Introduction

The stock market is a dynamic and ever-changing landscape, where investors and traders alike must stay informed to make informed decisions. On September 5, 2025, the US stock market closed with a mix of gains and losses, reflecting the volatility and uncertainty that continues to characterize the financial world. This article provides a comprehensive summary of the day's trading activity, highlighting key trends and market movements.

Market Overview

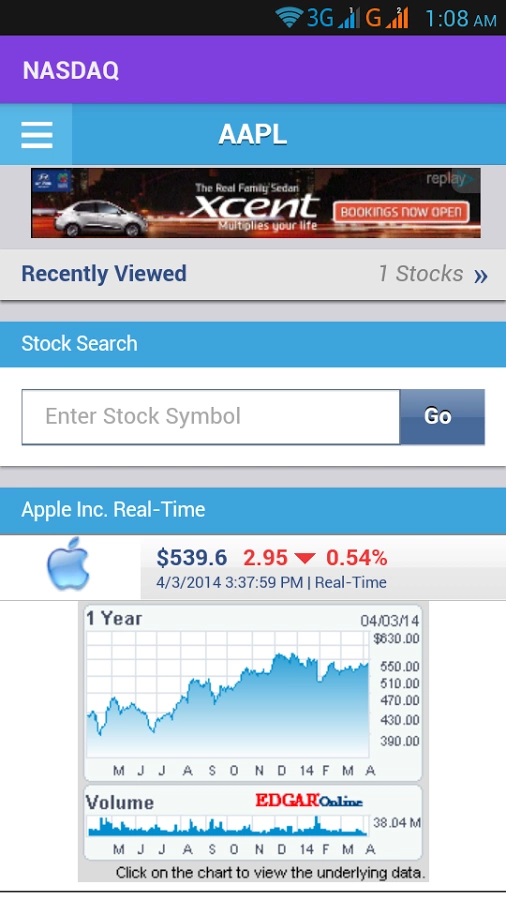

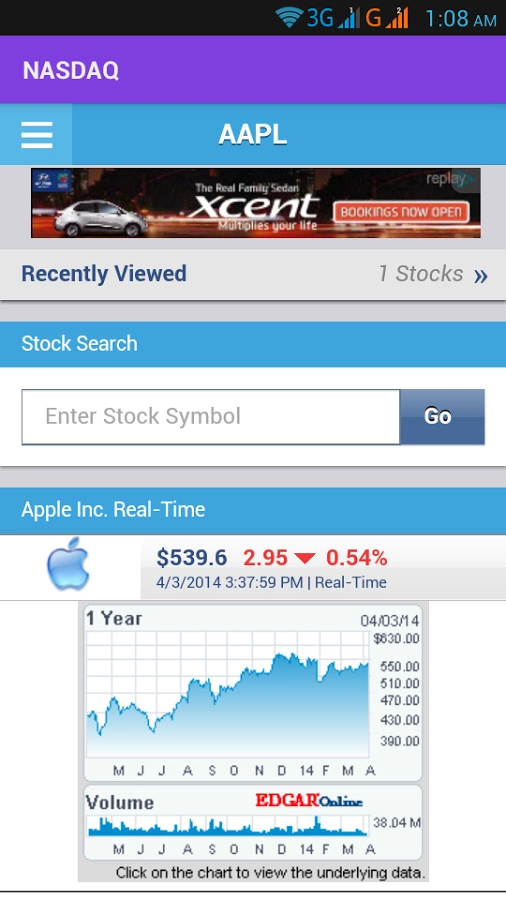

The S&P 500, a widely followed index of large-cap stocks, closed slightly lower on September 5, 2025, down 0.3%. The Dow Jones Industrial Average, which tracks the performance of 30 major companies, also ended the day in negative territory, down 0.5%. The NASDAQ Composite, which includes many technology stocks, fared slightly better, closing up 0.2%.

Sector Performance

Technology Stocks (IT)

Technology stocks were the standout performers on September 5, with the NASDAQ Composite leading the way. Companies like Apple, Microsoft, and Amazon all posted gains, driven by strong earnings reports and positive outlooks. Apple reported a 5% increase in revenue, with a particular focus on its services division, which includes Apple Music, iCloud, and Apple Pay. Microsoft also reported strong earnings, with a particular emphasis on its cloud computing business. Amazon saw a 3% increase in its stock price, driven by strong sales and a positive outlook for the holiday shopping season.

Energy Stocks (Energy)

Energy stocks, on the other hand, were among the worst performers on the day. The price of crude oil fell sharply, driven by concerns about global supply and demand. Companies like ExxonMobil and Chevron saw their stock prices fall by more than 2%. This decline was also influenced by the release of a report from the International Energy Agency (IEA) that warned of a potential oil supply shortfall in the coming years.

Financial Stocks (Financial)

Financial stocks were mixed on September 5, with some companies reporting strong earnings and others facing challenges. JPMorgan Chase reported a 6% increase in earnings, driven by strong performance in its investment banking and asset management divisions. However, Wells Fargo reported a 2% decline in earnings, due to ongoing legal issues and regulatory scrutiny.

Economic Indicators

Consumer Confidence Index

The Consumer Confidence Index, a measure of consumer sentiment, fell slightly in September, reflecting concerns about rising inflation and economic uncertainty. The index stood at 120.5, down from 121.1 in August.

Durable Goods Orders

Durable goods orders, a measure of business investment, rose 0.4% in August, driven by strong demand for transportation equipment and computers. This suggests that businesses are investing in long-lasting goods, which could be a positive sign for economic growth.

Conclusion

The stock market closed on September 5, 2025, with a mix of gains and losses, reflecting the volatility and uncertainty that continues to characterize the financial world. Technology stocks led the way, with strong earnings reports and positive outlooks, while energy stocks were among the worst performers, driven by concerns about global supply and demand. Investors and traders alike must stay informed and vigilant to navigate the ever-changing landscape of the stock market.