the tariffs on Chinese-made goods. As a result, its stock futures have experienced significant volatility, with investors weighing the potential impact on its profits and global supply chain.

Conclusion

The imposition of tariffs has sent shockwaves through the U.S. stock market, causing a surge in uncertainty and volatility. As investors grapple with the potential impact of tariffs on their portfolios, it is crucial to stay informed and adapt their strategies accordingly. While tariffs can create short-term challenges, they also present opportunities for long-term growth and diversification.