In the ever-evolving landscape of energy stocks, nuclear power has emerged as a significant player in the United States. As the nation seeks sustainable and reliable energy sources, nuclear power stocks have become a focal point for investors. This article delves into the world of nuclear power stocks in the US, highlighting key players, industry trends, and potential investment opportunities.

Understanding Nuclear Power Stocks

Nuclear power stocks are shares of companies involved in the nuclear energy industry. This includes companies that generate nuclear power, those involved in the construction and maintenance of nuclear reactors, and those that provide nuclear waste management services. The nuclear power industry in the US is regulated by the Nuclear Regulatory Commission (NRC), ensuring safety and compliance with industry standards.

Key Players in the Nuclear Power Industry

Several companies dominate the nuclear power sector in the US. Here are some notable players:

Exelon Corporation (EXC): Exelon is one of the largest nuclear power generators in the country, with a fleet of 23 reactors across 12 states. The company also owns and operates the largest US-based nuclear waste storage facility.

Entergy Corporation (ETR): Entergy is another major nuclear power generator, with a fleet of 18 reactors in 11 states. The company is also involved in the distribution and retail of electricity.

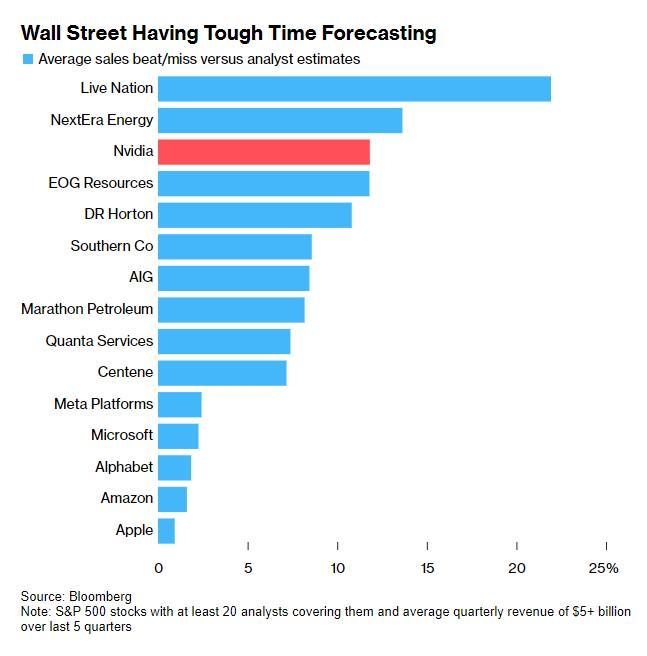

NextEra Energy, Inc. (NEE): NextEra Energy is a diversified energy company with a significant presence in the nuclear power sector. The company owns and operates the largest nuclear power plant in the US, the South Texas Nuclear Generating Station.

Industry Trends and Challenges

The nuclear power industry in the US faces several challenges and opportunities:

Regulatory Changes: The NRC has been implementing new regulations to enhance nuclear power plant safety. These changes can impact the operations and profitability of nuclear power companies.

Renewable Energy Competition: The rise of renewable energy sources like solar and wind has posed a challenge to nuclear power. However, nuclear power's low greenhouse gas emissions make it an attractive option for reducing carbon emissions.

Technological Advancements: Innovations in nuclear technology, such as small modular reactors (SMRs), could revolutionize the industry and create new investment opportunities.

Investment Opportunities in Nuclear Power Stocks

Investing in nuclear power stocks can be a lucrative opportunity for investors. Here are some factors to consider when evaluating nuclear power stocks:

Market Position: Companies with a strong market position and a diverse portfolio of nuclear power plants are likely to perform well.

Financial Health: Look for companies with stable financials, including low debt levels and strong cash flow.

Growth Potential: Companies involved in nuclear technology development or waste management may offer higher growth potential.

Case Study: Exelon Corporation

Exelon Corporation serves as a prime example of a successful nuclear power stock. The company has a strong market position, with a diverse fleet of nuclear power plants across the country. Exelon has also been actively investing in renewable energy projects, further diversifying its portfolio.

In conclusion, nuclear power stocks in the US present a unique investment opportunity. With the industry facing challenges and opportunities, investors should carefully evaluate key players and industry trends to make informed investment decisions.