The financial landscape of the United States is a dynamic and ever-evolving tapestry that has seen its fair share of fluctuations. As we approach October 2025, the market outlook for US stocks is a subject of keen interest among investors and financial analysts alike. This article aims to provide a comprehensive overview of the projected trends and potential opportunities in the US stock market for that month.

Economic Indicators and Trends

Inflation and Interest Rates: The economic backdrop of October 2025 is likely to be shaped significantly by inflation rates and the Federal Reserve’s stance on interest rates. If inflation remains under control and the central bank maintains a cautious approach to rate hikes, it could signal a positive outlook for stocks. Conversely, if inflation spikes or the Fed tightens policy too aggressively, it may lead to a more cautious market sentiment.

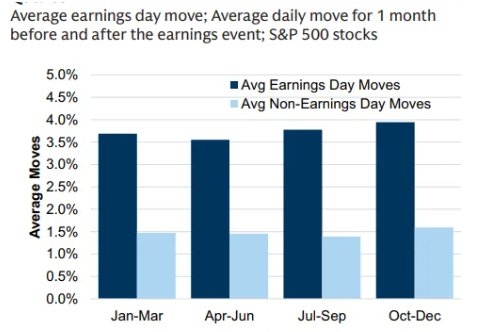

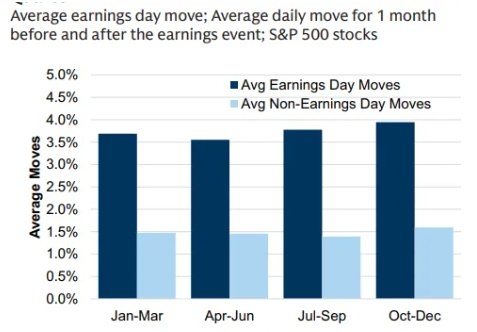

Corporate Profits: A critical factor in the performance of the US stock market is the health of corporate earnings. In October 2025, companies are expected to report their earnings for the third quarter, and investors will be closely watching for any signs of robust growth or potential weaknesses in the business landscape.

Sector Performance

Technology Stocks: The technology sector has long been a leading indicator of market trends. In October 2025, key players such as Apple, Google, and Microsoft are expected to continue their strong performance, driven by innovation and expansion into new markets.

Healthcare Stocks: With an aging population and advancements in medical technology, the healthcare sector could see significant growth. Biotechnology companies and pharmaceutical firms are likely to be among the top performers, as they continue to develop groundbreaking treatments and therapies.

Energy Stocks: The energy sector's outlook depends heavily on global oil prices and the United States' position in the energy market. In October 2025, the success of energy stocks could be tied to the country's ability to maintain a stable supply of oil and gas, as well as its role in the global energy transition.

Geopolitical Factors

Global Trade Tensions: The US stock market is sensitive to global trade tensions and geopolitical events. In October 2025, any escalation of trade disputes or international conflicts could impact market sentiment and lead to volatility in the stock market.

Elections and Policy Changes: Political stability and policy changes are also crucial factors in the market outlook. With elections looming, the potential for policy changes could influence investor sentiment and impact various sectors differently.

Case Studies

To illustrate the potential trends, let’s consider a few case studies from October 2025:

Tech Giant Apple: Despite facing increased competition from Asian manufacturers, Apple manages to maintain its dominance in the smartphone market, driven by its robust product innovation and loyal customer base.

Biotech Company XYZ: The biotech firm, XYZ, announces a groundbreaking treatment for a rare disease, sending its stock soaring as investors anticipate significant revenue growth.

Energy Sector Leader ABC: Despite global uncertainties, ABC Energy Company reports strong earnings, driven by increased production and stable oil prices, bolstering investor confidence.

In conclusion, the market outlook for US stocks in October 2025 is complex and multifaceted. Economic indicators, sector performance, geopolitical factors, and case studies all play a role in shaping the landscape. As investors, it is crucial to stay informed and adapt to the ever-changing market dynamics to make informed decisions.