Are you looking to dive into the world of stock investing but feel overwhelmed by the vast amount of information available? Look no further! Stock.Invest Us is your go-to resource for all things investment-related. In this article, we'll explore the basics of stock investing, provide valuable tips, and share success stories to help you on your journey to financial independence.

Understanding the Basics of Stock Investing

Before you start investing, it's crucial to understand the basics. A stock represents a share of ownership in a company. When you buy stocks, you're essentially purchasing a piece of that company. This ownership can come with several benefits, including dividends and the potential for capital gains.

To get started, you'll need to open a brokerage account. This account will allow you to buy and sell stocks, as well as access other investment opportunities. It's important to research different brokerage firms and choose one that fits your needs, whether it's low fees, user-friendly platforms, or access to research tools.

Key Tips for Successful Stock Investing

Do Your Research: Before investing in a stock, thoroughly research the company. Look at its financial statements, management team, industry position, and growth prospects. This will help you make informed decisions and avoid potential pitfalls.

Diversify Your Portfolio: Don't put all your eggs in one basket. Diversifying your portfolio can help mitigate risk and potentially increase your returns. Consider investing in different sectors, industries, and geographical locations.

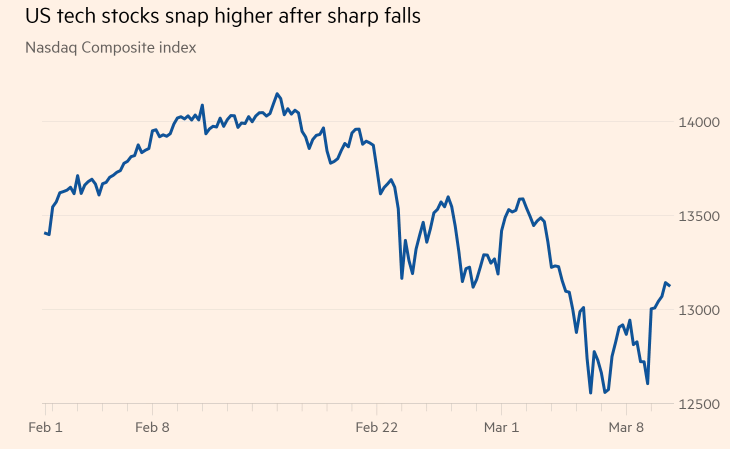

Stay Patient and Disciplined: The stock market can be unpredictable, and it's easy to get caught up in the hype. Stay patient and disciplined, and don't let emotions drive your investment decisions. This will help you avoid making impulsive and potentially costly mistakes.

Keep Learning: The stock market is constantly evolving, so it's important to stay informed and keep learning. Follow financial news, attend investment seminars, and read books on investing to enhance your knowledge and skills.

Use Stop-Loss Orders: A stop-loss order is an instruction to sell a stock when it reaches a certain price. This can help protect your portfolio from significant losses. Set realistic stop-loss levels based on your risk tolerance and investment goals.

Real-World Success Stories

To illustrate the potential of stock investing, let's look at a few real-world success stories:

Warren Buffett: The "Oracle of Omaha" is one of the most successful investors of all time. He started investing at a young age and has since built a fortune through his company, Berkshire Hathaway. Buffett's success is attributed to his long-term investment strategy, focus on value, and disciplined approach.

Peter Lynch: A former manager of the Fidelity Magellan Fund, Peter Lynch is known for his exceptional stock-picking skills. He achieved an average annual return of 29.2% over 13 years, making it one of the best-performing mutual funds of all time. Lynch's success is largely due to his ability to identify undervalued companies and his willingness to take calculated risks.

Elon Musk: As the CEO of Tesla and SpaceX, Elon Musk has become one of the most influential entrepreneurs in the world. His success can be attributed to his vision, perseverance, and ability to identify emerging trends in technology and transportation.

Conclusion

Stock.Invest Us is your ultimate guide to investment success. By understanding the basics, following key tips, and staying informed, you can navigate the stock market and achieve your financial goals. Remember, investing is a marathon, not a sprint, so stay patient, disciplined, and focused on long-term success.